USD/JPY rises as court rules against Trump’s trade tariffs

- USD rises as court blocks Trump’s trade tariffs

- FOMC minutes show Fed left rates on hold owing to tariff uncertainty

- JPY falls on safe haven outflows

- USD/JPY tests 146 resistance

USD/JPY is rising for a fifth straight session, boosted by a stronger USD and the unwinding of JPY safe-haven trade.

The latest moves come as the US Court of International Trade ruled that Trump’s global trade tariffs are illegal. The court accused Trump of wrongfully invoking an emergency law to justify the bulk of his tariffs.

The White House filed an appeal with the US Supreme Court likely to have the final say. For now, the ruling blocks the tariffs unless the appeals court allows them.

US stock futures and the USD have jumped on the ruling, as it would mean that fears of an economic slowdown and higher inflation due to the tariffs will not play out in the way that the market had been pricing in.

The FOMC minutes yesterday reiterated the Fed’s patient stance on further rate cuts owing to the uncertainty in the outlook caused by tariffs. The hawkish minutes support the pair.

Attention will turn to US 1 GDP data, although this is not the preliminary reading, so it tends to be less market-moving. Jobless claims and pending home sales will also be released.

The yen is falling on safe-haven outflows following the court’s decision. However, the pair's upside could be limited, given that the Fed is still expected to cut rates twice this year and the BoJ is expected to hike rates.

Tokyo inflation is due later today and is expected to show core Tokyo CPI rose to 3.5% from 3.4%. Hot inflation supports the view the BoJ could hike rates again.

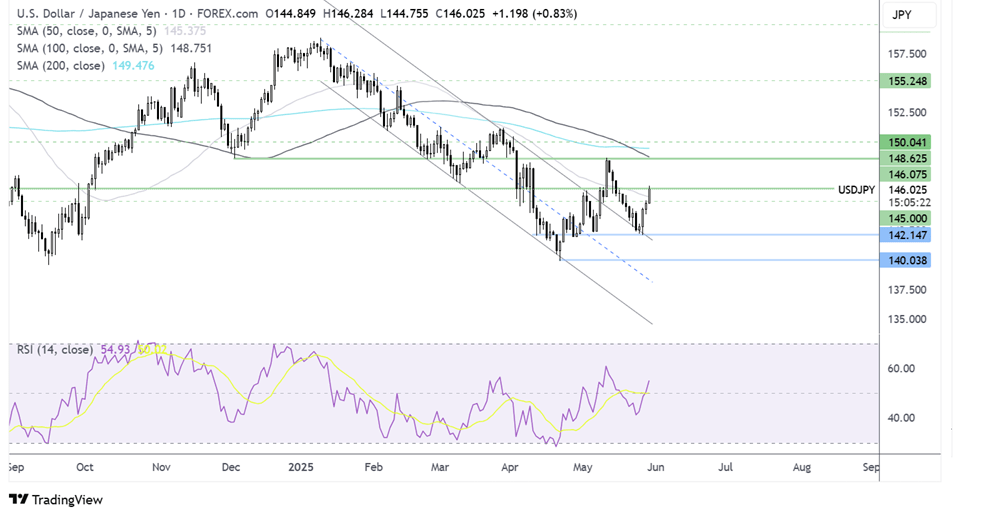

USD/JPY forecast -technical analysis

USD/JPY has rebounded from 142.10 support, recovering above the 50 SMA to 146.00. The bullish engulfing candle, combined with the RSI above 50, makes buyers hopeful for further upside.

Buyers will look to extend the bullish momentum above 146,00 towards 148.65, the May high. A rise above here creates a higher high, exposing the 200 SMA at 149.45.

Support can be seen at 145.00, the 50 SMA, and the round number. A break below 142.10 creates a lower low.

DAX rises to a record high on trade tariff block & Nvidia optimism

- DAX rises on court’s Trump trade block

- Nvidia calms China worries with solid guidance

- DAX eyes 24,5000

The DAX and its European peers are heading for strong open trading at record highs after a court ruling against U.S. President Trump's reciprocal trade tariffs. Technology shares are expected to be upbeat following positive earnings from Nvidia.

The market mood has improved on news of the US trade court blocking Trump’s trade tariffs from coming into effect. The White House has appealed the ruling,

The knee-jerk reaction has been a rally in equities. However, now the legal wrangling begins, which could create more uncertainty until the Supreme Court ruling. This uncertainty could result in delays to investment and hiring. Also, it's worth noting that the ruling doesn’t apply to sector-specific tariffs like autos and semiconductors.

Meanwhile, Nvidia beating on the top and bottom line is also helping risk sentiment. Nvidia posted an almost 70% increase in revenue to $46.1 billion amid incredibly strong demand. The US export restrictions to China are costing the AI chip maker $8 billion, but upbeat guidance helped to offset those concerns.

There is no high-impact eurozone data today. Later today, attention will turn to US GDP data and jobless claims figures.

The DAX remains supported by expectations that the ECB will cut rates again.

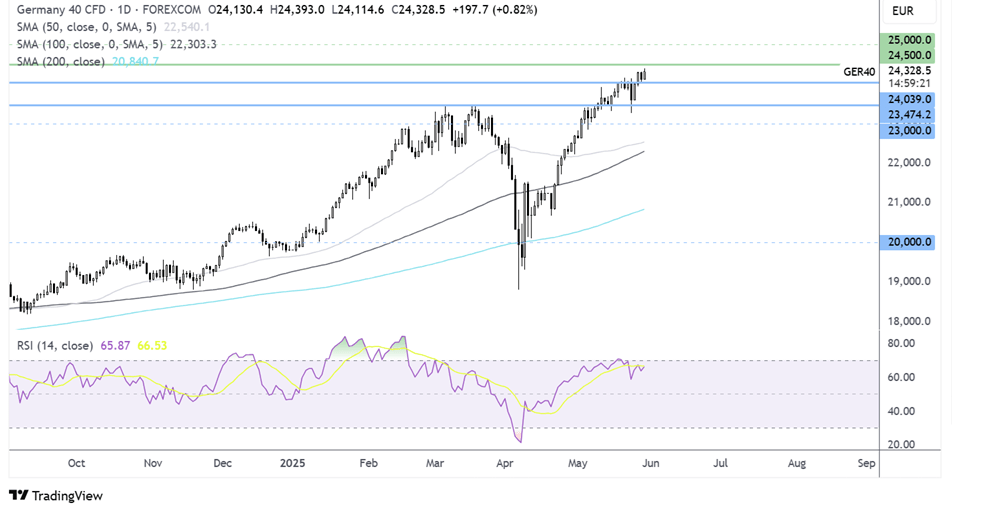

DAX forecast – technical analysis

The DAX has extended its recovery from the 18,800 April low, rising to fresh record highs. With blue skies above, buyers will look to extend the bullish run towards 24,500 as the next logical level and beyond.

Support can be seen at 24,000 and below here, 23,500, the March high, and 23,200, last week’s low. Should sellers take out this level, 23,000 comes into play.