After rallying sharply at the start of the week, the USD/JPY went on to rise above the 146.00 handle overnight. But that’s where the music stopped. In the last few hours, yen has been going higher, almost in a straight line. Initially, the yen’s sharp rally from its overnight lows was triggered by a renewed drop in Japan’s bonds, lifting yields. Then, it was mixed-bag US data and concerns that the trade court ruling will be overturned that undermined risk appetite and pressured the USD/JPY. The currency pair was now well over 200 pips worse off from its overnight highs, as long-dated Japanese continued to press higher as the time of writing. Against this backdrop, the USD/JPY outlook remains tilted to the downside.

Bond market concerns at the forefront

While the USD/JPY and risk sentiment may have turned positive earlier this week, the bond market has been telling a different story. The US 30-year yield again rose above 5% — a level that has been associated with a risk off signal for the wider financial markets – before easing back down somewhat. Normally, rising US bond yields are supportive for the dollar. But they are not rising because of optimism about growth. It is concerns about the US’s growing debt and the government’s ability to fund its future spending and tax cuts. Hence, gold has bounced strongly off the $3250 support level despite rising yields, which traditionally would have crushed the metal because of the fact gold doesn’t pay any interest or dividends. With the US recently losing its final top-tier credit rating at the hands of Moody’s a couple of weeks ago, investors are worried that debt concerns and government spending will push yields even higher and thus they are shorting Treasuries and the dollar, buying gold and foreign currencies, including the yen. This makes the USD/JPY outlook appear more tilted to the downside risks than upside.

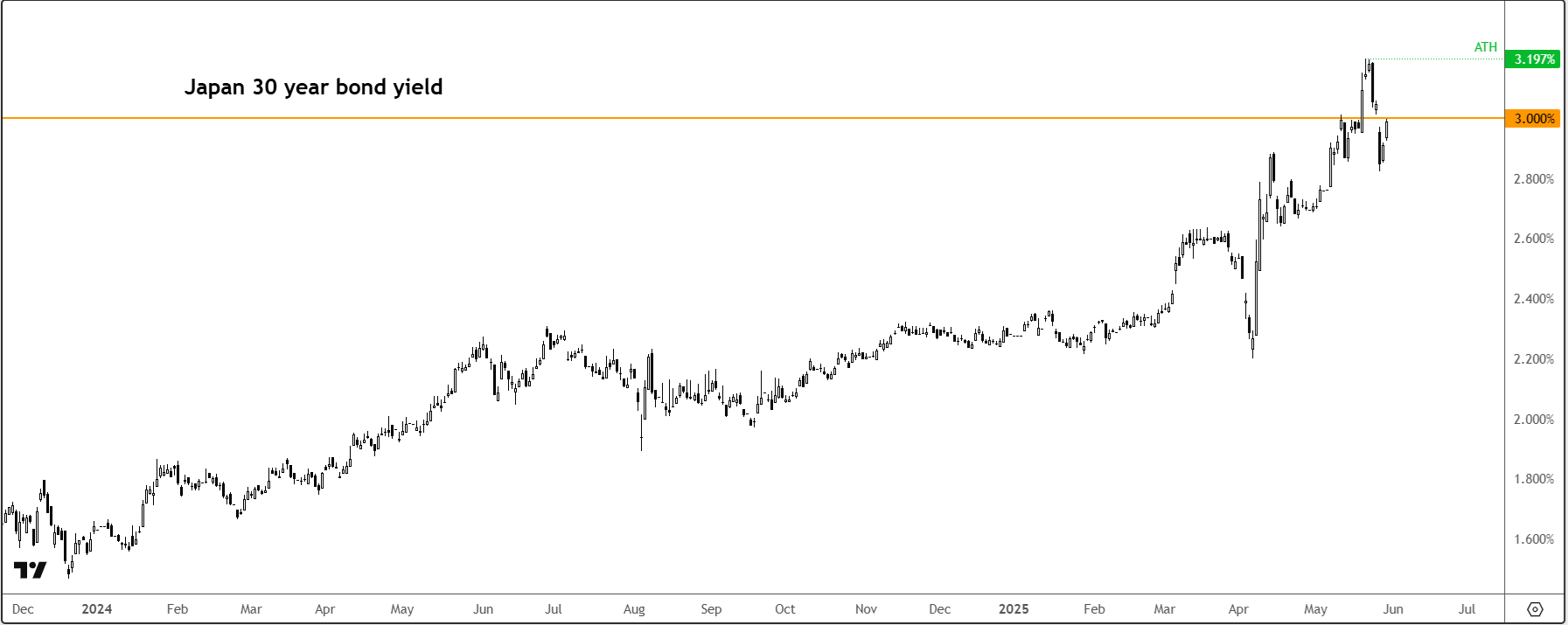

USD/JPY outlook undermined as Japan’s 30 yields climbs above 3% again

Japan’s super-long bonds have taken a hit again. This comes after reports earlier this week that the government there will be changing the composition of bond issuance from long to more short-dated maturities, helped to fuel what looks like a short-lived comeback.

Now the Japanese government bond market was once considered one of the most stable globally. The Bank of Japan, which owns over half of Japan’s government bonds, has started reducing its holdings, slashing some ¥21 trillion from its balance sheet since late 2023. But with the BOJ stepping back, investor demand isn’t filling the void. Recent auctions for 20- and 40-year bonds saw the weakest demand in years, pushing prices down and yields up.

Japan’s bond market is now caught in broader global volatility triggered by US trade policy changes and rising concerns over sovereign debt. The BOJ faces a delicate balance between controlling inflation and avoiding economic disruption. Japan’s finance ministry is considering issuing fewer long-term bonds, while the BOJ will review its bond-buying program in June. The situation has global implications—rising Japanese yields could shift capital away from US markets – reversing the carry trade.

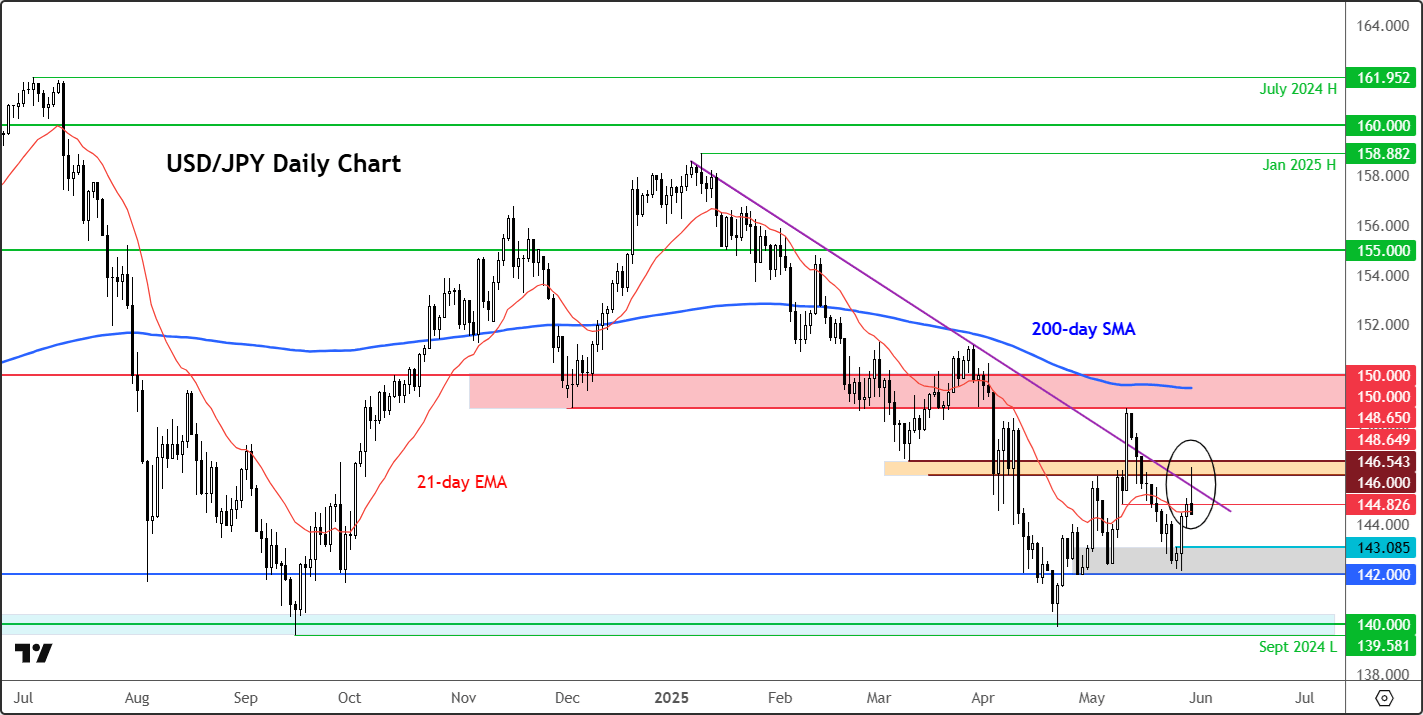

Technical USD/JPY outlook remains bearish

Source: TradingView.com

The recent trend has been bearish on the USD/JPY chart, as indicated for example by the downward sloping moving averages and the bearish trend line shown on the chart. Speaking of the trend line, the attempted breakout above it has clearly failed, with rates turning sharply lower on the session. Such an intraday reversal usually doesn’t reverse again on the same day. So, the USD/JPY could be on the verge of a more significant breakdown and this time it may even go on to take out that key 142.00-143.10 support area (grey shading on the chart). Resistance now comes in around 144.80ish. as things stand, only a decisive break above 146.00-146.55 resistance area is now going to flip the script. Thus, as things stand, the technical USD/JPY forecast is bearish.

Source for all charts used in this article: TradingView.com

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R