USD/NOK Summary

Norges Bank caught markets napping with a surprise 25bp cut on Thursday, lowering the sight deposit rate to 4.25%—the first move lower in five years. The krone slumped on the decision, but the move didn’t stick. While rate differentials briefly weighed on USD/NOK, geopolitical risk has been the dominant force.

The pair remains tightly linked to Brent crude and S&P 500 futures, acting as a proxy for Middle East tensions. With headlines driving direction, rallies may be short-lived unless the conflict escalates further.

Norges Bank Blinks, Signals Shallower Easing Cycle

Norges Bank surprised markets on Thursday with a 25bp rate cut to 4.25%—its first in five years—delivering the move earlier than flagged in March and catching most forecasters off guard.

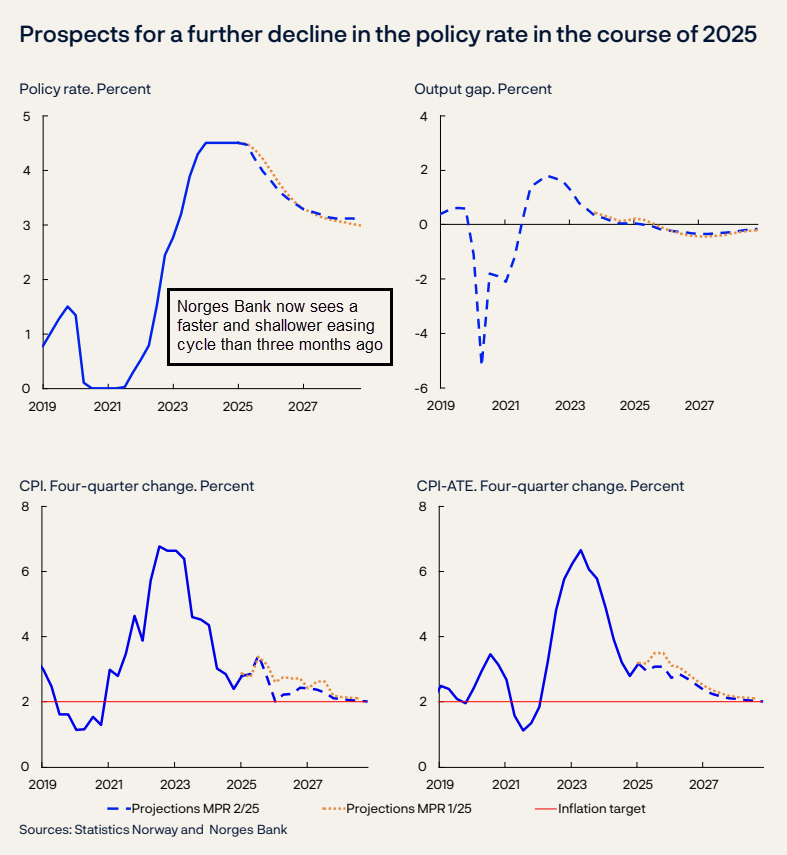

While the timing of the cut came as a surprise, the overall easing path was merely tweaked with the Bank signalling a faster but shallower cutting cycle than three months ago, with the policy rate expected to fall to 3% by the end of 2028—slightly above the level projected in March.

Source: Norges Bank

The decision was driven by softer-than-expected inflation and an improved growth outlook, with policymakers noting the 2% inflation target is now within sight. Still, they kept a cautious tone, warning that fewer cuts will be delivered if wage and price pressures linger.

While the timing caught economists off guard, for currency traders, it was another central bank stepping off the brake while the Fed remains on hold, shifting yield differentials in favour of the greenback. The reaction in markets was swift: the Norwegian krone slumped more than 1% against the US dollar, bond yields tumbled, and traders quickly moved to price in more easing in the back half of the year.

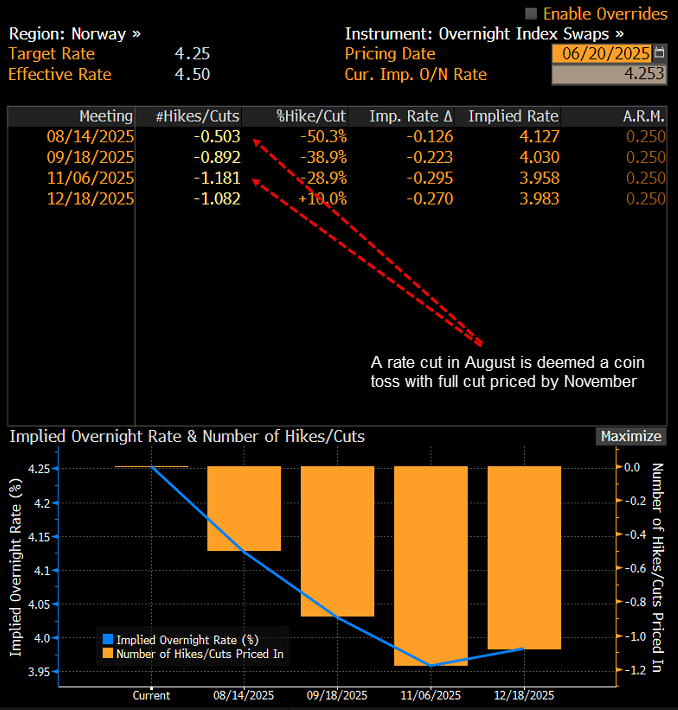

Based on swaps markets, another 25bp rate cut on August 14 is deemed a coin flip, with a move by September 18 priced at 89%. That would leave the policy rate at 4% and points to quarterly reductions over the course of 2026, based on the bank’s own rate track.

Source: Bloomberg

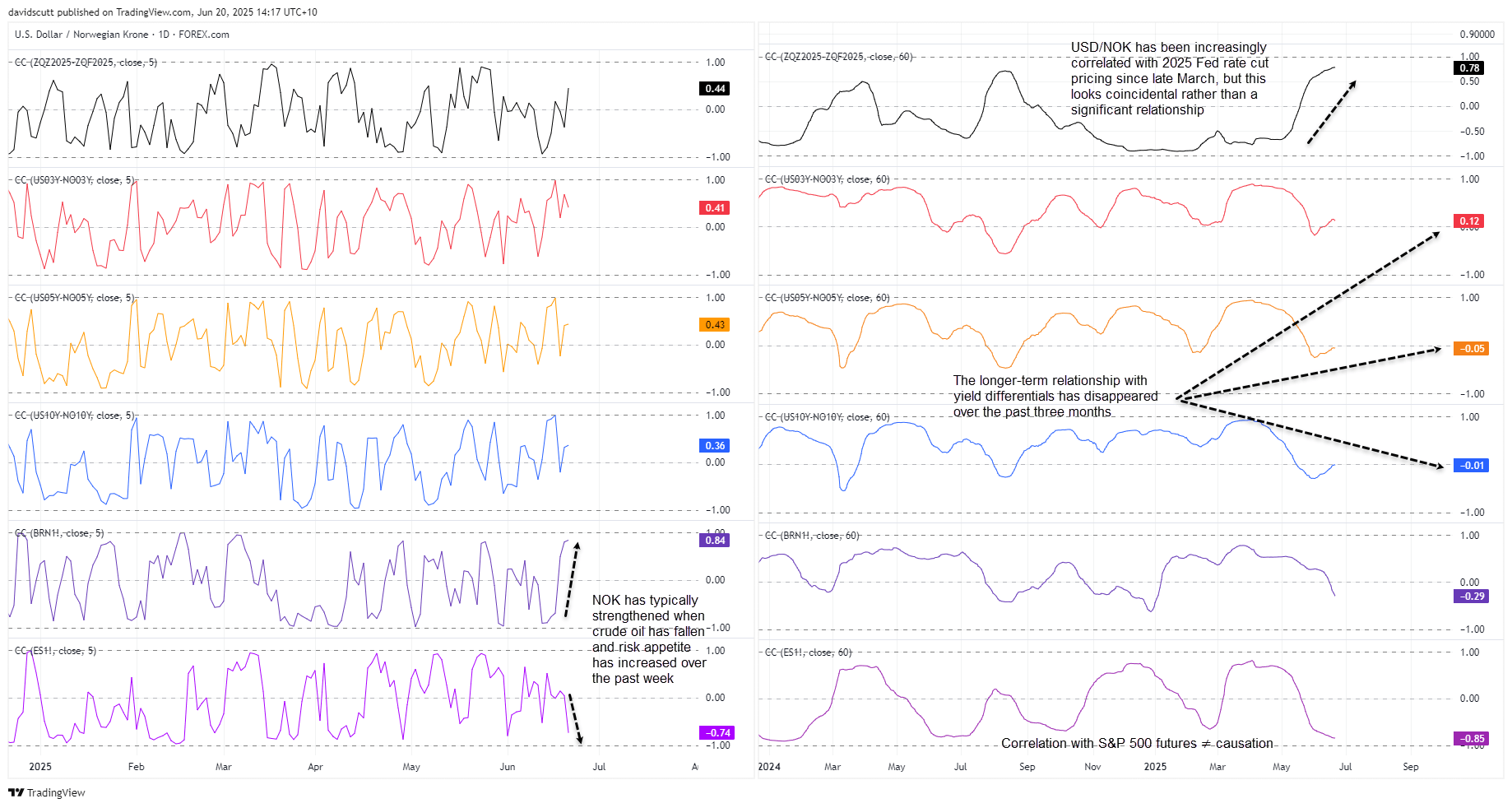

USD/NOK Shifts to Geopolitical Risk Barometer

While rate differentials played a key role behind Thursday’s move, over the past week, USD/NOK has been more a play on geopolitical risk, demonstrating a strong relationship with brent crude futures. It has also seen a mildly strong inverse relationship with S&P 500 futures over the same period. Despite being an energy superpower like the United States, like so many other currencies against the USD this week, it suggests the NOK has just been a barometer on Middle Eastern geopolitical risk, strengthening when crude prices have fallen and weakening when they rally.

Zooming out, it’s noteworthy that over the medium-term, the mildly positive correlation often seen between USD/NOK and U.S.-Norwegian yield spreads has disintegrated since Donald Trump’s ‘Liberation Day’ tariff announcement in early April.

Source: TradingView

With the krone likely to remain a geopolitical risk barometer for up to a fortnight until Donald Trump decides whether the U.S. should enter the conflict between Iran and Israel directly, it points to headline risk being the primary driver for USD/NOK next week. Bolstering that view, the pop in USD/NOK following the Norges Bank decision has now been largely reversed, coinciding with a more than 2% drop in brent futures on Friday.

USD/NOK: Selling Pops Preferred

Source: TradingView

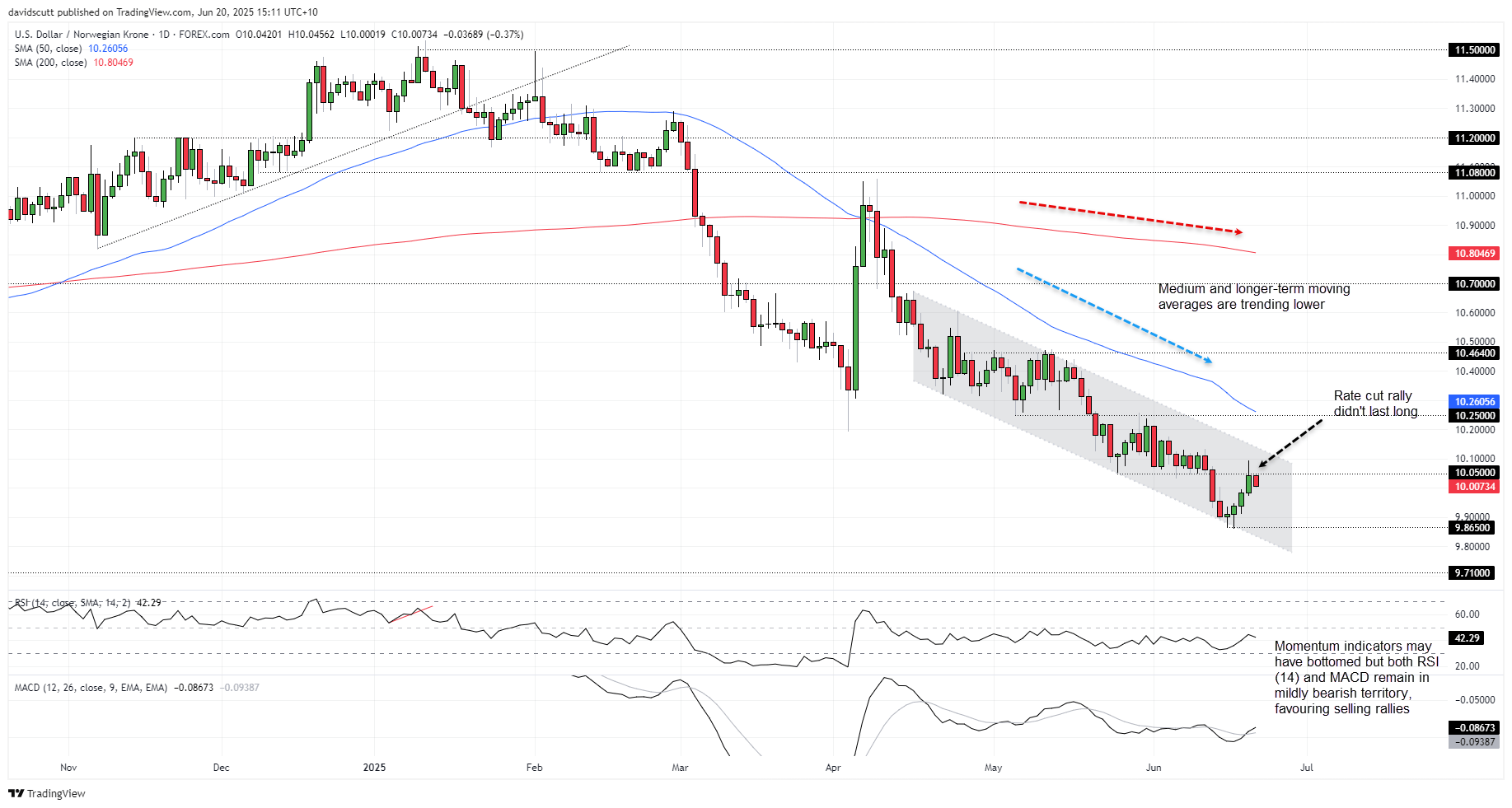

For now, USD/NOK remains in a downtrend established in mid-April. With the 50 and 200-day moving averages trending lower and indicators like RSI (14) and MACD providing mildly bearish signals despite having bottomed near-term, the broader backdrop is one that favours selling rallies over buying dips.

Resistance levels of note include 10.05, 10.25, the 50-day moving average and 10.464. On the downside, bids may emerge at 10.00 and again at 9.865 where the pair bounced earlier this month. A break of the latter would bring a retest of the late 2022 lows of 9.71 into play.

-- Written by David Scutt

Follow David on Twitter @scutty