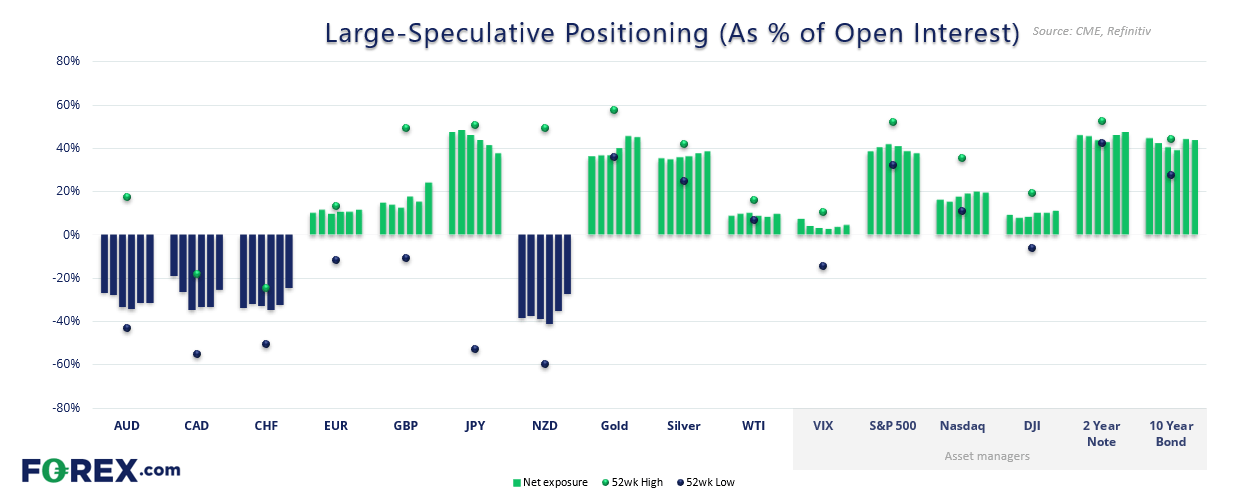

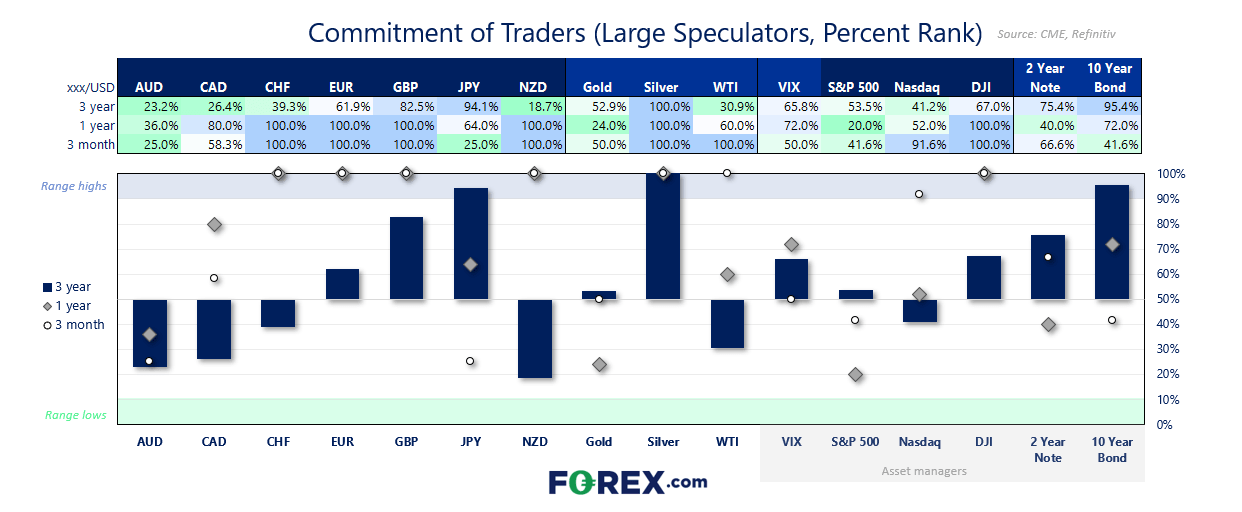

CFTC’s latest Commitments of Traders (COT) report reveals asset managers pushed their net-long exposure to the US dollar to a record high. Large speculators also ramped up bearish positioning on the Australian dollar, while net-short exposure to the Canadian dollar and New Zealand dollar fell. Meanwhile, the British pound remains a favourite among speculators, and silver shorts were trimmed aggressively.

USD Bears in Control as AUD Sentiment Sours, EUR and CAD Gain Bullish Traction

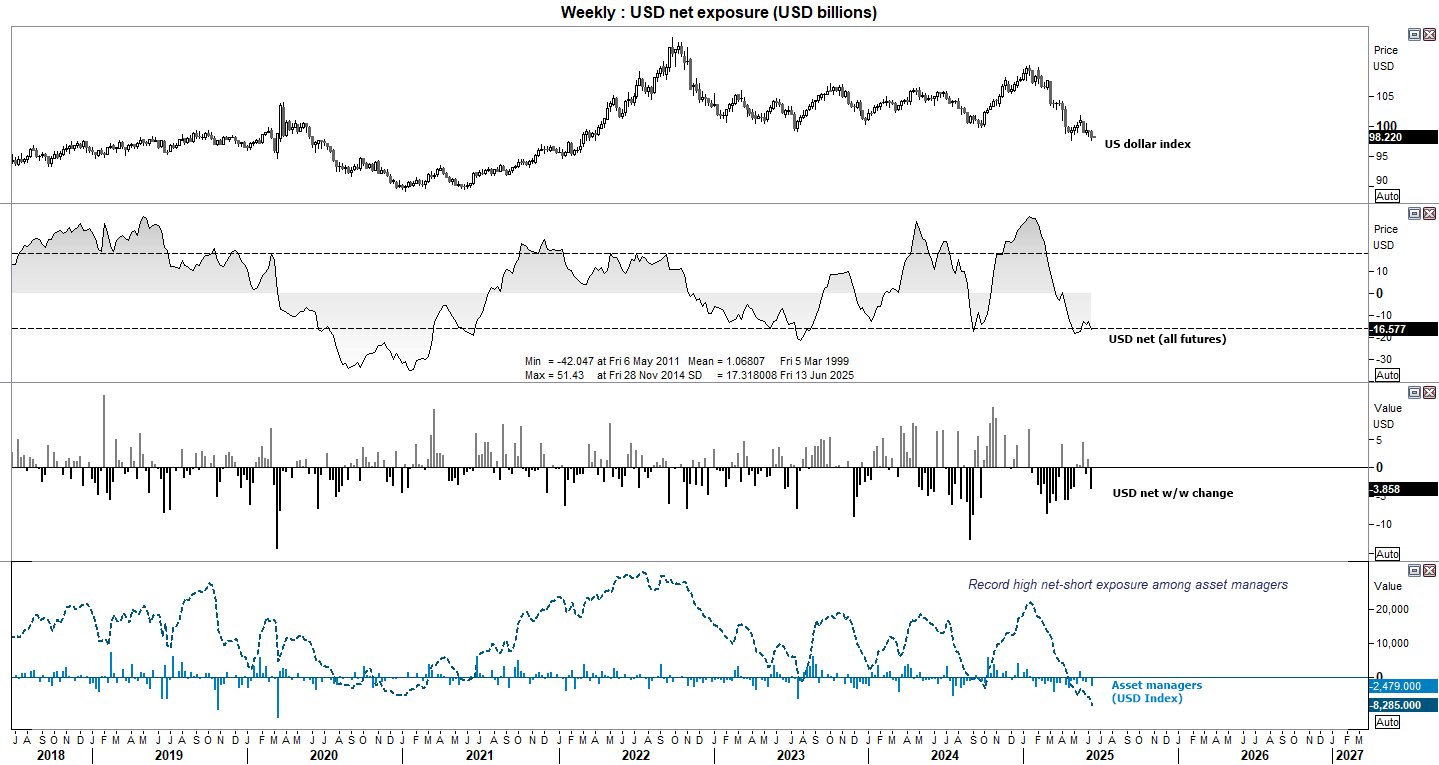

- US Dollar (USD): Asset managers reached a record high level of net-short exposure to US dollar index futures

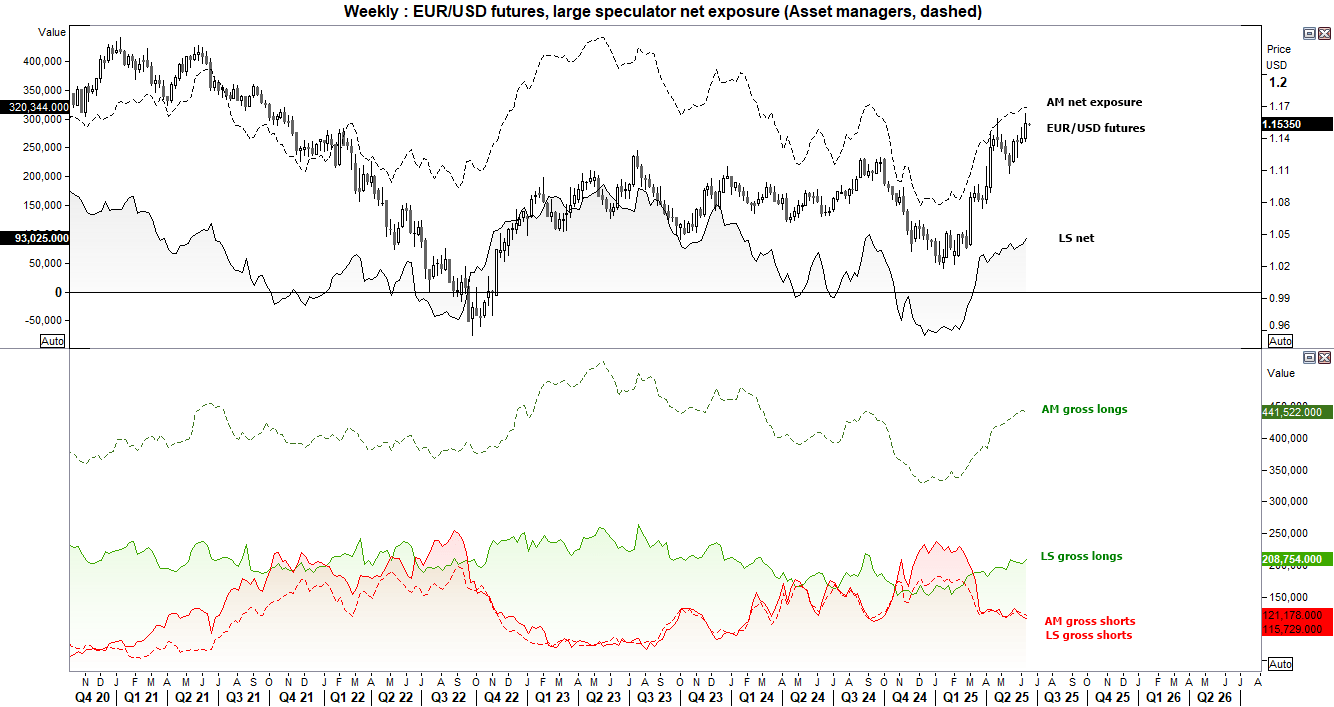

- European dollar (EUR): Net-long exposure increased 10.2k contracts among large speculators

- British pound (GBP): Net-long exposure rose by 16.4k contracts, gross shorts -9k (-13.2%), longs rose 7.4k contracts (7%)

- Japanese yen (JPY): Net-long exposure fell -6.5k contracts

- Australian dollar (AUD): Net-short exposure rose 6.8k contracts, with gross-shorts rising 7.2k contracts (7.8%), longs were flat on the week

- Canadian dollar (CAD): Net-long exposure rose 15.3k contracts, with gross-longs rising 2.4k (6.4) and shorts falling by -14.3k contracts (-11.3%)

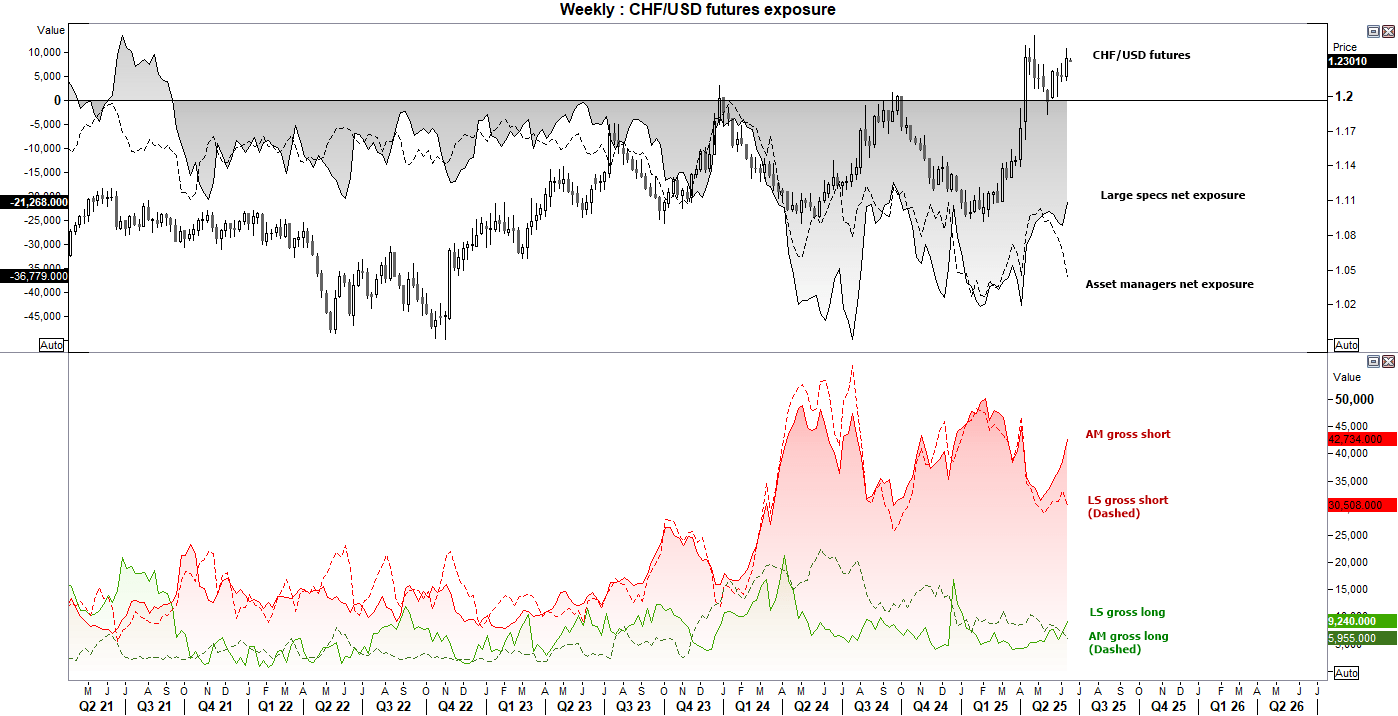

- Swiss franc (CHF): Gross-long exposure increased 29% last week, shorts reduced by -8%

- Gold (GC): Net-long exposure was little changed between large speculators or managed funds

- Silver (SI): Large speculators reduced gross-short exposure by -17.9k contracts (-11.4%)

- Crude Oil (WTI): Gross-longs rose 24k contracts, mostly due to short covering with gross-longs falling -2.7k contracts (-12.6%)

US Dollar Positioning (IMM Data): Weekly COT Report Analysis

Asset managers pushed their net-short exposure to the US dollar index to a record high of -8.2k contracts. The US dollar index also printed its lowest weekly close since March 2022. If we look at positioning against USD futures in aggregate, traders were net-short by -$16.6 billion last week, which is an increase of 3.9 billion.

I have made the case in recent weeks that the US dollar selloff could be in for a bounce. But unless traders get behind it, any such bounce could be limited, unless a suitably bullish catalyst unfolds.

EUR/USD Positioning: Euro Futures – Weekly COT Report

While large speculators increased their net-long exposure to EUR/USD futures by 10.2k contracts last week, asset managers trimmed their by -273. And while asset managers bullish exposure remain elevated compared to large speculators, they’re not at a sentiment extreme and there is little appetite for shorts. Furthermore, net-long exposure to EUR/USD futures is trending higher among large specs. None of which points to an imminent reversal lower for the euro, or higher for the US dollar index.

CHF/USD Positioning: Swiss Franc Futures – Weekly COT Report

Trader’s net-exposure to the Swiss franc saw quite the divergence last week, with large speculators decreasing net-short exposure by -4.8k contracts and asset managers increasing theirs by 5.6k contracts. While this effectively cancels one another out, the bigger picture should be considered.

Large specs have been reducing short exposure due to safe-haven demand while asset managers have been increasing their dur to the prospects of negative interest rates. The Swiss National Bank (SNB) are expected to cut their interest rate by 25bp to 0% this week. Its unclear whether they’ll signal further cuts, but the overnight index swap market (OIS) remain in negative territory to suggest they will. So that could see large specs eventually increase their net-short exposure to the Swiss franc in due course, if or when its safe-haven demand falters.

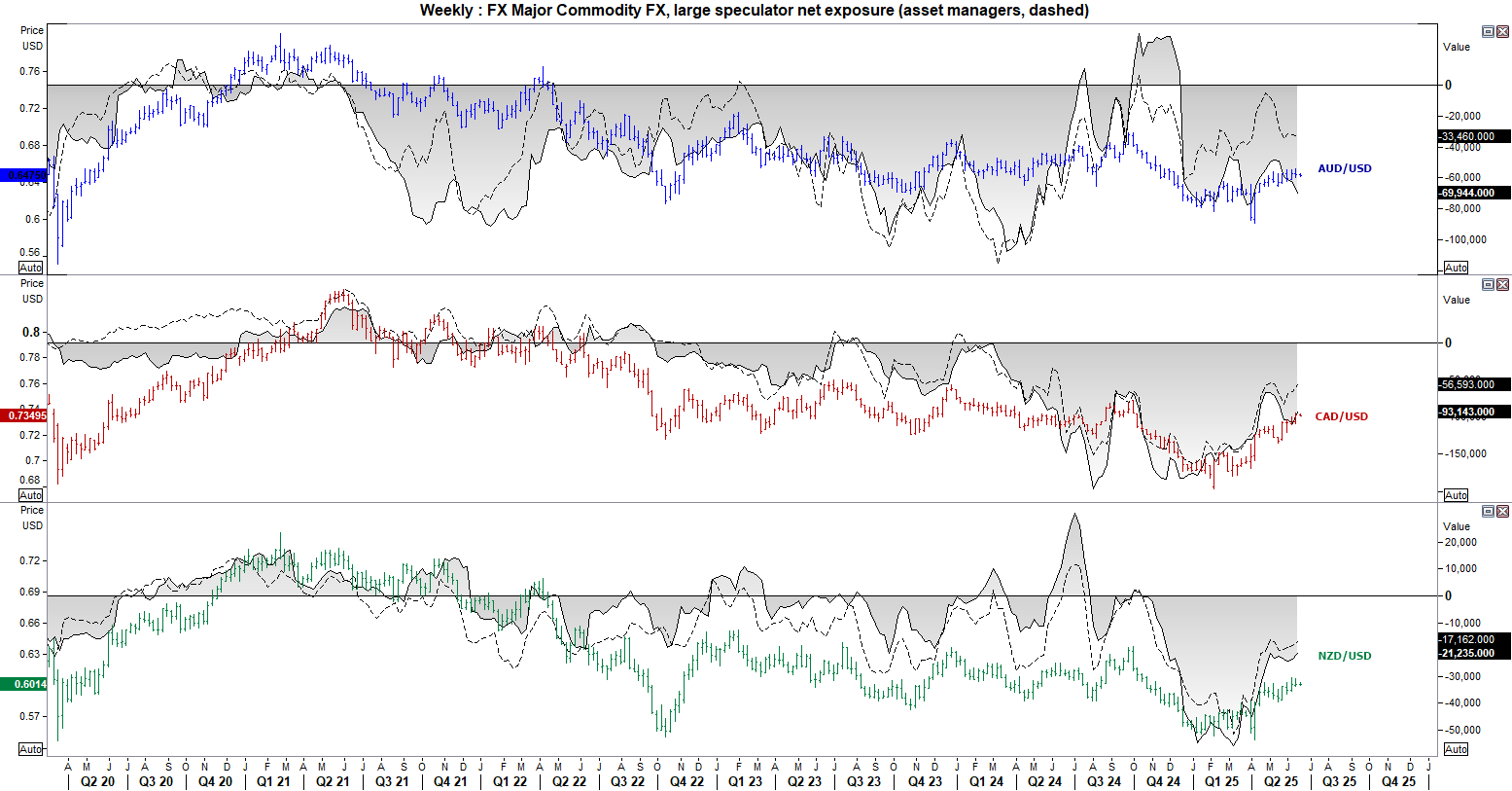

Commodity FX Positioning (AUD, CAD, NZD): Weekly COT Report Overview

Positioning among the major commodity FX currencies has diverged in recent weeks, with net-short exposure to the Canadian dollar and New Zealand dollar falling, yet rising against the Australian dollar.

The Reserve Bank of New Zealand (RBNZ) is at or near the terminal rate of its easing cycle, which has made NZD the outperformer over AUD during a weaker US dollar environment. The Bank of Canada (BOC) also held rates for a second consecutive meeting earlier in June, with hotter inflation suggesting the central bank could be closer to its terminal rate.

Yet bets against the Australian dollar are on the rise, with net-short exposure increasing last week due to a rise in gross shorts and a reduction in gross longs. The fact that AUD/USD continues to falter each time it tries to break above 65c is also a clue that the Aussie could be near an inflection point. And with recent data showing slower inflation and growth, a slightly softer set of employment figures this week could weigh further on AUD/USD on bets of an interest rate cut by the Reserve Bank of Australia (RBA) in July.