USD/JPY falls as trade worries rise on Trump’s erratic policies

USD/.JPY is falling sharply at the start of the week; the US dollar is slumping further following incoherent policy from the US administration.

Chaos and confusion from President Trump are prompting open windows in the sell America trade. Yeah, OK, meanwhile, is helping the safe-haven demand for the Japanese yen.

At the end of last week, Trump ramped up rhetorically against China. Well, this weekend, Trump increased tariffs on aluminium and steel imports to 50%, which escalated trade war worries.

Recent data also triggered USD weakness, with US jobless claims last Thursday coming in weaker than expected, creating some nervousness ahead of this week's number from the payroll report.

Today, attention is on the US manufacturing ISM report, which is expected to show the sector remained in contraction at 49.5, up from 48.7. Weak data could further pressure the USD.

As far as the yen is concerned, with currency, we can't last week on news that Japan was considering trimming its issuance of super long bonds, which is enough to calm the markets in the short term.

On the managed policy side, the market is pricing in another rate cut by the BJJ before the end of the year as inflation data creeps higher. The US-Japan trade talks and any evolution in inflation will be key for the BoJ.

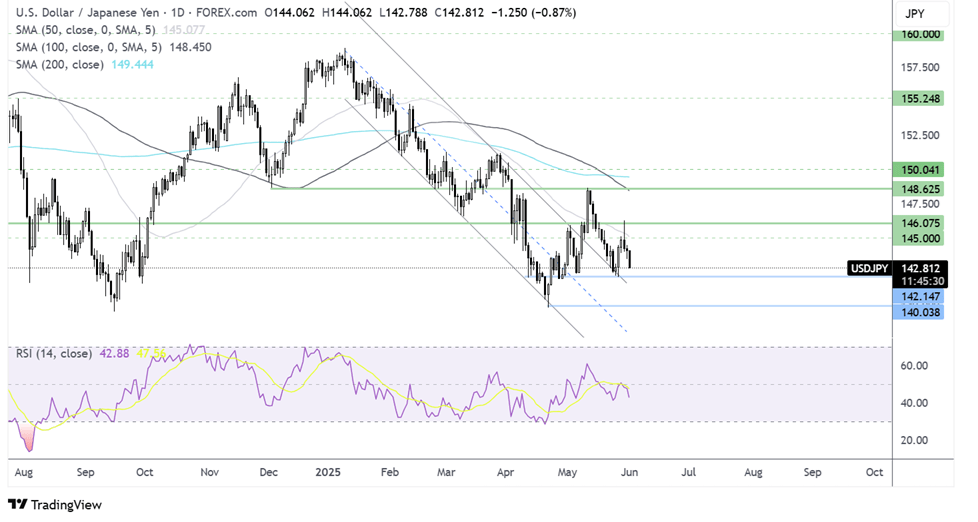

USD/JPY forecast – technical analysis

After a failed recovery to 146.20, USD/JPY is falling back towards 142.20 support. The bearish engulfing candle, combined with the long upper wick on Thursday’s candle and the RSI below 50, keeps sellers hopeful of further losses.

A break below 142.20, the late May low, opens the door to a deeper decline to 140.00.

On the upside, resistance can be seen at 145.00, with a rise above 146.20 needed to create a higher high and bring 148.65 into focus.

Oil rises amid escalating Russia-Ukraine tensions

Oil prices jumped higher at the start of the week amid rising geopolitical tensions, shrugging off a largely expected OPEC+ agreement to increase production in July.

Oil is rising as tensions between Russia and Ukraine intensified following a drone attack launched by Ukraine deep inside Russian territory.

This is overshadowed by the OPEC+ decision to add an additional 411,000 barrels of oil a day to the output agreed upon in July. This marked the third straight month of the same increase. Over half of the remaining output will be split among the big three of the OPEC group: Saudi Arabia, Russia, and the United Arab Emirates.

The move was widely expected and so had been priced in, although some questions remain, including whether they will find buyers for the additional oil. It is spread right across Saudi Arabia, so weak exports in April of 5.75 million barrels per day, down from 5.8 million in March. Meanwhile, Russia's seaborne experts were 5.0 million barrels per day in March, largely flat compared to April. Still, they dipped in May to 4.82 million barrels per day, suggesting that an increase in output may not translate into higher shipments if the demand isn't there.

With Trump's ramping up of rhetoric against China, concerns of an escalation in the trade war may hurt the demand outlook, in which case, any increase in oil prices may be short-lived.

The market will need to see a persistent ramping up of tensions between Russia and Ukraine in order for the price increase to be sustained.

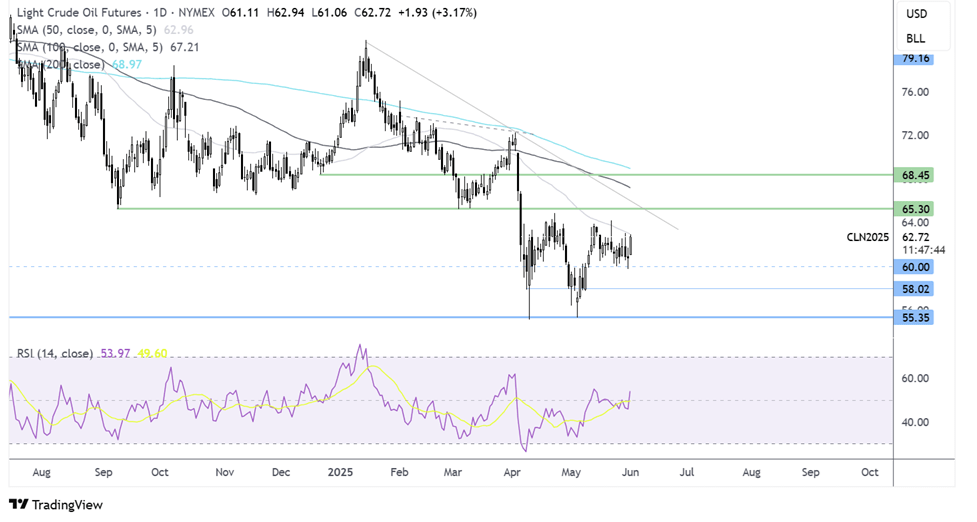

Oil forecast – technical analysis

Oil has recovered from the 60.00 round number but continues to trade within a familiar range, capped by the 50 SMA.

Buyers, supported by the RSI above 50 will look to rise above the 50 SMA at 63.00 and horizontal resistance at 64, and head towards 65.00 round number. A rise above here brings 68.50 into play.

Failure to rise above the 50 SMA could see the price re-test the 60.00 round number. A break below here opens the door to 58 and 55.00, the 2025 lows.