Key Events:

- BOJ maintains rates at 0.5% despite price pressures, as Trump tariffs cast uncertainty over economic growth

- USDJPY holds above the key 146.90 level, while the U.S. Dollar Index remains above 103 ahead of the FOMC meeting

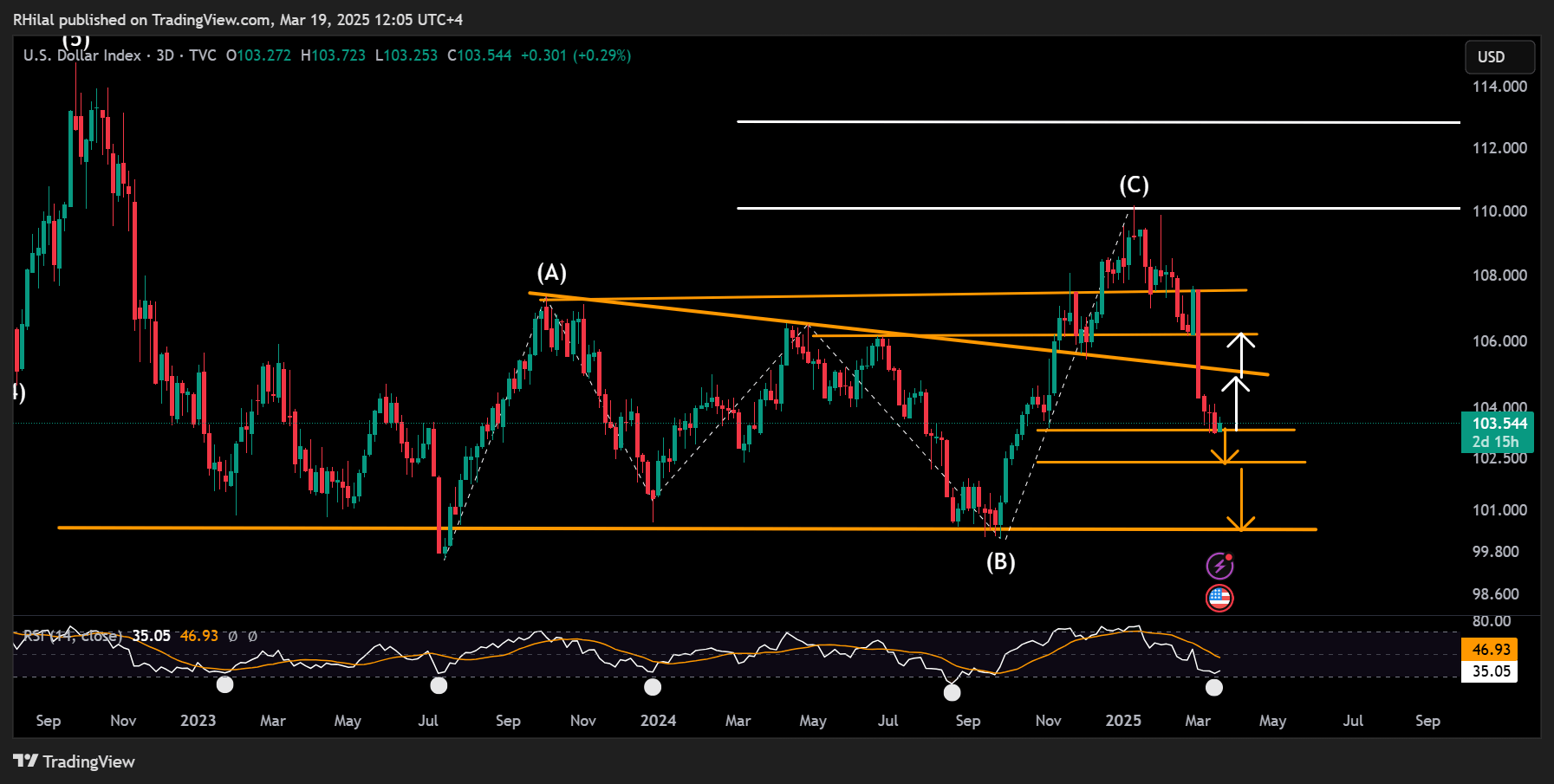

US Dollar Index: 3-Day Time Frame – Log Scale

Source: Tradingview

From a three-day time frame perspective, DXY is exhibiting weakness near the November 2024 lows at approximately 103.30. However, the Relative Strength Index (RSI) is hovering at oversold levels previously seen in September 2024, December 2023, and July 2023—periods that preceded notable rebounds in the DXY. Given that the RSI is revisiting similar conditions, reversal risks may be on the horizon for the U.S. dollar.

The chart reflects a tug-of-war between technical indicators and weak fundamentals, as the market anticipates a dovish tone from the Federal Reserve in light of tariff-related risks and economic slowdown concerns.

- A break below 103 could expose 102.50 and 100.70 as potential support levels

- Conversely, if the DXY holds above 103.30, upside targets may extend towards 105 and 106.20, potentially reversing recent gains across the currency markets

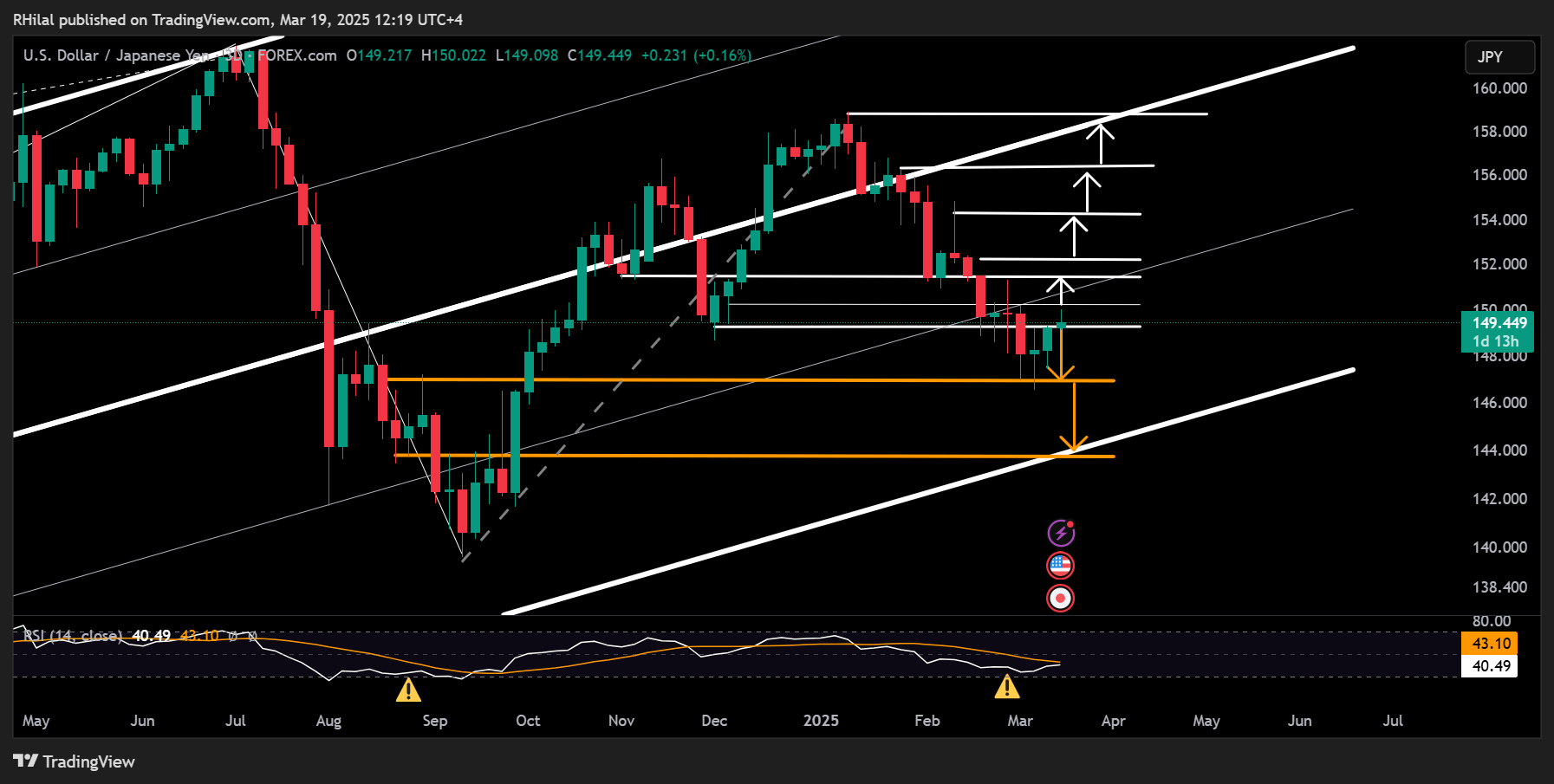

USDJPY Forecast: 3-Day Time Frame – Log Scale

Source: Tradingview

Unlike the U.S. Dollar Index, USDJPY has remained resilient above its 2025 lows at 146.90, aligning with the 0.610 Fibonacci retracement level of the September 2024 – January 2025 uptrend. The rebound coincides with the RSI recovering from oversold levels, last seen in September 2024. However, momentum is currently stalling below the 150 resistance level, as markets brace for potential FOMC-induced volatility.

- A break above 150.20 could extend gains towards 151.50, 152.20, and 154.80, aligning the trend with 2025 highs

- On the downside, if USDJPY closes below 146.90, a potential short-lived drop may occur, targeting 143.70—which aligns with the 0.786 Fibonacci retracement level of the September 2024 – January 2025 uptrend and the lower boundary of the January 2023 – July 2024 duplicated channel.

Written by Razan Hilal, CMT

Follow on X: @RH_waves