Key Events:

- BOJ rate expectations lean toward holding steady at 0.5%, despite a sharp uptick in Tokyo CPI to 3.4%

- U.S. Dollar remains range-bound ahead of major leading economic indicators: GDP, Core PCE, PMI, and NFP

- Investors await mega-cap earnings to assess the impact of tariffs on corporate performance and economic outlook

- Tariff talks continue to unsettle markets, but focus is shifting toward this week’s data-heavy calendar

Markets remain in a holding pattern as tariff negotiations continue to weigh on sentiment. Key U.S. economic data and corporate earnings could be the catalyst for a breakout, with current conditions resembling a 'calm before the storm' as technical setups take shape.

Starting with the US Dollar:

DXY 4H-Time Frame – Log Scale

Source: Tradingview

Despite recent remarks by Trump during his "100 years in office" campaign, which included criticism of Fed policy, claims of declining inflation, and renewed optimism around tariffs boosting growth — the U.S. Dollar Index has remained flat in what looks like an inverted head and shoulders formation.

Markets are waiting for hard data to validate any directional breakout. This week's U.S. data releases will be crucial:

- Advance GDP is expected to drop sharply from 2.4% to 0.2%,

- ADP Non-Farm Employment forecasted to fall from 155K to 114K,

- Core PCE likely declining from 0.4% to 0.1%. If the numbers beat expectations, a dollar recovery could follow.

If not, the BOJ meeting on Thursday and Non-Farm Payrolls on Friday could trigger the next wave of volatility. For now, markets remain cautiously range-bound.

BOJ Outlook: Rate Hold Likely, But Inflation Raises Questions

Tokyo’s latest Core CPI jumped from 2.4% to 3.4%, raising fresh concerns around the BOJ's expected decision to hold rates steady. With inflation now well above the central bank’s target — and ongoing tariff consequences still playing out — the likelihood of a policy surprise can't be fully ruled out.

Technically, both the Dollar Index and USDJPY charts suggest potential for a short-term bullish correction, as oversold conditions emerge. However, a surprise rate hike by the BOJ or disappointing U.S. data could revive recession fears and send the pair lower.

So, what are the scenarios and possible setups for the USDJPY Trade?

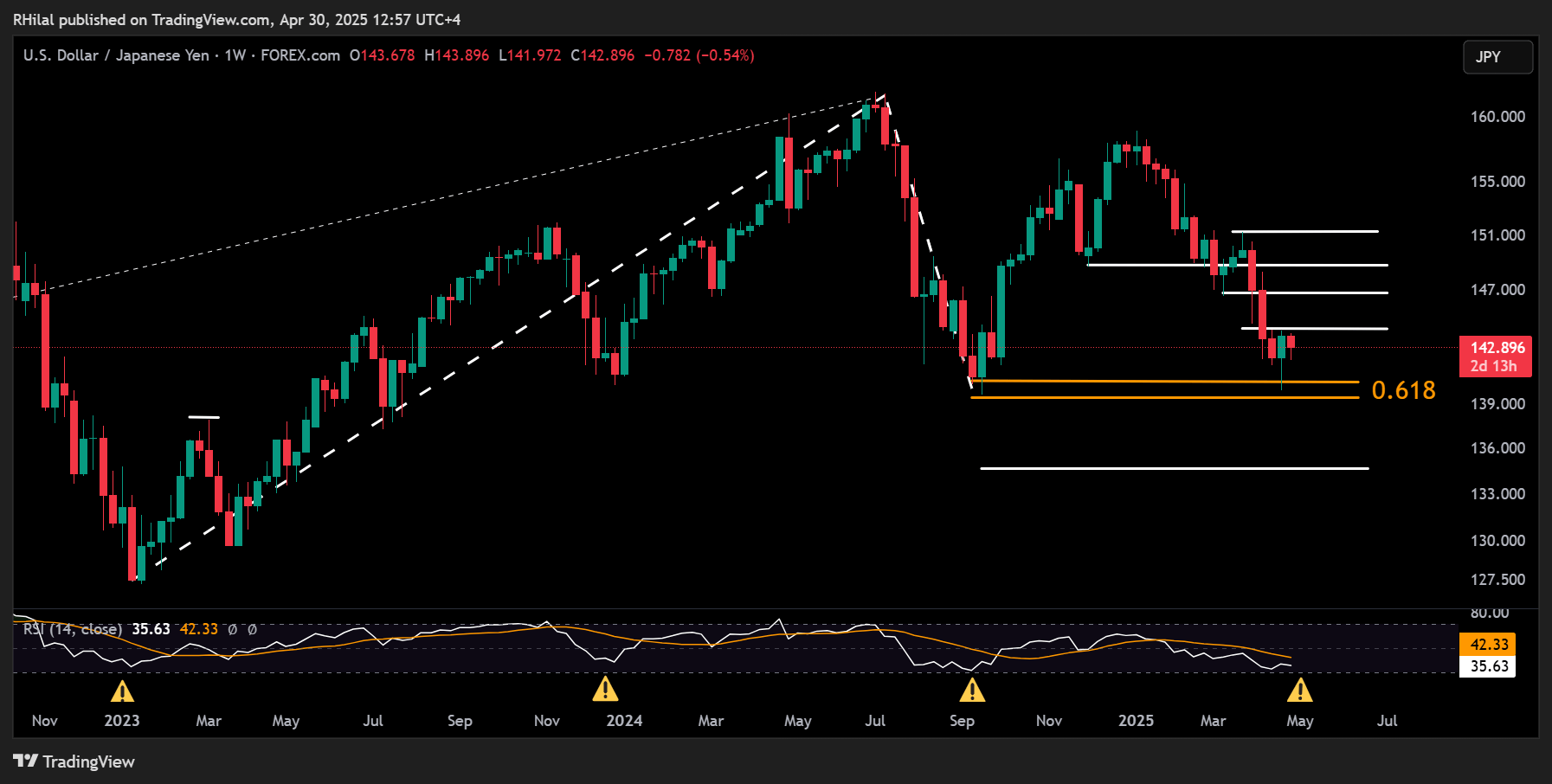

USDJPY Forecast: Weekly Time Frame – Log Scale

Source: Tradingview

From a weekly perspective, USDJPY is currently holding above the critical 0.618 Fibonacci retracement level, calculated from the uptrend that spans from the January 2023 low (127.22) to the January 2025 high (161.95).

This aligns closely with the 139.80 support, which also coincides with the September 2024 lows.

Downside Scenario: If the pair breaks below 139.00, further support may emerge near 138.00 and 134.00.

Upside Scenario: If oversold momentum triggers a rebound above 144.00, resistance levels to watch are 146.50, 148.70, and 151.20 respectively.

Written by Razan Hilal, CMT

Follow on X: Rh_waves