The US dollar was the strongest FX major on Monday after President Trump delayed his 50% tariffs on the European Union until July 3. US consumer confidence also rose 12.3 points from depressed levels and inflation expectations eased slightly.

Any signs that tariffs have been watered down generally benefits the USD. It made the most ground against the Japanese yen (JPY) amid a risk-on start to the week, despite the Bank of Japan (BOJ) governor Ueda opening the door for hikes and a stronger set of domestic inflation on Friday. Ueda said they must be vigilant to the upside risks of food prices – though if the Japanese yen wasn’t so weak it could curb food prices.

- The US dollar index rebounded 0.65% from the December low, and is ~ a day or two’s trading range away from the 100 handle.

- USD/JPY rose 1.1% during its best day in two weeks and formed a bullish outside day.

- USD/CAD rallied from trend support and the 1.37 handle in line with my near-term bullish bias, though I am also on guard for an eventual breakdown of the 2021 bullish trendline on anticipation of a stronger Canadian dollar.

- The Japanese yen was broadly lower against all if FX peers, with the stronger British pound seeing GBP/JPY finally rise in line with my bullish bias outlined on Friday.

- The New Zealand dollar (NZD/USD) was the second weakest forex major ahead of today’s RBNZ meeting, where a 25bp cut is expected and focus will be on forward guidance and updated forecasts.

- Wall Street indices rose in line with my bias (where I suggested swing lows were in place) with Nasdaq1 00 futures rising 2.3%, S&P 500 futures up 2% and Dow Jones rising 1.7%

- ASX 200 futures (SPI 200) rose 0.6% and reached the February VPOC (volume point of control) at 8498, a break above 8500 brings the 8600 handle into focus for bulls.

View related analysis:

- USD/JPY and GBP/JPY Snap Losing Streaks, US Dollar Selling Eases

- Canadian Dollar Outlook: USD/CAD Bears Test Key Trendline

- Wall Street Futures, ASX 200 Hint at Swing Lows

- US Dollar Shorts Trimmed, Gold Bulls Return: COT report

- AUD/USD Weekly Outlook: CPI, RBNZ, PCE - Key Data Ahead

USD/JPY Technical Analysis: US Dollar vs Japanese Yen

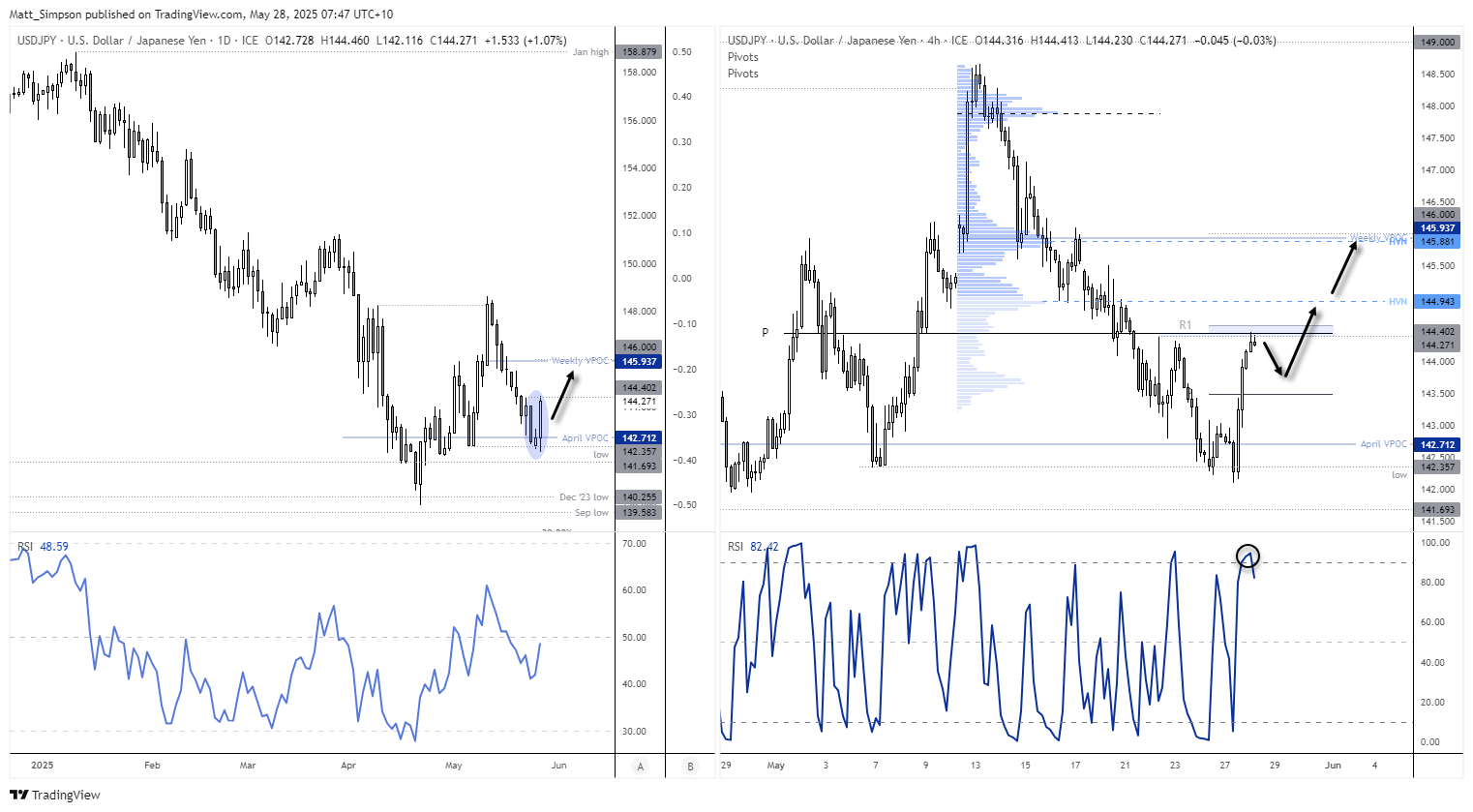

The bullish outside day on Monday is the third of a 3-candle bullish reversal pattern called a ‘Morning Star Formation’. This marks Monday’s low as an important swing low for USD/JPY, which was preceded by a bullish divergence on the daily RSI (2) in the oversold zone.

146 is the next resistance level for USD/JPY bulls to target, which sits near a weekly VPOC (volume point of control).

The 4-hour chart shows that Monday’s rally stalled at the monthly pivot point (144.43) and weekly R1 pivot (144.56) with an overbought RSI. Perhaps bulls can be treated to a pullback and seek evidence of an intraday swing low above the weekly R1 pivot around 143.50.

Economic Events in Focus (AEST / GMT+10)

The RBNZ is expected to cut its overnight cash rate (OCR) by 25bp to 3.25% on Wednesday, marking the sixth cut of this easing cycle and widening the RBA-RBNZ cash rate spread to 60bp.

Markets will watch for signals of further cuts, which could weaken AUD/NZD by hinting at a lower year-end cash rate compared to the RBA.

RBA cash rate futures currently imply a 78% chance of a 25bp cut at their next meeting, and those odds could rise further if today’s trimmed mean CPI comes in softer than expected. It could also see AUD/USD fall further within its sideways range.

- 10:00 – FOMC Member Williams Speaks (USD, Gold, Crude Oil, Wall Street Indices)

- 11:30 – Australian Trimmed Mean CPI (AUD/USD, ASX 200)

- 12:00 – RBNZ Interest Rate Decision, Monetary Policy Statement (NZD/USD, AUD/NZD, AUD/USD)

- 12:10 – Federal Reserve (Fed) Waller Speaks (USD, Gold, Crude Oil, Wall Street Indices)

- 13:00 – RBNZ Press Conference (NZD/USD, AUD/NZD, AUD/USD)

- 17:55 – German Unemployment Change (EUR/USD, EUR/GBP, EUR/JPY, DAX)

- 18:00 – Swiss ZEW Expectations (USD/CHF, CHF/JPY)

- 20:00 – OPEC Meeting (Brent, WTI Crude Oil)

- 22:30 – FOMC Member Barkin Speaks (USD, Gold, Crude Oil, Wall Street Indices)

- 23:00 – FOMC Member Williams Speaks (USD, Gold, Crude Oil, Wall Street Indices)

- 01:00 – BOE MPC Member Bailey Speaks (GBP/USD, GBP/JPY, EUR/GBP, FTSE)

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge