Japanese Yen Outlook: USD/JPY

USD/JPY seems to be defending the rebound from the monthly low (139.89) as it attempts to retrace the decline from the start of the week, and the Bank of Japan (BoJ) interest rate decision may keep the exchange rate afloat as the central bank is expected to retain the current policy.

USD/JPY Defends Rebound from Monthly Low Ahead of BoJ Rate Decision

Keep in mind, USD/JPY bounced back ahead of the 2024 low (139.58) to pull the Relative Strength Index (RSI) above 30, and the exchange rate may stage a larger recovery as the BoJ remains reluctant to pursue a rate-hike cycle.

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

Looking ahead, the BoJ is anticipated to keep interest rates on hold as the central bank insists that ‘in the second half of the projection period of the January 2025 Outlook for Economic Activity and Prices, underlying CPI inflation is likely to be at a level that is generally consistent with the price stability target.’

Japan Economic Calendar

In turn, more of the same from the BoJ may drag on the Japanese Yen as the central bank sticks to a wait-and-see approach, but USD/JPY may struggle to retain the rebound from the monthly low (139.89) should Governor Kazuo Ueda and Co. show a greater willingness to further normalize monetary policy.

With that said, swings in the carry trade may sway USD/JPY amid the diverging paths between the BoJ and Federal Reserve, but the exchange rate may further retrace the decline from the start of the month should it continue to hold above the 2024 low (139.58).

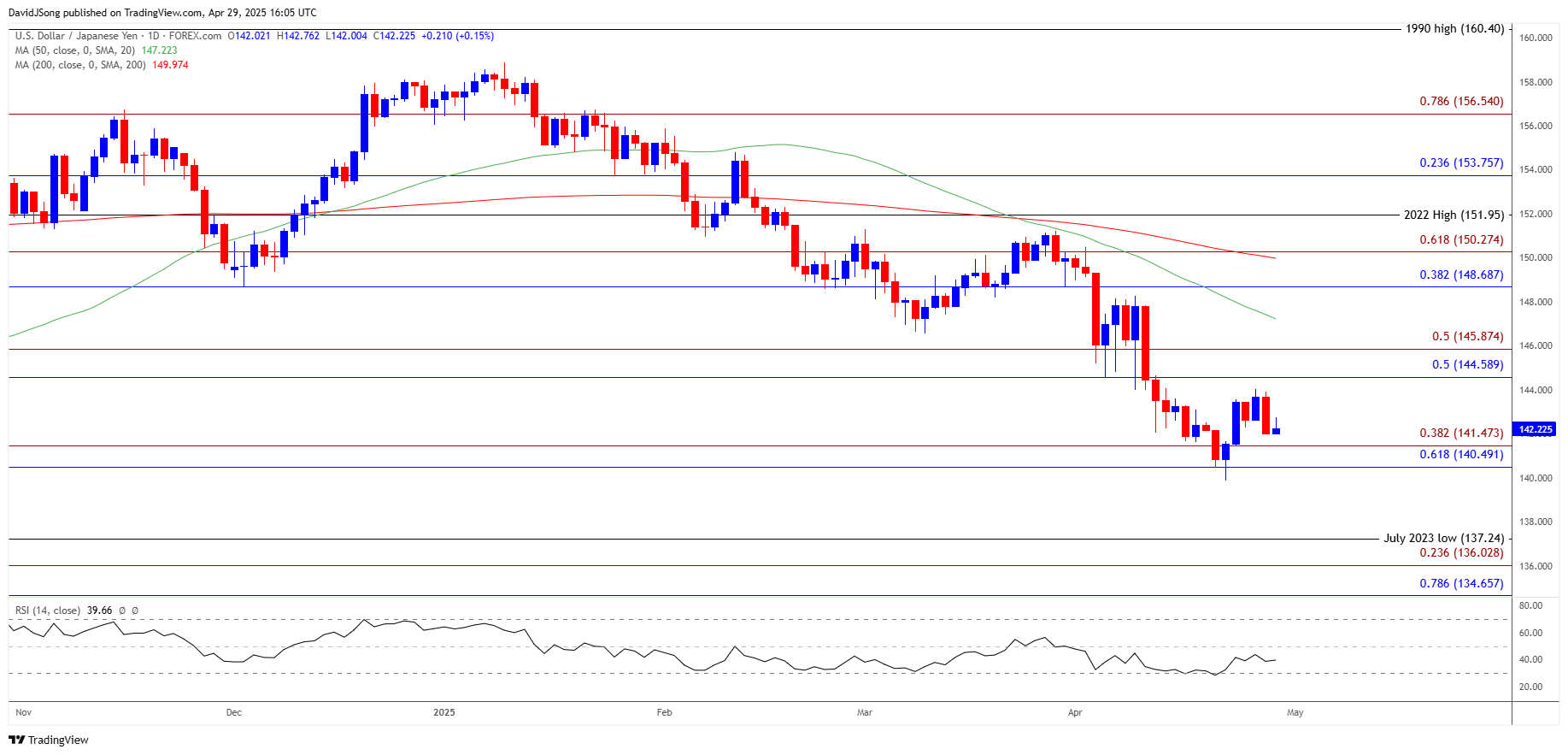

USD/JPY Price Chart – Daily

Chart Prepared by David Song, Senior Strategist; USD/JPY on TradingView

- USD/JPY holds above the 2024 low (139.58) amid the failed attempts to close below the 140.50 (61.8% Fibonacci retracement) to 141.50 (38.2% Fibonacci extension) zone, with a move/close above the 144.60 (50% Fibonacci retracement) to 145.90 (50% Fibonacci extension) region bringing the 50-Day SMA (147.22) on the radar.

- Next area of interest comes in around 148.70 (38.2% Fibonacci retracement) to 150.30 (61.8% Fibonacci extension), but USD/JPY may continue to track the negative slope in the moving average as long as it holds below the indicator.

- As a result, USD/JPY may stage further attempts to test the 2024 low (139.58), with a close below the 140.50 (61.8% Fibonacci retracement) to 141.50 (38.2% Fibonacci extension) zone bringing the July 2023 low (137.24) on the radar.

Additional Market Outlooks

British Pound Forecast: GBP/USD on Cusp of Testing 2024 High

Euro Forecast: EUR/USD Defends Weekly Low Ahead of Euro Area GDP Report

AUD/USD V-Shape Recovery Stalls Ahead of December High

Gold Price Coils Above 50-Day SMA

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong