The USD/JPY is our featured currency pair in this edition of Technical Tuesday. We saw some interesting price action last week, suggesting the pair may have resumes its bearish trend again. The US dollar has also struggled amid quiet conditions, struggling to find the same sort of love equity markets enjoyed amid easing trade tensions. Meanwhile, the narrowing of the spread between the US and Japanese bond yields point to a lower USD/JPY forecast.

USD/JPY Forecast: Dollar on the backfoot

The dollar’s recent slide has extended into this week, albeit marginally, with USD/JPY gently offered as attention shifts to FX policy talks between US and Japanese finance ministers at the G7 meetings in Canada. Markets are trading in a subdued fashion, lacking fresh impetus from the US economic calendar, and are instead leaning into broader macro themes.

There’s little in the way of tier-one US data this week, but there is some speculation that any future US trade agreements in Asia might carry a currency clause, preventing those nations from weakening their currencies. That’s lent strength to a wide range of emerging market currencies.

As far as the USD/JPY forecast is concerned, and with finance chiefs from the US and Japan expected to touch on currency matters, there’s a touch of caution in the air. Japanese policymakers may use the opportunity to raise concerns over excessive yen weakness.

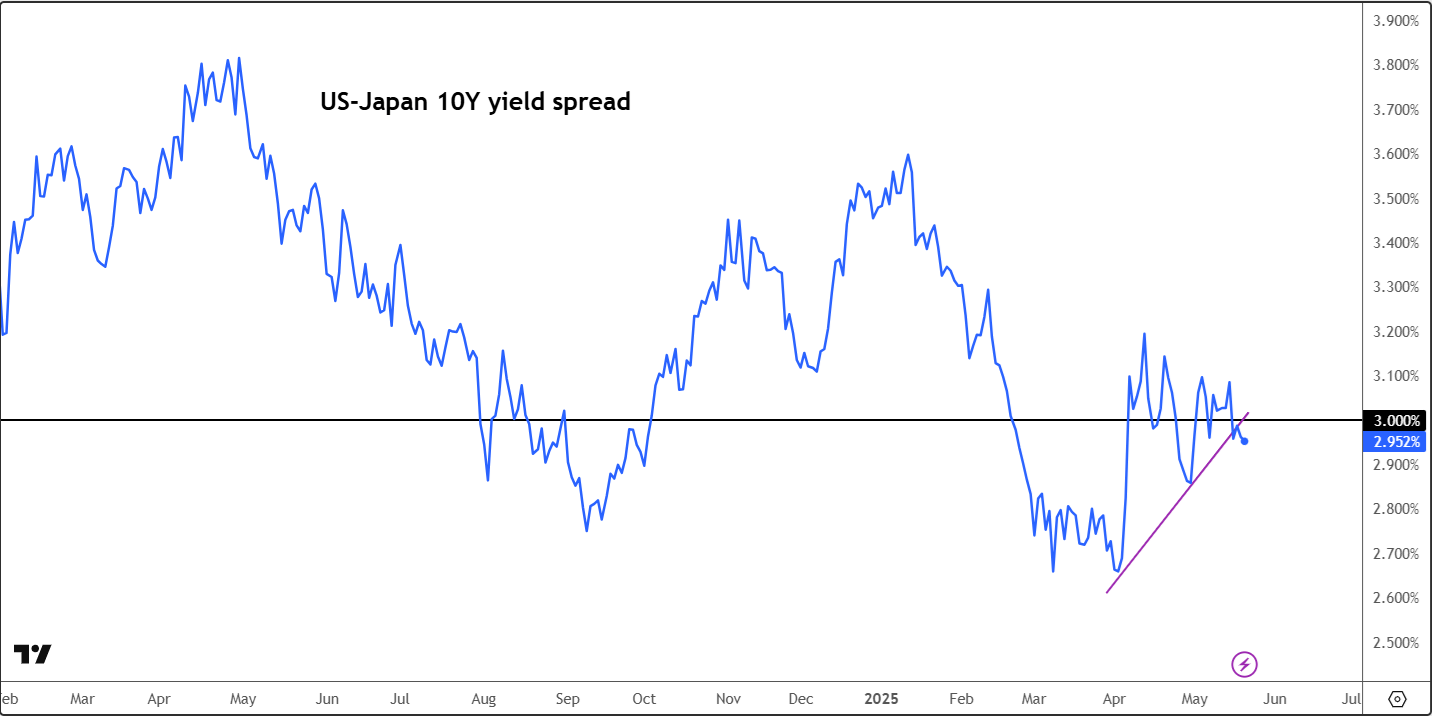

US-Japan yields spread favours USD/JPY downside

While the recent strength in US yields may still favour the dollar, we have seen a bit of the unwinding in the US bond market sell-off, causing long-term yields to dop from their recent highs. Tomorrow’s 20-year US Treasury auction could be a more meaningful driver, especially if yields shift sharply.

On top of this, Japanese 10-year bond yields have also been on the ascendency again. This has caused the yield differential between the US and Japan 10-year bonds to narrow in the favour of the yen. If the spread narrows further, then surely this will further boost the bearish appeal of the USD/JPY forecast.

Technical USD/JPY forecast: Resumption of the downtrend?

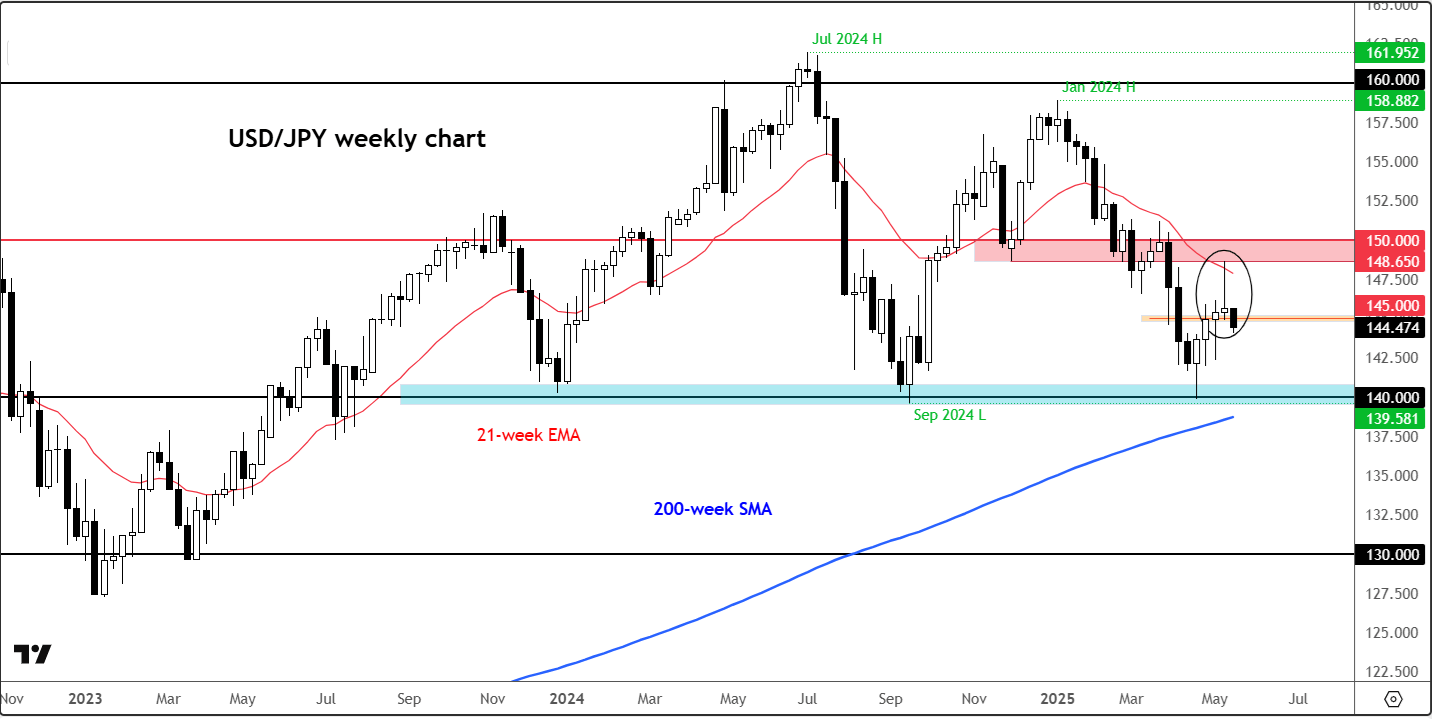

The long-term bullish trend on the weekly and higher time frames of the USD/JPY ended in July 2024 when rates repeatedly failed to hold the breakout above 160.00 handle. Since then, we have seen at least two periods of extended declines: once last summer when the unwinding of the carry trade was the theme, and once at the start of this year, when trade war concerns boosted the appeal of the haven yen. In the last several weeks, we saw the USD/JPY stage an impressive recovery as it found good support from around the 140.00 handle and made its way past 148.00 at one stage, before ease lower again. This upsurge was directly in response to the easing of trade tensions, which saw global equity markets rally hard. But it looks like that bullish momentum for the USD/JPY came to a halt last week. The key question now is whether that was a mere pause before more gains are followed, or has the downward trend resumed?

USD/JPY key levels to watch

Looking at the weekly chart of the USD/JPY, one can observe that an inverted hammer candle was formed last week when rates tested – and reversed from – the bottom range of a key resistance zone between 148.65 to 150.00. This area is shaded in red on the chart. The fact that resistance held here suggests that the bearish trend that began last summer may have now resumed. This thesis will remain valid particularly while rates now hold below the low of the previous week’s range and interim resistance around 145.00. The bears will now want to defend this level to exert further pressure if they want to revisit the 140.00 area again. However, if we see a mid-week bullish reversal and rates go back above 145.00, then that would put the bears in a spot of bother. So, they key level to watch now is at 145.00 on the upside.

Meanwhile, if the downward pressure persists, watch out for possible short-term bounces around round handles like 144.00, 143.00 etc.

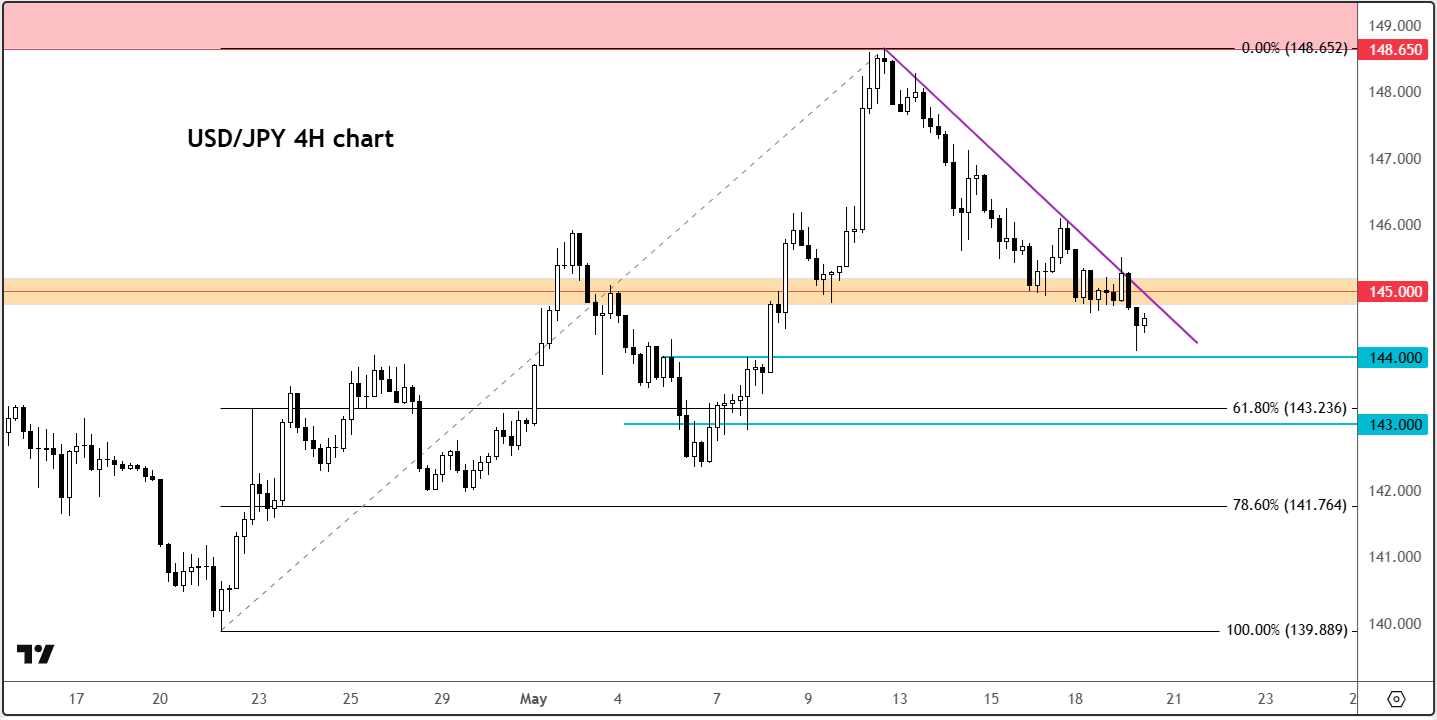

Additionally, as shown on the USD/JPY 4H chart, there are potential support areas around the 61.8% (143.24) and 78.6% (141.76) Fibonacci retracement levels against the most recent low (139.89) that also need to be watched.

Bottom Line: USD/JPY could continue to edge lower this week, especially if the G7 discussions produce any FX-related headlines. With emerging market currencies catching a bid and the dollar losing steam amid speculative trade chatter, the balance of risks points towards modest yen strength in the near term.

Source for all charts used in this article: TradingVIew.com

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R