- USD no longer responding to yield advantage

- USD/JPY breaks YTD lows with bearish momentum signals

- USD/CAD closes below 200DMA, eyes deeper downside

- RSI and MACD support continuation of USD selling

Summary

The U.S. dollar is under pressure despite a backdrop of sharply higher Treasury yields, with its traditional safe haven appeal being challenged across the board. Whether it's safe havens like the yen and franc or cyclicals like the Aussie and Loonie, there's been a notable shift in sentiment. If this continues, the unwinding of extended USD longs could have further to run, especially in pairs like USD/JPY and USD/CAD, where bearish setups are starting to emerge.

Still A Safe Haven?

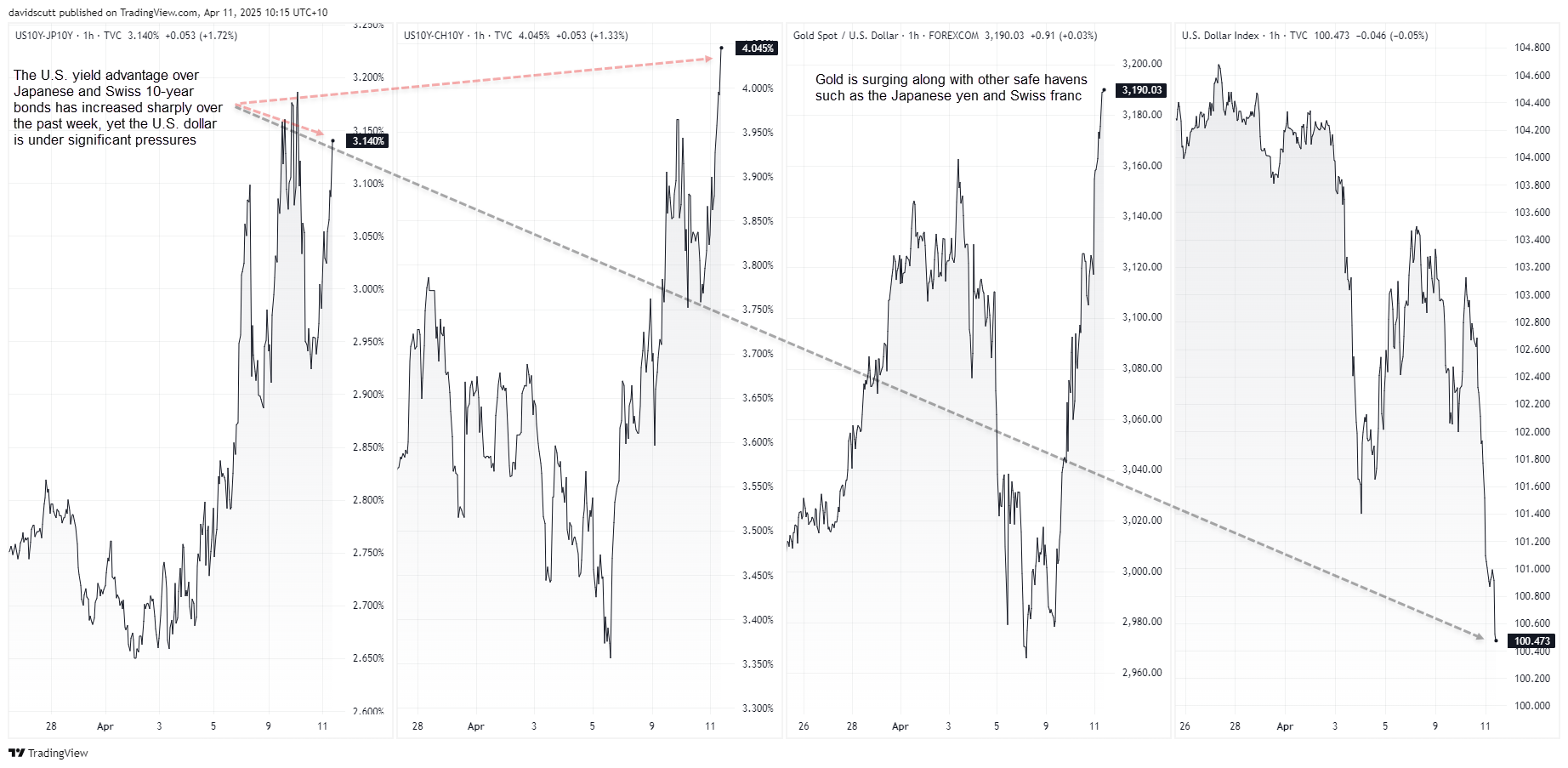

The safe haven status of the U.S. dollar is being questioned by markets, with vastly higher U.S. Treasury yields no longer fuelling strength in the greenback as they did for much of the post-pandemic era. Instead, the dollar is coming under pressure, especially against other perceived safe havens such as the Swiss franc, Japanese yen and gold.

You can see that clearly in the chart below, with the U.S. dollar index (DXY) getting hammered despite sharply higher yield differentials between the United States and countries like Japan and Switzerland.

Source: TradingView

Even currencies with strong cyclical attributes—such as the Australian, New Zealand and Canadian dollars—have managed to catch a bid despite the risk-off environment, underlining how dramatic the shift away from the U.S. dollar has been.

Should this trend persist, it suggests those currencies hit hardest by U.S. dollar strength in recent years—like the Japanese yen and Canadian dollar—may have room to run far further than the moves already seen.

USD/JPY Breaking Down

Source: TradingView

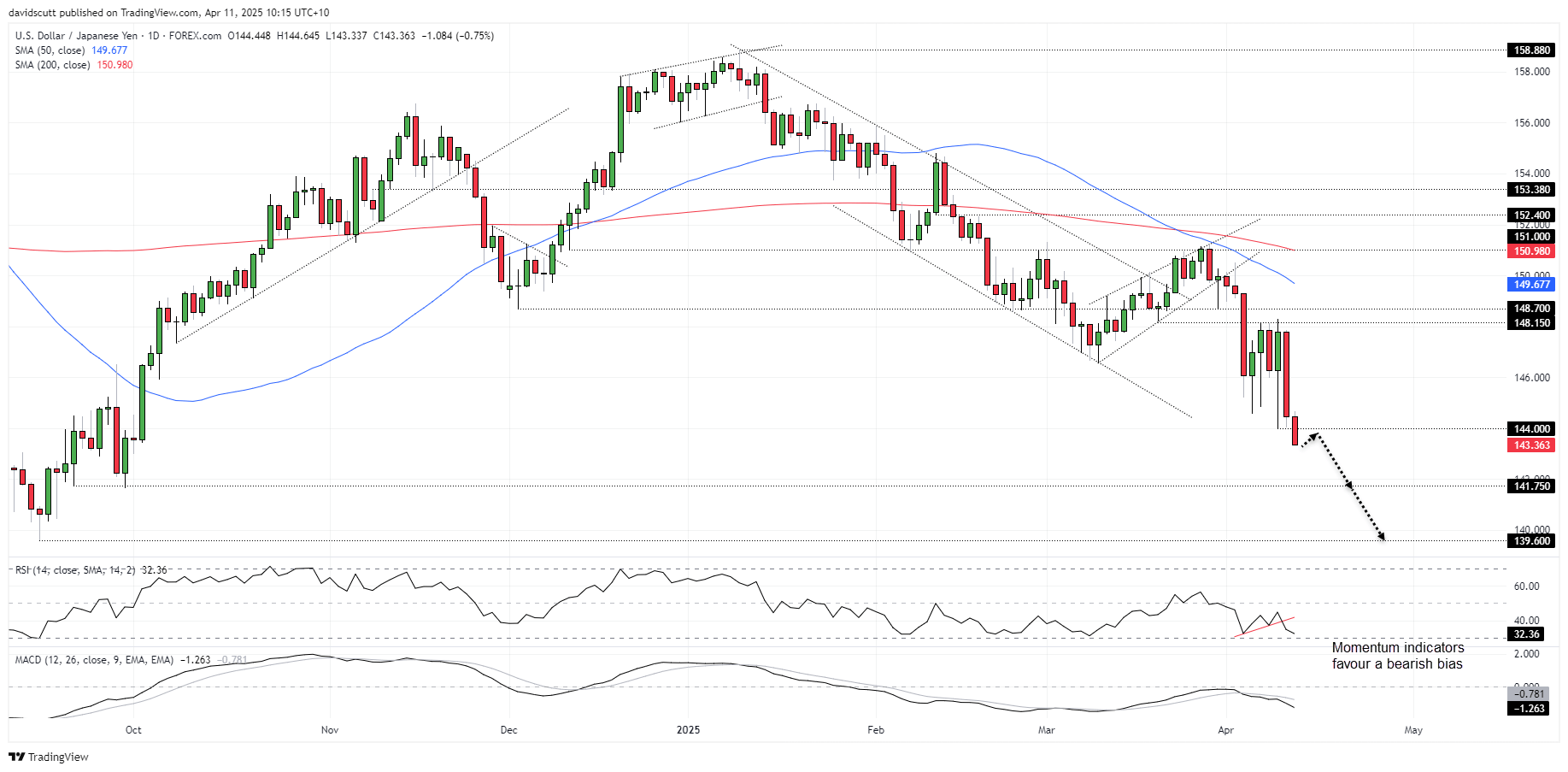

USD/JPY screens as a decent short setup in the near term, with the price breaking beneath year-to-date lows set earlier this week during early Asian trade on Friday. Momentum indicators are also supporting the downside, with the minor uptrend in RSI (14) now broken and the indicator pushing to fresh lows. MACD has also crossed below zero, confirming strengthening bearish momentum.

Those considering shorts could sell the break of 144.00 with a stop above the level for protection. 141.75 screens as a potential target, with 139.60 another possibility for those seeking greater risk-reward.

USD/CAD Breaches 200DMA

Source: TradingView

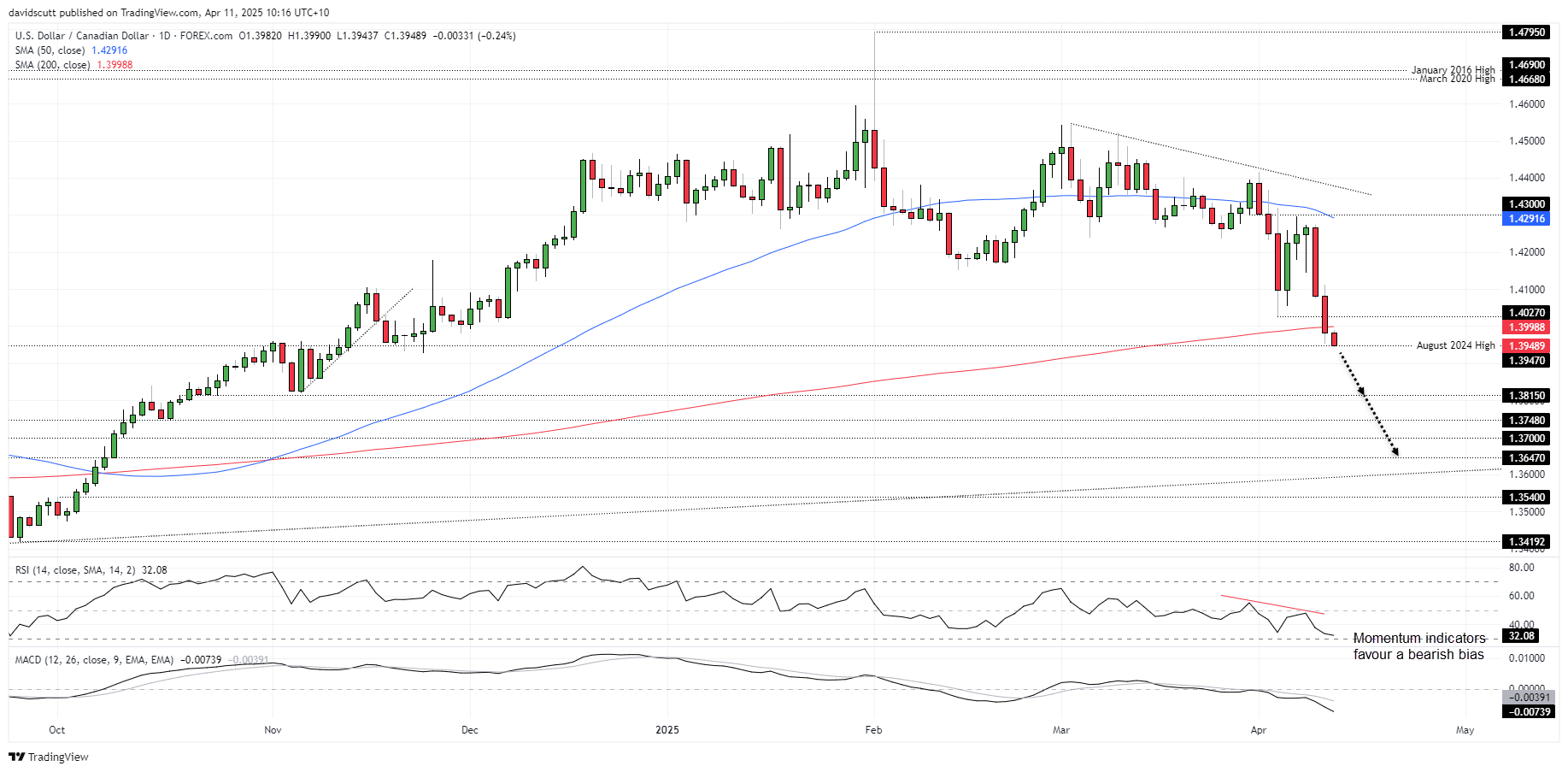

USD/CAD bears will also be eyeing a deeper downside flush, with the pair breaking and closing beneath the 200-day moving average on Thursday. The price now finds itself resting on 1.3947, the high set in August last year. A break of this level could encourage other traders to join the bearish move, generating a setup where shorts could be established with a stop above the 200-day moving average for protection.

1.38115 screens as an initial target, with other minor levels such as 1.3748, 1.3700 and 1.3647 also in play. Momentum indicators favour retaining a bearish bias, with RSI (14) trending strongly lower but not yet oversold. MACD further bolsters the bearish signal.

-- Written by David Scutt

Follow David on Twitter @scutty