Weekly Technical Trade Levels on USD Majors, Commodities & Stocks

- Technical setups we are tracking into the weekly / monthly open

- Next Weekly Strategy Webinar: Monday, June 9 at 8:30am EST

- Review the latest Video Updates or Stream Live on my YouTube playlist.

In this webinar we take an in-depth look at the technical trade levels for the US Dollar (DXY), Euro (EUR/USD), British Pound (GBP/USD), Australian Dollar (AUD/USD), Canadian Dollar (USD/CAD), Japanese Yen (USD/JPY), Swiss Franc (USD/CHF), Gold (XAU/USD), Silver (XAG/USD), Crude Oil (WTI), S&P 500 (SPX500), Nasdaq (NDX), Dow Jones (DJI), and Bitcoin (BTC/USD). These are the levels that matter on the technical charts into the weekly open / June trade.

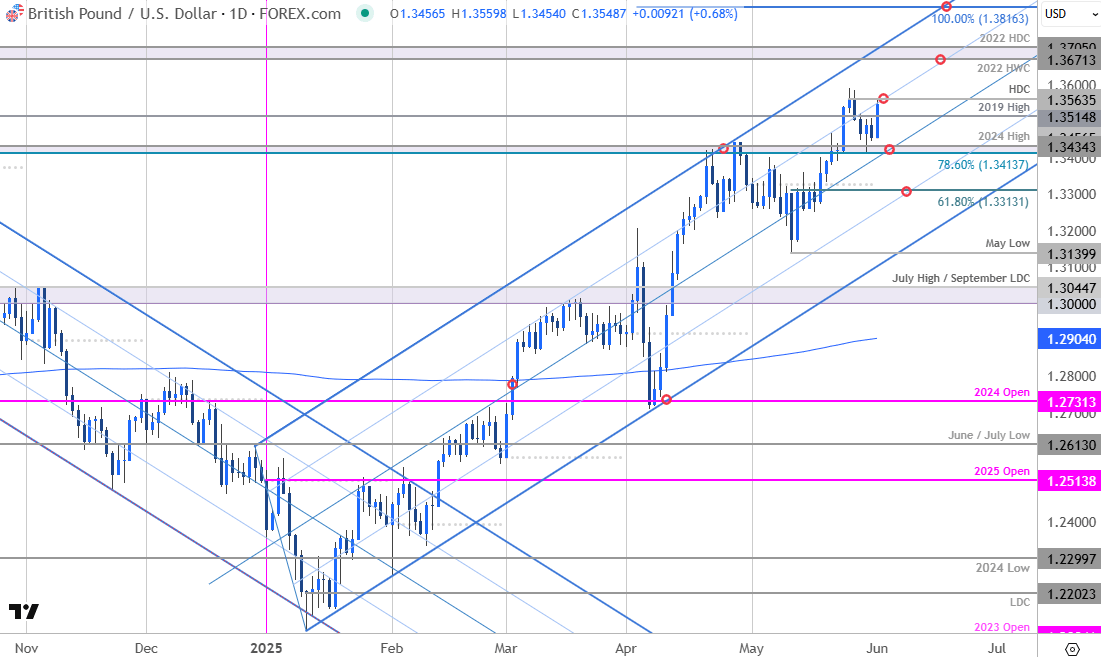

British Pound Price Chart – GBP/USD Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; GBP/USD on TradingView

One of the cleaner setups into the start of the week / month- Sterling opens the session with a test of confluent resistance into the yearly high-day close (HDC) at 1.3564- looking for a reaction there today with a breach / close above needed to fuel the next leg of the advance towards 1.3671-1.3705.

Initial support rests with the 2019 high at 1.3515 backed closely by the 78.6% retracement / 2024 high at 1.3414/34- note that the median-line converges on this threshold over the next few days and a break / close below would suggest a more significant high was registered last month / a larger reversal is underway. Review my latest British Pound Short-term Outlook for a closer look at the GBP/USD trade levels.

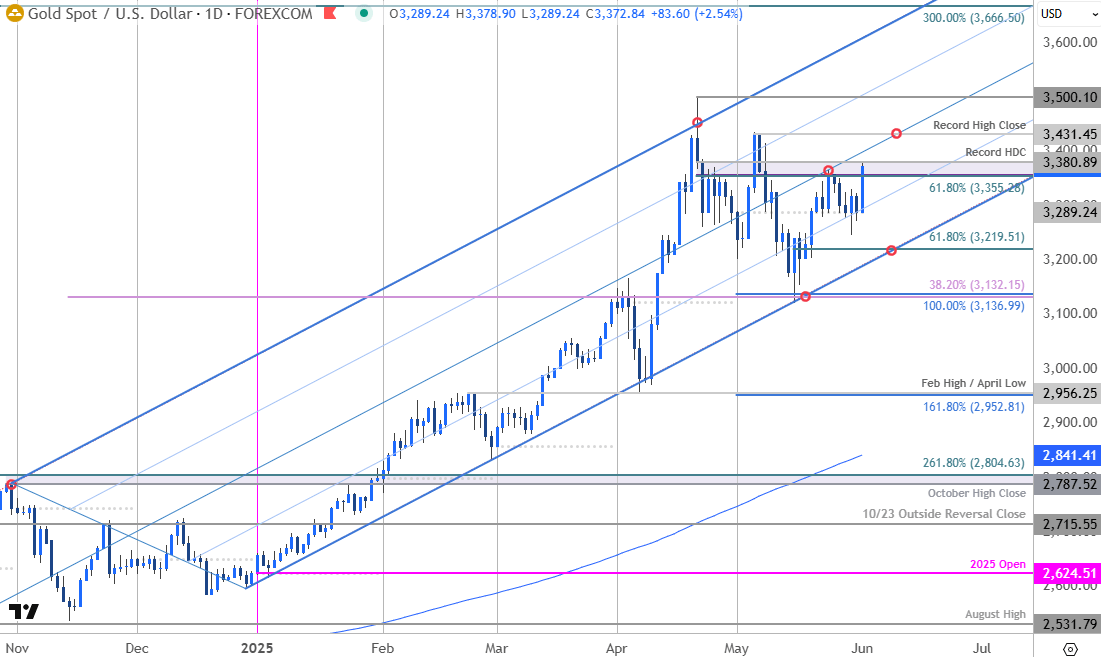

Gold Price Chart – XAU/USD Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; XAU/USD on TradingView

Gold is poised to mark the largest single-day advance in nearly a month with XAU/USD stretching back into resistance at 3355/80- a region defined by the 61.8% retracement of the April decline and the record high-day reversal close. Looking for a reaction off this mark with a close above the median-line needed to fuel a run towards the record high-close at 3431 and the all-time high at 3500.

Weekly / monthly open support rests at 3289 with key support / medium-term bullish invalidation now raised to the 61.8% retracement of the May rally near 3219. Review my latest Gold Short-term Outlook for a closer look at the XAU/USD trade levels.

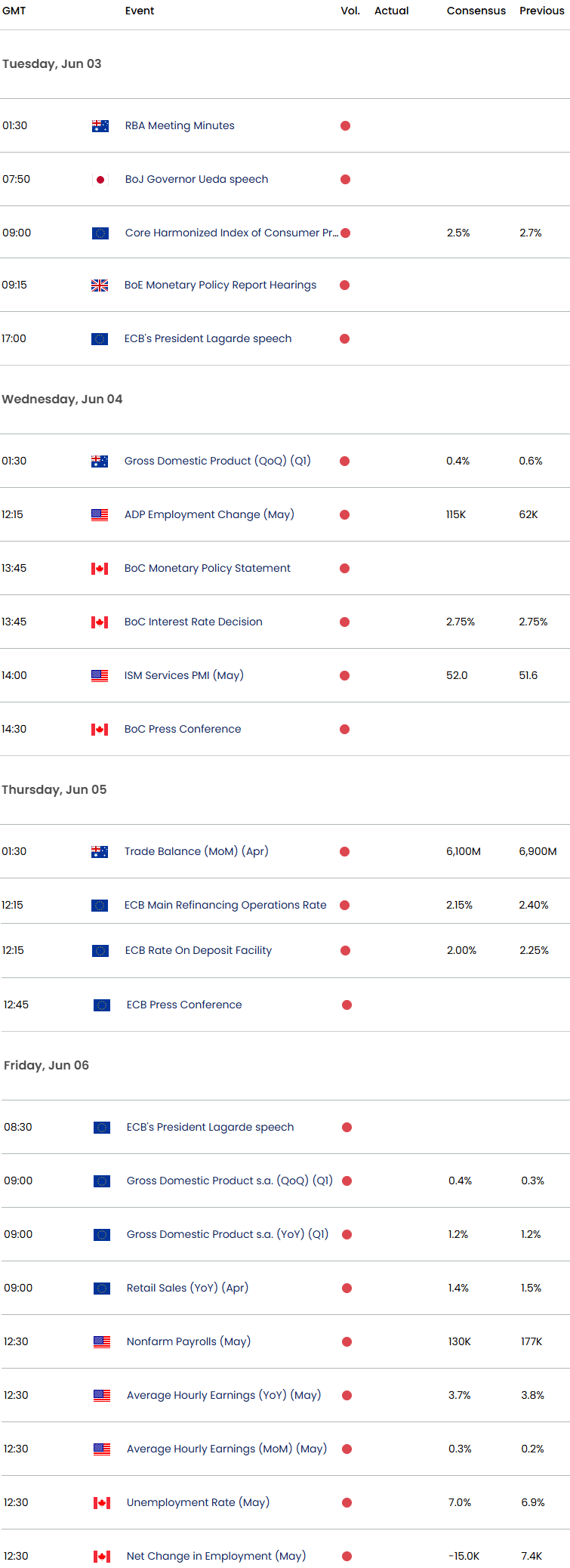

Economic Calendar – Key USD Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

--- Written by Michael Boutros, Sr Technical Strategist

Follow Michael on X @MBForex