Summary

Japanese price pressures continue to build, sending underlying inflation even further away from the Bank of Japan’s target, piling pressure on policymakers to resume their rate hiking cycle despite elevated uncertainty abroad.

Japan Inflation Pressures Intensify

While Bank of Japan (BOJ) policymakers see inflationary pressures waning due to slower economic growth and a reversal of recent strength in rice prices, for now, that’s cold comfort for consumers who continue to see prices increase at rates not seen in decades.

Source: TradingView

According to the latest nationwide figures, headline inflation rose 3.5% over the past year, down a tenth of a percent from the month prior. However, excluding fresh food, price pressures intensified, with the rate jumping to 3.7%—a tenth above expectations and nearly two full percentage points above the BOJ’s 2% target. It marked the fastest annual growth since January 2023.

Once energy and fresh food prices were stripped out, the annual rate rose to 3.3%—the fastest increase since January 2024 and a sharp acceleration from the 3% pace in April.

BOJ Forecast Under Threat

Earlier this week, BOJ officials flagged that the recent lift in inflation was being driven by “the past rise in import prices” and “the recent rise in food prices such as rice,” but warned those effects are set to wane. They noted “underlying CPI inflation is likely to be sluggish” due to soft economic conditions, though it’s expected to “increase gradually” as growth picks up and labour shortages push up wages.

Over time, they said inflation is projected to reach levels “generally consistent with the price stability target,” though warned of “extremely uncertain” global risks that could derail the outlook.

While that may be the view right now, the longer price pressures remain elevated, the greater the risk they’ll influence consumer and business behaviour permanently—a scenario that could spark the BOJ back into action and add to upward pressure on Japanese bond yields.

Geopolitics Driving USD/JPY Moves

Given its historical relationship with interest rate differentials, that could spark renewed downside pressure on USD/JPY. For now, though, geopolitical tensions remain a key driver for the yen.

That’s reflected in the strong correlation USD/JPY has seen with crude oil futures over the past week, sitting at 0.83. As tensions have grown, USD/JPY has been drifting higher, reflecting Japan’s standing as a major energy importer. The United States, on the other hand, is an energy superpower, making it less vulnerable to supply shocks.

USD/JPY: Bullish Bias Favoured

Source: TradingView

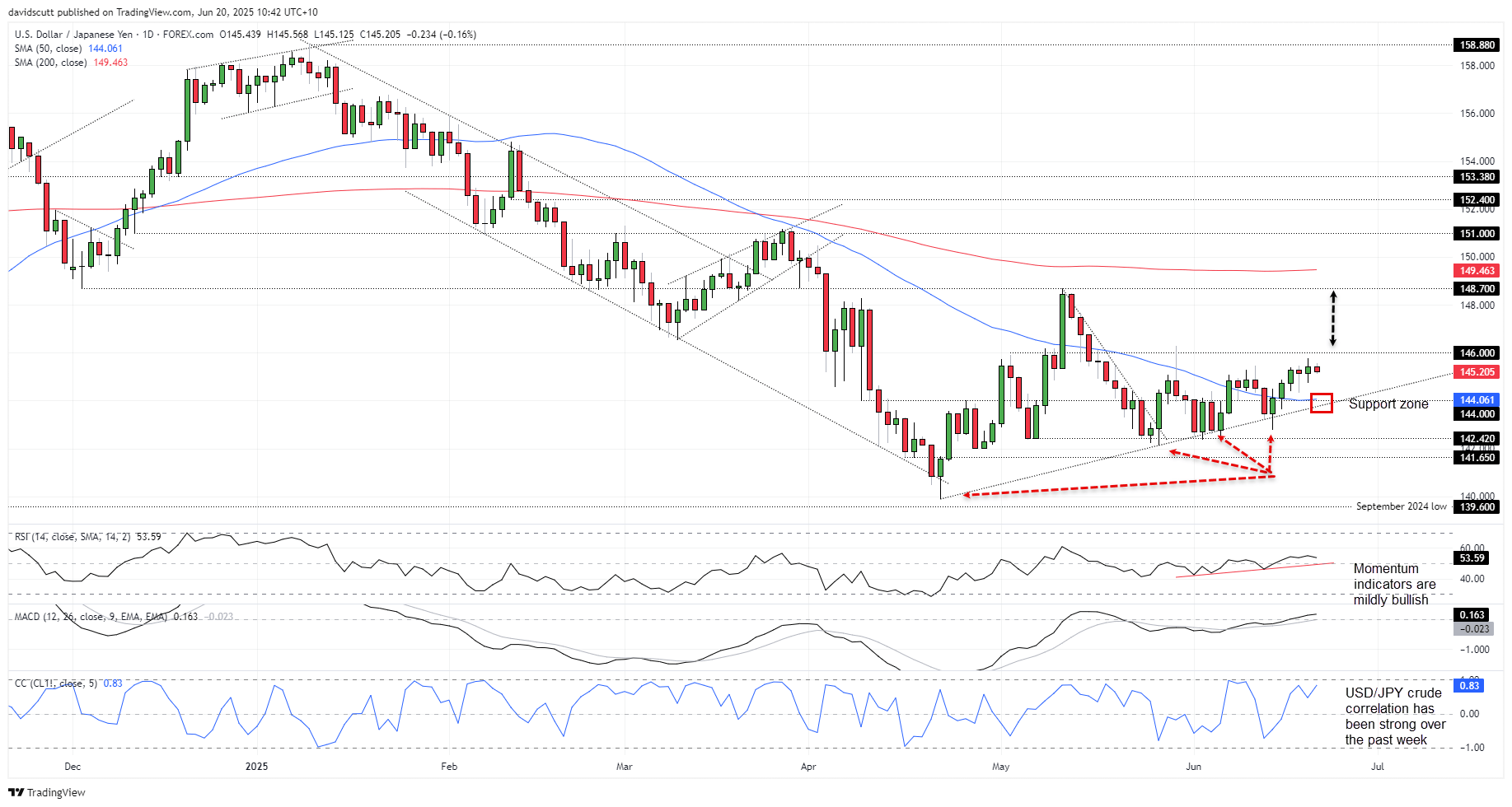

Whether you’re talking price action or momentum signals, both have been mildly bullish for USD/JPY over recent weeks. The price remains in an uptrend from the lows set in April and has reclaimed the important 50-day moving average, adding to the sense that directional risks are shifting. RSI (14) and MACD back this view up, with the former sitting in an uptrend and above 50, while the latter has pushed above zero having already crossed the signal line from below.

146 is the first topside level of note, coinciding with where the price was comprehensively rejected on May 29. If that were to be broken, there’s little visible resistance evident until 148.70.

On the downside, the 50-day moving average, 144, and April uptrend are within close proximity, making that a key support zone to watch should the slow grind higher suddenly reverse. If that were to give way, 142.42 marks the start of another support zone where buyers have been lurking over recent months.

-- Written by David Scutt

Follow David on Twitter @scutty