USD/JPY Talking Points:

- USD/JPY continued to slide earlier this morning, setting a fresh four-month low. While the 150 break two weeks ago was driven by the JPY side after a stronger CPI print, the more recent break was driven by USD-weakness on the back of recession fears in the United States.

- There remains potential for larger carry unwind scenarios, and that’s something that could have a detrimental effect on U.S. equities.

- Beware the bear trap: USD/JPY has set multiple fresh lows over the past month but outside of the CPI-fueled breakdown on the 20th, there’s been a penchant for bear traps along the way.

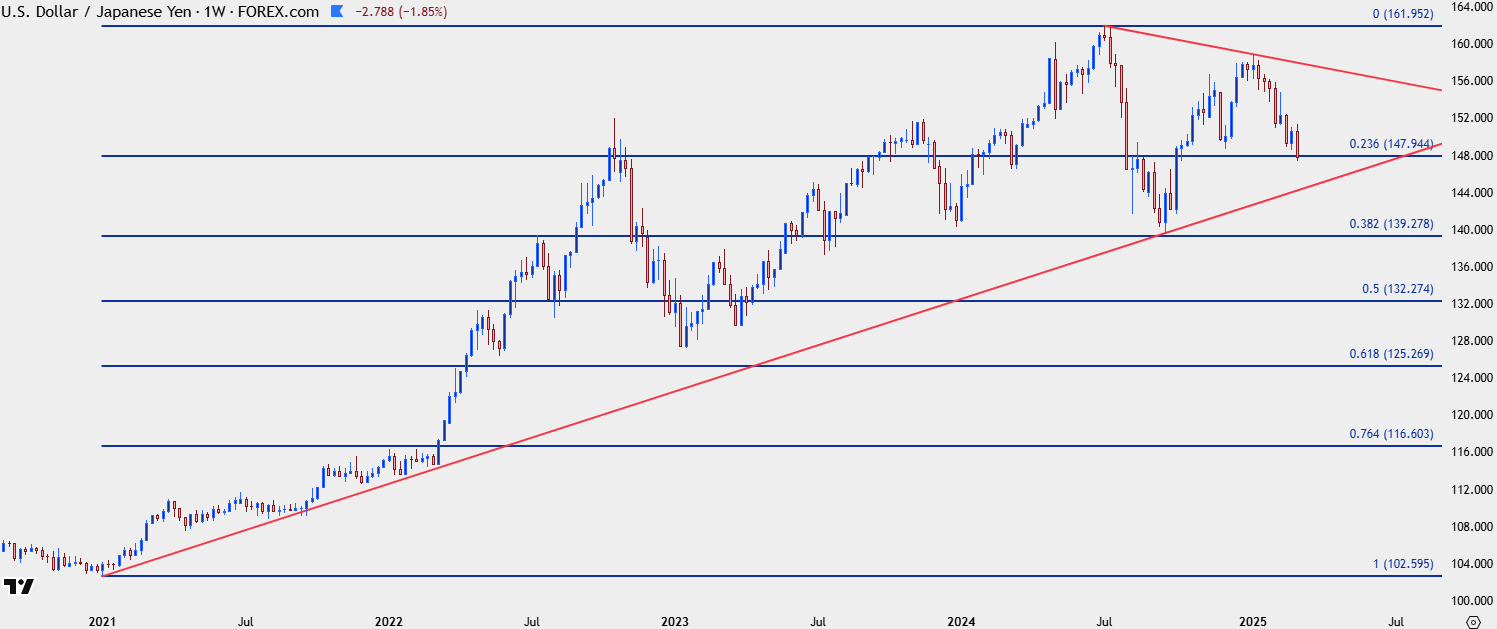

USD/JPY remains well-elevated on a long-term basis, as the pair has just crossed the 23.6% retracement of the 2021-2024 major move. While the pair was catapulted higher via the carry trade, with higher U.S. inflation starting the move in 2021 and FOMC rate hikes driving it into another gear in 2022, bulls have continued to hold on even as the Fed has cut rates multiple times and the Bank of Japan has hiked rates twice. That’s compressed the rate divergence between the two economies but we haven’t yet seen recurrence of the carry unwind scenario that swept global markets by storm last summer, when a swell of Yen-strength drove a global de-leveraging event across several different markets.

USD/JPY Weekly Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

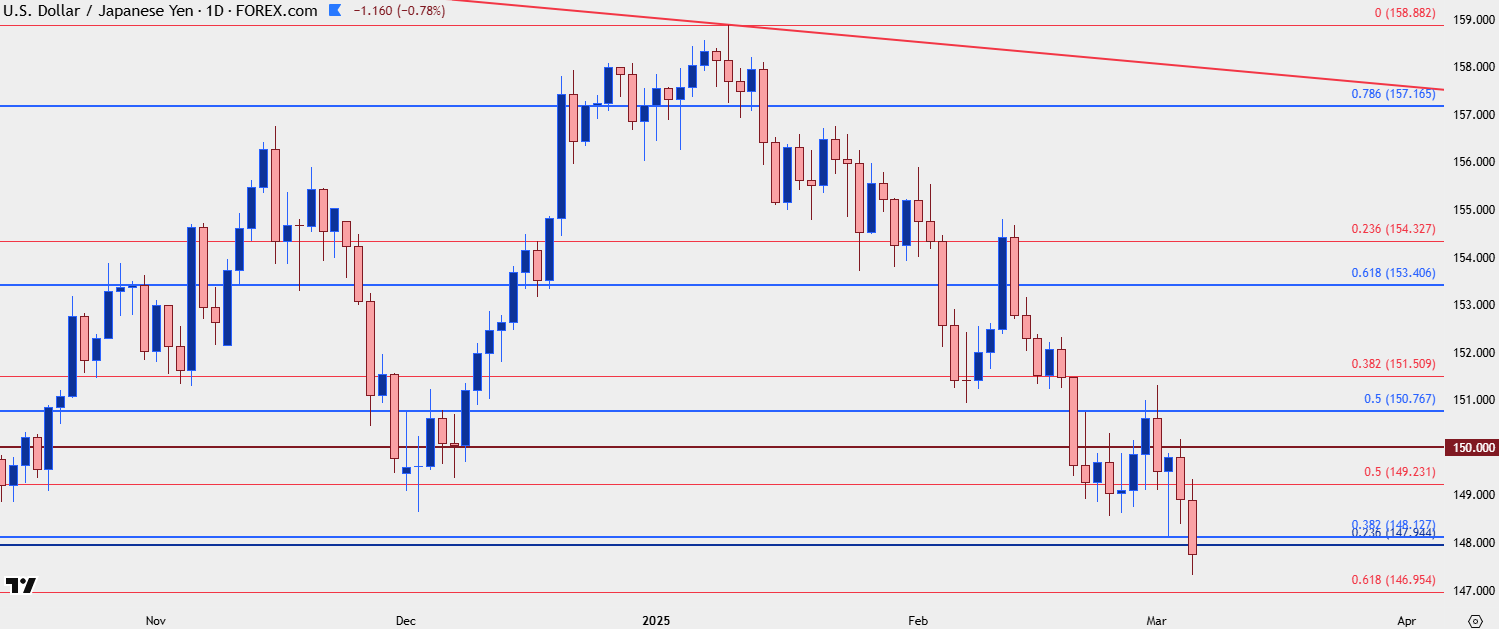

USD/JPY Shorter-Term

While it’s been a steady stream of lower-lows and highs from the weekly chart above, shorter-term has been a more challenging backdrop in the pair as sellers haven’t been able to show much for extension when given the opportunity at prints of fresh lows. There was the CPI-fueled breakdown on the 20th of February, and that’s what initially pushed the pair back below the 150.00 handle; but selling pressure slowing below the big figure and that’s led to a grinding backdrop over the past couple of weeks.

This highlights the fact that pullbacks to lower-high resistance could be considered for bearish trend continuation, while chasing breakdowns may be seen as a less attractive strategy given the pair’s recent penchant for showing bear traps.

So far this week, there’s already been three clean tests of resistance at prior supports, with Monday’s test of 150.77, yesterday’s test of 150.00 or this morning test of 149.23, which finally pushed the pair below the 23.6% retracement of the longer-term move looked at above which plots at 147.94.

USD/JPY Daily Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

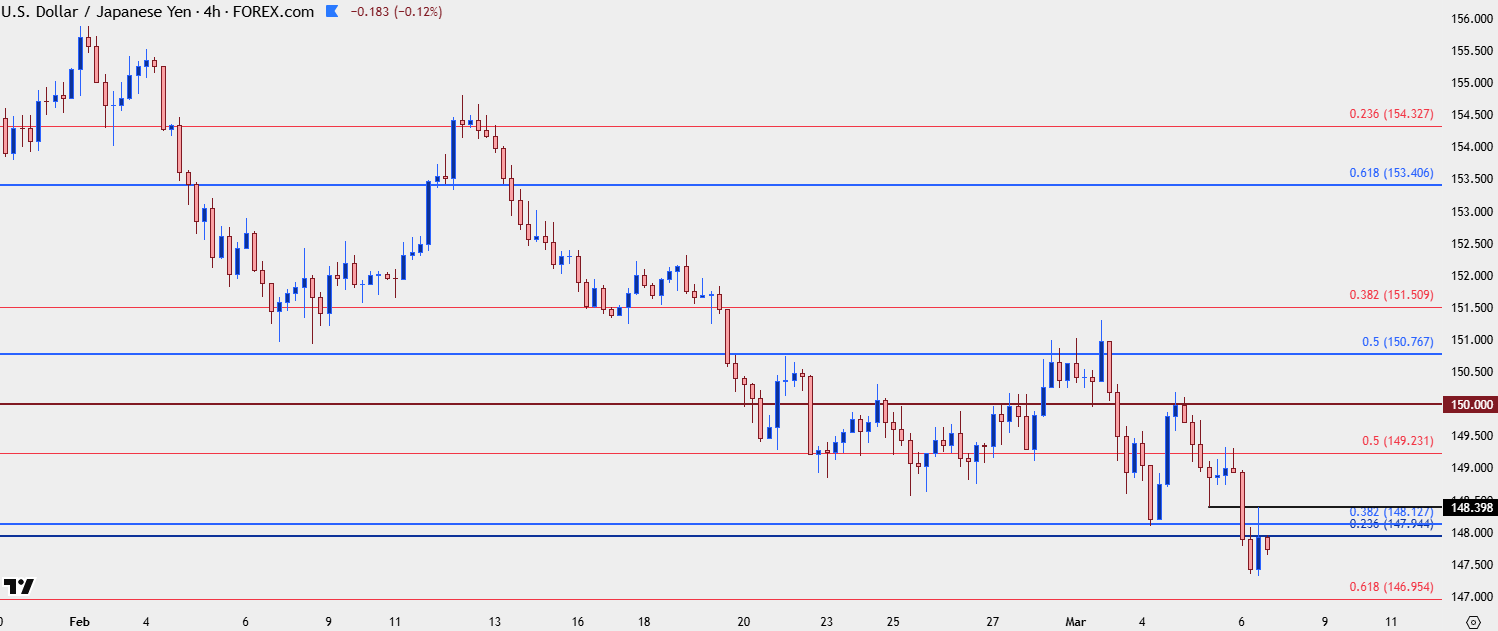

USD/JPY Shorter-Term Levels

The four-hour chart shows recent gyrations clearly, with the longer-term Fibonacci level at 147.94 coming into hold the highs for the two most recently completed four-hour bars. But, the past four-hour candle closed in positive territory while also setting a higher-high above the previous, with resistance showing at prior support of 148.40. This keeps the door open for a larger pullback, and above that, 149.23 is in-play and then 150.00 is above that.

For next support, the 61.8% retracement of the same Fibonacci setup that showed 149.23 as the 50% marker plots just a little lower, at 146.95.

USD/JPY Four-Hour Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

--- written by James Stanley, Senior Strategist