USD/JPY outlook - key takeaways:

- USD/JPY outlook hangs in balance as it tests 150.00 resistance ahead of Fed decision

- BoJ stays cautious amid US trade policy risks, next hike likely in summer

- US dollar rebounds modestly, but mixed US data clouds the picture

The USD/JPY remained on the front-foot after the Bank of Japan refused to offer any major clues in terms of a potential rate hike in the next meeting. Citing worries over the potential impact of US tariffs, it held rates unchanged at 0.5% as expected. Despite rising wage pressures, the BOJ is evidently not in a rush to hike for now – but it hasn’t ruled one out at its next meeting either. So, the yen could still make a comeback should global bond yields outside of Japan resume lower. In recent days, US yields have held steady owing to mixed data. With the US Federal Reserve to make its own policy announcement later, the USD/JPY outlook could take a new direction in the near-term, as the pair continues to test a major resistance zone near the 150.00 area.

Bank of Japan kept policy unchanged as expected

The Bank of Japan kicked off the big central bank rate decisions overnight, by not doing much at all and then yen moved only a little – lower. In a subtle shift, the central bank flagged trade policies as a new risk to its outlook. With just a fortnight remaining before President Donald Trump’s fresh wave of reciprocal tariffs is unveiled, there was no surprised to see Governor Ueda remaining tight-lipped about future policy changes.

Ueda said that “wages and prices are on track, but it’s difficult to judge how much closer we are to achieving our goal when uncertainties over the US and overseas trade policies are high.” He added that the central bank would like to review things “once the situation’s a little clearer in early April.”

Thus, for now, the BOJ appears content to bide its time, having last raised rates two months ago. With inflation trends broadly tracking the bank’s forecasts, the consensus among economists is that the next move may not come until June or July.

With spring wage negotiations once again delivering robust pay rises, Japan’s positive wage-price dynamic appears to be gathering fresh momentum—helping to underpin core inflation close to the Bank of Japan’s 2% target.

Major Japanese companies recently agreed to significant wage hikes for the third year running. They are aiming to help workers cope with high inflation and address labour shortages. With wages rising, this is not only expected to boost consumer spending but also further fuel inflationary pressures.

A recent Bloomberg survey of 52 economists points to the Bank of Japan’s next rate hike likely landing between June and September. Interestingly, a growing minority—now 13%, up from just 4% previously—are tipping a move as early as 1st May.

Could Federal Reserve tilt towards a cut sooner than expected?

With the BoJ now out of the way, the focus will turn to the US Federal Reserve later on today. While major policy shifts from the Fed are seen as highly unlikely, any dovish surprise could well jolt the dollar. Markets broadly expect the Fed to hold rates steady, keeping the Federal Funds Rate within the 4.25% to 4.5% range. That said, traders will pore over every line of the policy statement, updated economic projections, and Chairman Jerome Powell’s press conference for any hints on the path ahead. Particular attention will be paid to Powell’s remarks on the economic and inflation outlook, especially in light of President Trump’s tariff manoeuvres. Should the Fed chief suggest rate cuts might come sooner than previously expected, the dollar could soften—potentially weighing on USD/JPY.

US dollar index rebounds from 5 month lows – for now

The Fed’s meeting comes with the US dollar index bouncing slightly off a five-month low near 103.40 support. The greenback has found mild support after factor data defying recession chatter yesterday, as US industrial production surged by 0.7% month-on-month in February, comfortably ahead of the 0.2% expected. The print marked an all-time record high for output. Manufacturing activity also impressed, climbing 0.9%, fuelled by a sharp 8.5% jump in motor vehicles and parts production.

However, other macro pointers have been far from impressive lately. With uncertainty still hanging over Trump’s economic and labour market policies, households seem increasingly keen to tuck away their cash rather than spend it. This was plain to see in February’s US retail sales, released on Monday. Sales edged up by a mere 0.2% month-on-month, well short of the 0.6% forecast, while January’s figure was revised down sharply to -1.2%. That said, there was a silver lining: the control group measure of retail sales surprised to the upside, jumping 1.0% against expectations of just 0.3%. Adding to the downbeat tone, Monday’s Empire State Manufacturing Index also disappointed with a reading of -20.0 versus -1.9 forecast. These soft figures follow last week’s weaker-than-expected CPI and PPI data, as well as a lacklustre University of Michigan consumer sentiment survey, which declined for the third straight month.

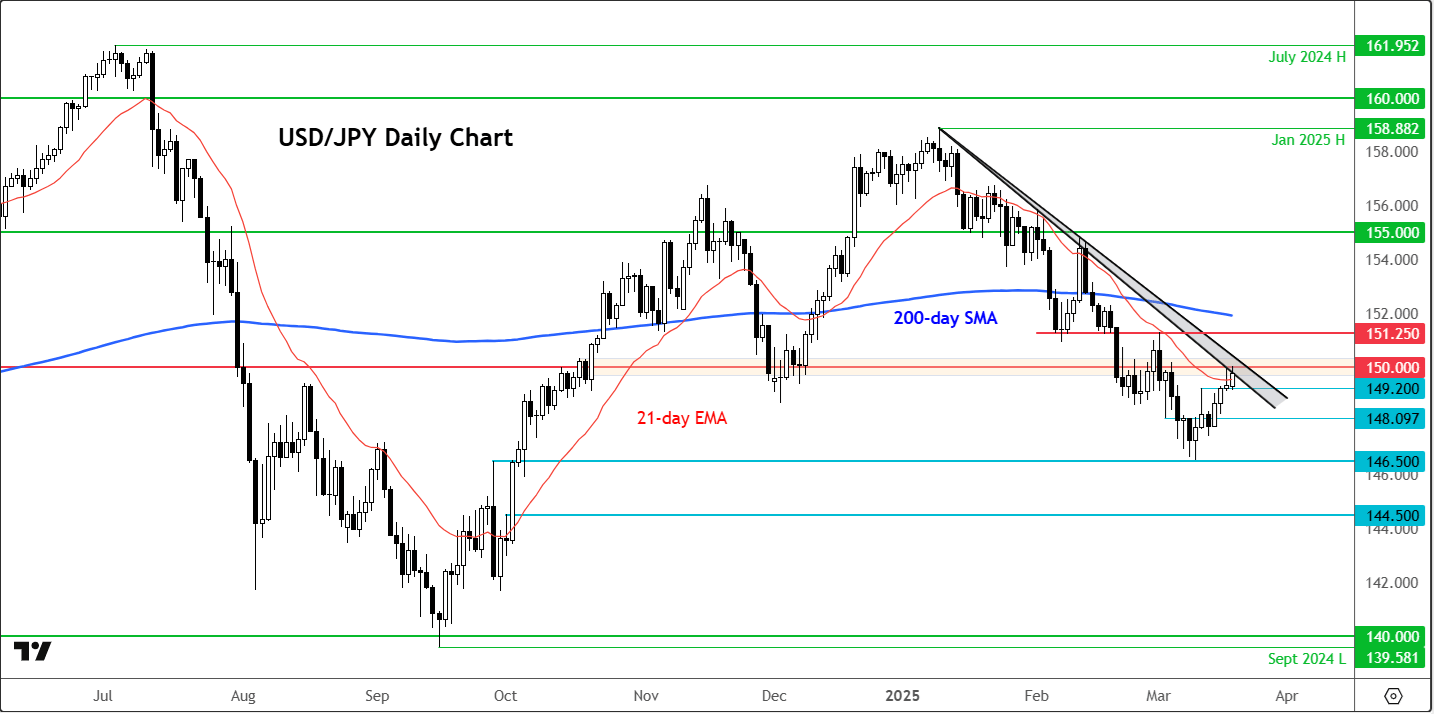

Technical USD/JPY outlook: Key levels to watch

Source: TradingView.com

At the time of writing, the USD/JPY was probing the underside of a key trend resistance around the 150.00 handle—a level that previously served as critical support before giving way last week. Now retesting this zone from below, there’s a chance the pair could roll over and head lower once more. That said, a decisive break back above 150.00 would likely shift momentum back in favour of the bulls, undermining the short-term bearish USD/JPY outlook.

Should selling pressure re-emerge at this pivotal 150.00 barrier, initial support sits at 149.20, followed by 148.10, with a further decline potentially opening the door for a move towards liquidity below last week’s low at 146.50. Beyond that, eyes would turn to the psychological 145.00 level, and then 144.50.

Conversely, should the 150.00 resistance buckle, the stage could be set for a squeeze higher, targeting the next resistance at 151.25, before the 200-day moving average comes into play near the 152.00 mark.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R