USD Talking Points:

- U.S. Dollar bulls have had an open door to run a pullback from oversold conditions but so far this week, they’ve failed to push through short-term resistance levels.

- The larger drivers remain with Chair Powell’s speech later today and then the European Central Bank rate decision tomorrow, ahead of the Good Friday holiday and the long weekend in the United States.

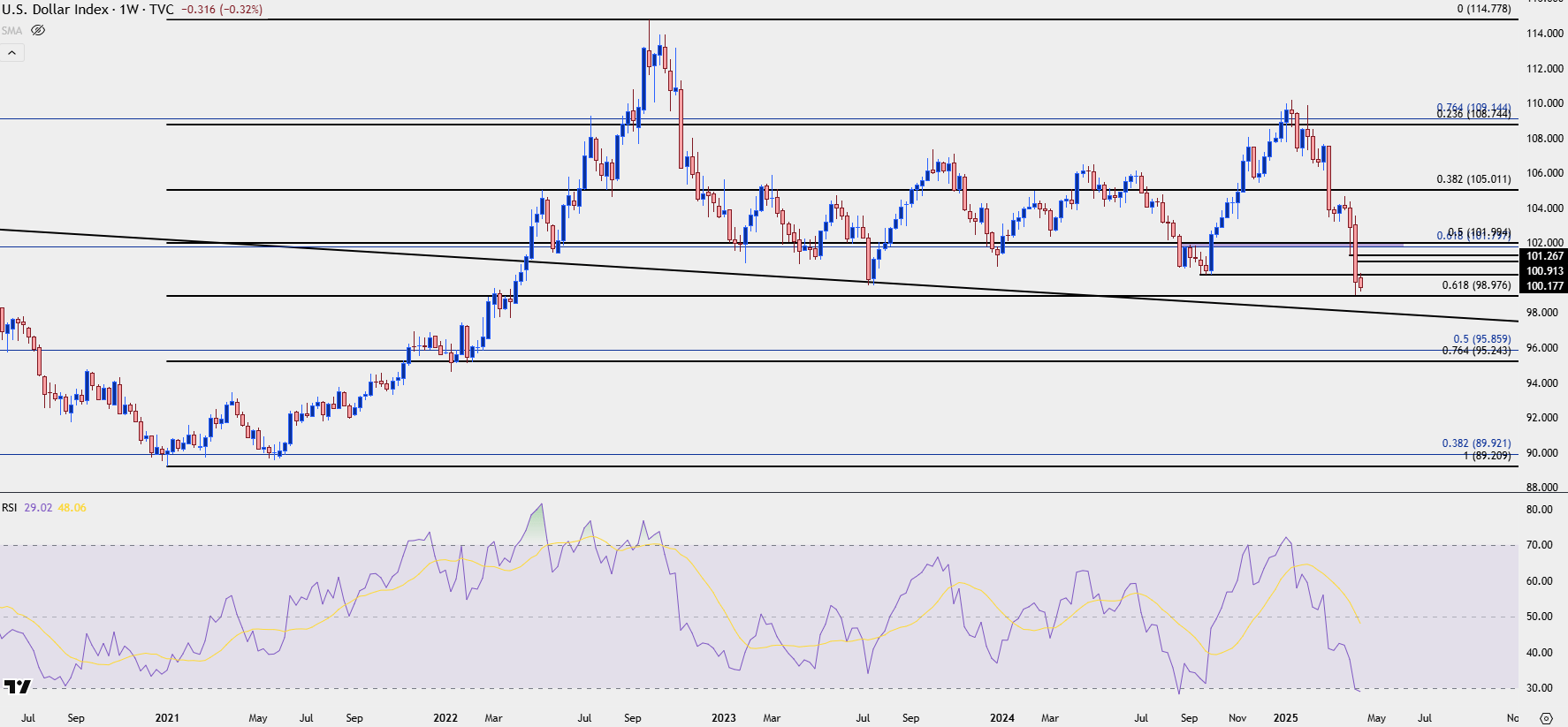

Last week saw the US Dollar go oversold on the weekly chart for only the second time in the past seven years. That low on Friday printed right around a key Fibonacci level at 98.98, and so far this week, that low has been respected with higher lows for both Tuesday and Wednesday trade.

But the problem to this point is what’s happened at short-term resistance, taken from the swing-low last year at 100.18, and this is where bulls have suddenly lost interest in continuing the bounce. This isn’t to say that topside scenarios can be ruled out yet as two of the bigger items on this week’s economic calendar remain, with Chair Powell’s speech later today and then the European Central Bank rate decision tomorrow. But, to this point sellers have an open door to push for a fresh low and the question now is whether bulls will defend the line-in the-sand around the 98.98 Fibonacci level.

U.S. Dollar Daily Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

USD: The Drivers Ahead

If there’s been any large change of late it’s been the Federal Reserve’s response to volatility. Since the GFC, each time a frightening theme has taken grip of markets, the Fed has had a tendency to talk up rate cuts which helped to bring some support to matters. Even when inflation remained high, in both 2021 and later in 2022, the Fed used the prospect of loose monetary policy to keep equity bulls on the bid, initially dismissing runaway inflation as ‘transitory.’

But this time – that hasn’t been the case, and in Chair Powell’s appearance two weeks ago he said that the bank was adopting a wait-and-see mode despite the sell-offs that had already enveloped stocks. That led to more selling later in the session with the S&P 500 closing at lows for the week. And then that weekend, the ‘Black Monday’ calls permeated social media as it was clear that the Fed put wasn’t really a thing at that point.

Since that speech we have seen another CPI report and this showed inflation below expectations, with headline inflation as low as it’s been in four years. But the question remains as to whether the Fed’s caution around tariff implications will allow them to signal rate cuts on the way. The Fed has continued to say that their expectation was for tariffs to be inflationary, which gives them pause from committing to rate cuts. Also in the camp from a stronger USD is this morning’s U.S. retail sales print, which came in at 1.4% against a 1.3% expectation; so despite the recession fears that drove the initial breakdown in the USD in March, the American consumer has continued to spend.

If Powell does signal a higher likelihood of rate softening, USD bears could get the push they’ve been looking for to probe for a fresh low. If they don’t, there could be motive for profit taking from sellers ahead of tomorrow morning’s European Central Bank rate decision.

For the ECB, a rate cut is and has been widely-expected here, but that hasn’t stopped EUR/USD from breaking out to fresh three-year-highs. So far bulls have staged a strong defense, with a bounce from the 1.1275 Fibonacci level, which I’ll look at in more detail later this afternoon, after the speech from Chair Powell.

The move in EUR/USD is similarly stretched as the move in the USD and the 1.1500 level is a major psychological level in the pair, which could be a hindrance to bullish continuation themes. In the USD, weekly RSI currently sits at 29.07 and if we are going to get that crossover back above 30, then likely the matter will require some help from the next two drivers.

If we do hear Christine Lagarde lean a bit more dovish tomorrow, that could give both USD shorts and EUR/USD longs reason to take profit after strong trending moves; and if that shows into the end of the week, that could bring with it a crossover from oversold in the Dollar and from overbought in EUR/USD.

U.S. Dollar Weekly Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

--- written by James Stanley, Senior Strategist