US Dollar Outlook: USD/JPY

USD/JPY no longer carves a series of higher highs and lows as it pulls back ahead of the monthly high (151.31), and the exchange rate may track the negative slope in the 50-Day SMA (151.54) as it still holds below the moving average.

USD/JPY Pulls Back Ahead of Monthly High with US PCE in Focus

USD/JPY may struggle to retain the advance from the monthly low (146.54) as Bank of Japan Governor Kazuo Ueda reiterates that ‘if the outlook for economic activity and prices presented in the January Outlook Report is realized, the Bank will accordingly continue to raise the policy interest rate,’ and the diverging paths between the BoJ and Federal Reserve may continue to influence the exchange rate as Chairman Jerome Powell and Co. pursue a less restrictive policy.

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

In turn, swings in the carry trade may sway USD/JPY as Fed officials still forecast lower interest rates for 2025, but the exchange rate may extend the advance from the start of the week as the update to the US Personal Consumption Expenditure (PCE) Price Index is anticipated to show sticky inflation.

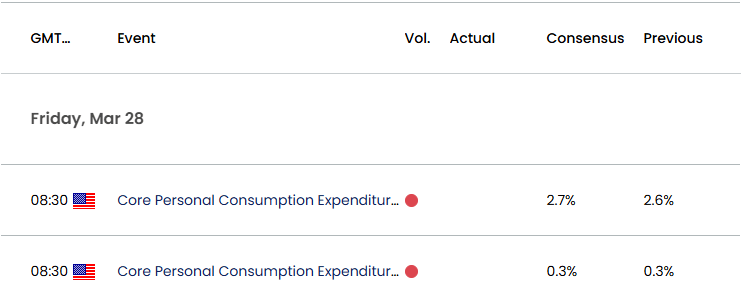

US Economic Calendar

The core PCE, the Fed’s preferred gauge for inflation, is expected to increase to 2.7% in February from 2.6% per annum the month prior, and signs of persistent price growth may keep USD/JPY afloat as it encourages the Federal Open Market Committee (FOMC) to retain the current policy.

However, a softer-than-expected PCE print may push the FOMC to further unwind its restrictive policy, and speculation for a looming Fed rate-cut may drag on the Greenback as the central bank projects that ‘the appropriate level of the federal funds rate will be 3.9 percent at the end of this year.’

With that said, USD/JPY may track the negative slope in the 50-Day SMA (151.54) as it pulls back ahead of the monthly high (151.31), but the exchange rate may attempt to retrace the decline from the February high (155.89) should it defend the advance from the start of the week.

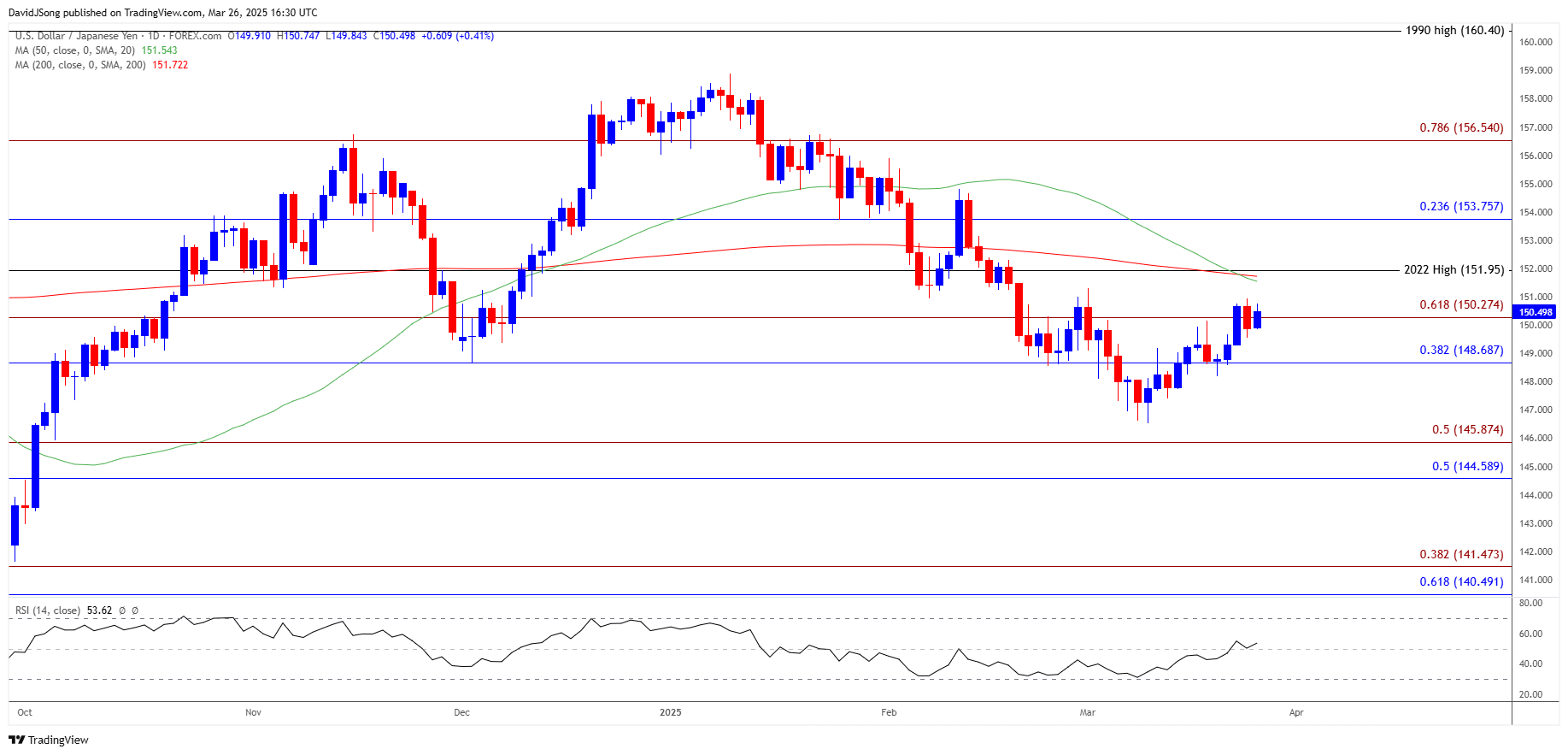

USD/JPY Price Chart – Daily

Chart Prepared by David Song, Senior Strategist; USD/JPY on TradingView

- USD/JPY holds below the monthly high (151.31) as it struggles to extend the recent series of higher highs and lows, and a move below the 148.70 (38.2% Fibonacci retracement) to 150.30 (61.8% Fibonacci extension) zone may push the exchange rate back towards the monthly low (146.54).

- A break/close below the 144.60 (50% Fibonacci retracement) to 145.90 (50% Fibonacci extension) region opens up the October low (142.97), but a breach above the monthly high (151.31) may push USD/JPY towards 151.95 (2022 high).

- A break/close above 153.80 (23.6% Fibonacci retracement) brings the February high (155.89) on the radar, with the next area of interest coming in around 156.50 (78.6% Fibonacci extension).

Additional Market Outlooks

British Pound Forecast: GBP/USD Coils with UK CPI on Tap

AUD/USD Halts Four-Day Selloff Ahead of Australia CPI

Canadian Dollar Forecast: USD/CAD Breakout Looms on Trump Tariffs

EUR/USD Post-Fed Weakness Pulls RSI Back from Overbought Zone

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong