Over the last three trading sessions, the Japanese yen has strengthened by more than 2% against the U.S. dollar, reaching the 140 yen per dollar area as the bearish bias intensifies in the short term. Selling pressure has remained active, driven by uncertainty surrounding the upcoming Federal Reserve decision, as well as the lack of meaningful progress in trade negotiations, which continues to prevent a recovery in short-term confidence in the dollar.

The Fed Decision Approaches

The Fed’s monetary policy decision is scheduled for tomorrow, May 7. The current market consensus expects the interest rate to remain at 4.5%. According to the CME Group’s FedWatch tool, there is a 96.8% probability that the central bank will keep its current stance unchanged.

Source: Data - FXStreet

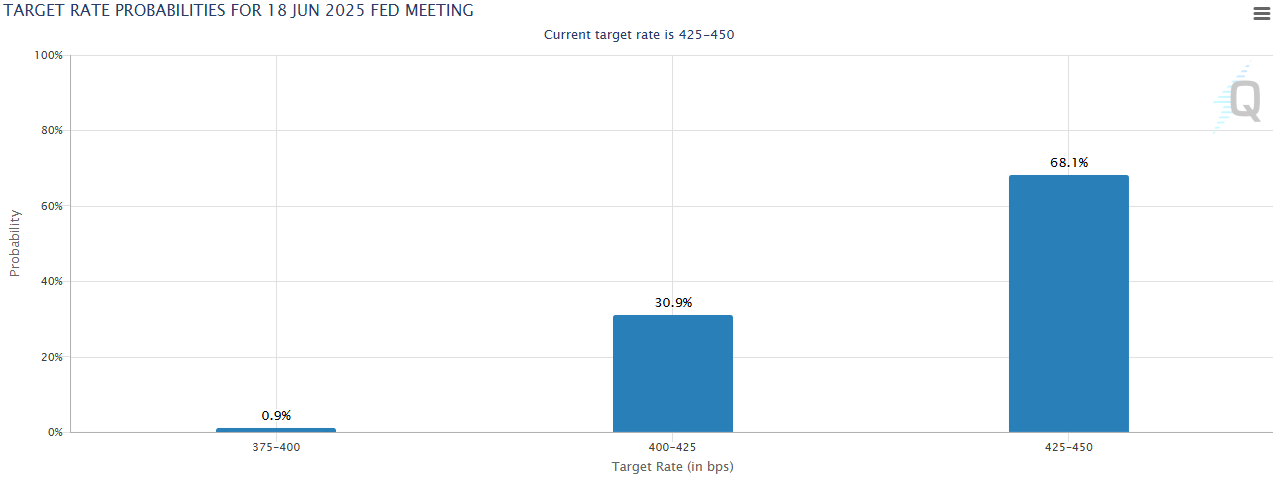

In addition, the outlook for the next decision on June 18 is also evolving. According to CME Group, there is a 68.1% probability that the Fed will keep the rate at 4.5% at that meeting as well.

Source: CME Group

At the moment, the Fed seems committed to maintaining higher rates without making drastic changes to its monetary stance—something that could help support demand for the U.S. dollar in the coming weeks.

It is also important to note the strong interest rate disparity between the United States and Japan. While the Fed maintains its rate at 4.5%, the Bank of Japan continues with ultra-low rates, around 0.50%. Recently, loss of confidence in the dollar has been largely driven by trade war concerns. However, if this rate gap persists, high yields on U.S. bonds may continue to attract capital and boost dollar demand—as long as the Fed sticks to its current policy. In that case, upside pressure on USD/JPY could return in the longer term.

Is the Yen Still a Safe Haven?

There is still no clear resolution to the trade conflict. The 145% tariff on Chinese goods remains in place, and although President Trump has repeatedly said it could be relaxed soon, no formal negotiation or official timeline has been established between the U.S. and China.

Additionally, it was recently reported that the European Union may impose up to $100 billion in tariffs if no concrete agreement is reached with the U.S. These developments have added to global uncertainty and weakened confidence in the dollar due to the potential impact of reciprocal tariffs on the U.S. economy.

In this context, the Japanese yen remains a key safe-haven currency, thanks to its historical stability during risk-off environments. If fear surrounding the trade war once again dominates the market, the yen’s safe-haven appeal could strengthen, increasing demand for the currency. This would likely lead to a stronger bearish bias on USD/JPY, despite the ongoing interest rate gap between the two countries.

USD/JPY Technical Outlook

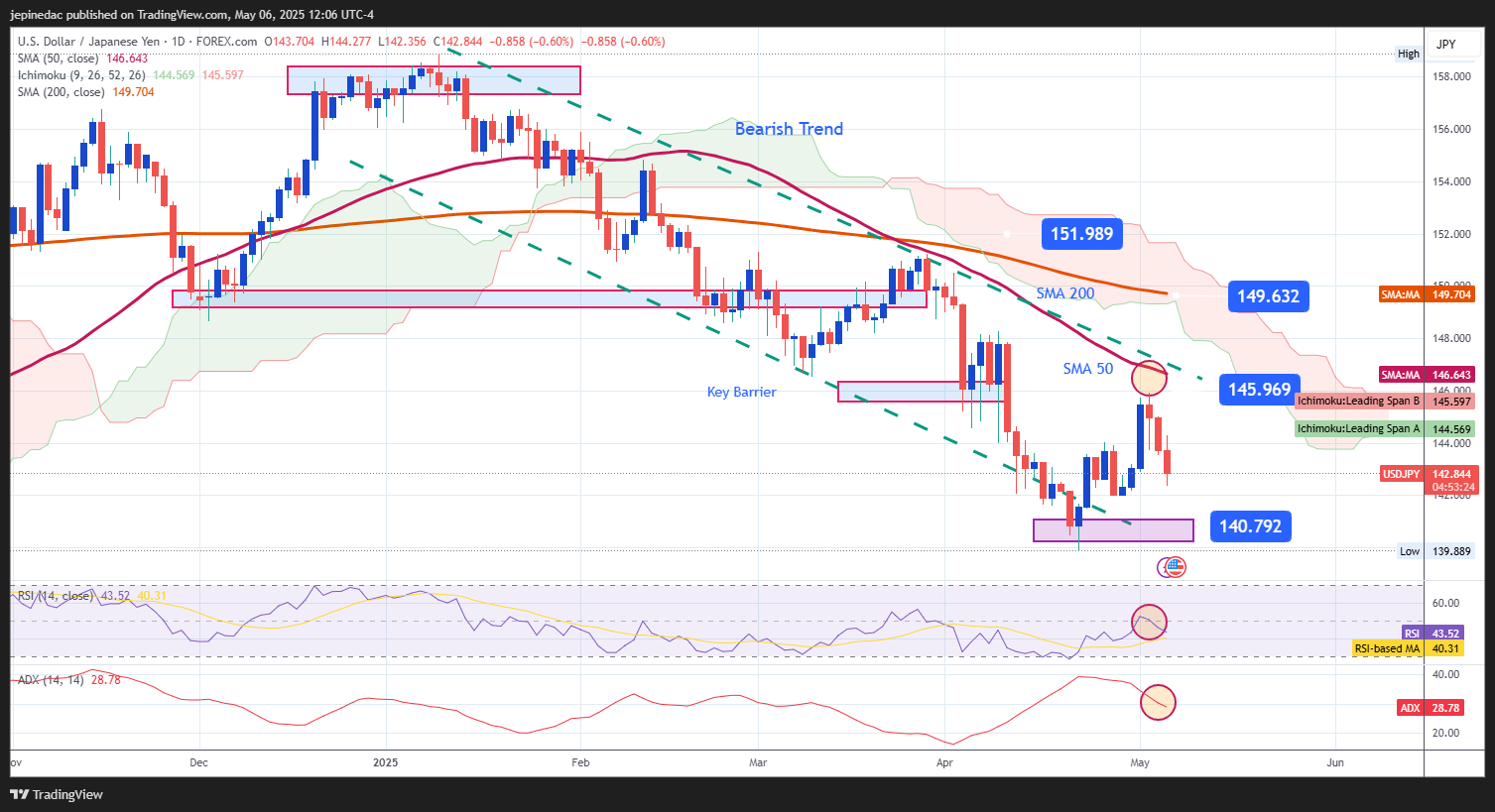

Source: StoneX, Tradingview

- Bearish Channel Still Intact: Since January 2025, USD/JPY has been trading within a well-defined descending channel, with bullish attempts failing to break this structure. The price is currently preparing to retest the support zone, and if a new low is reached, bearish pressure could intensify.

- RSI: The RSI line remains near the neutral 50 level, but with a slight downward slope, suggesting that bearish momentum may be increasing. If this slope steepens, selling pressure on the pair could strengthen further.

- ADX: Although the ADX remains above the neutral level of 20, its slope has begun to turn negative, signaling declining volatility in recent movements. This behavior may indicate a shift toward a technical consolidation phase for USD/JPY.

Key Levels:

- 149.632 – Distant Resistance: Aligns with the 200-period simple moving average. A bullish move toward this level could pose a technical threat to the bearish structure, potentially triggering a sustained upside reversal.

- 145.969 – Current Resistance: Corresponds to the top of the descending channel, aligned with the 50-period simple moving average. May act as a barrier to short-term bullish corrections.

- 140.792 – Key Support: Represents the most recent low. A sustained drop to this zone could reinforce the bearish bias and extend the ongoing downward trend on the chart.

Written by Julian Pineda, CFA – Market Analyst

Follow him at: @julianpineda25