US Dollar Outlook: USD/JPY

USD/JPY gives back the rally from the start of the week as the Federal Reserve still plan to further unwind its restrictive policy in 2025.

USD/JPY Rally Unravels as Fed Still Forecasts Lower US Interest Rates

Keep in mind, USD/JPY showed a limited reaction to the Bank of Japan (BoJ) meeting as Governor Kazuo Ueda and Co. held the benchmark interest rate at 0.50%, and it seems as though the central bank remains reluctant to carry out a rate-hike cycle as ‘underlying CPI inflation is expected to increase gradually.’

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

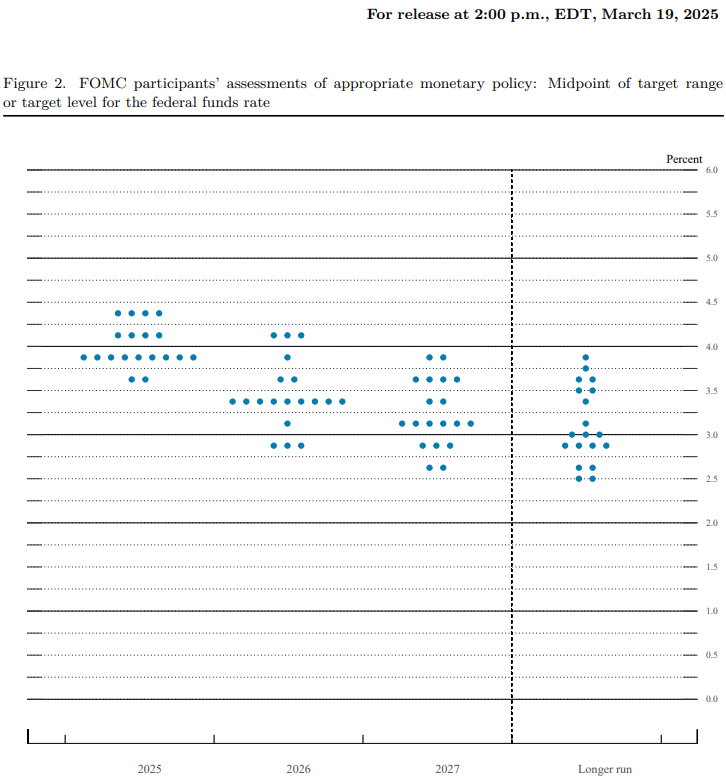

Federal Reserve Summary of Economic Projections (SEP)

Source: FOMC

Nevertheless, USD/JPY may struggle to retain the advance from the monthly low (146.54) as it snaps the recent series of higher highs and lows, and swings in the carry trade may continue to sway USD/JPY as the Fed’s Summary of Economic Projections (SEP) shows that the ‘median participant projects that the appropriate level of the federal fund rate will be 3.9% at the end of this year.’

The fresh forecasts from Fed officials suggest the central bank will continue to pursue neutral stance despite the ongoing change in US trade policy, but it seems as though the Federal Open Market Committee (FOMC) will stick to the sidelines at its next meeting in May as Chairman Jerome Powell reiterates that ‘we do not need to be to be in a hurry to adjust our policy.’

With that said, USD/JPY may consolidate over the remainder of the week as it pulls back ahead of the monthly high (151.31), but the exchange rate may track the negative slope in the 50-Day SMA (152.32) as it holds below the moving average.

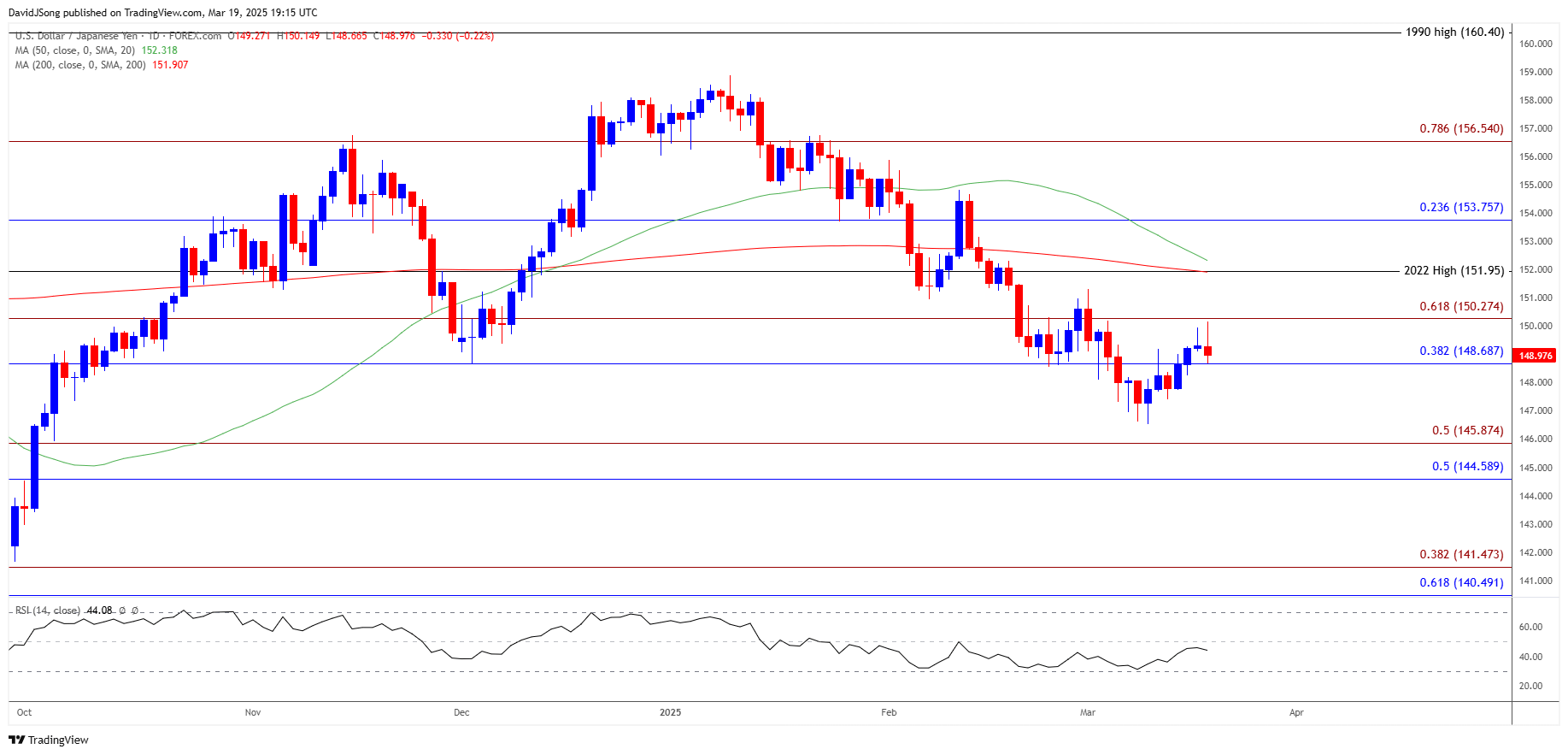

USD/JPY Price Chart – Daily

Chart Prepared by David Song, Senior Strategist; USD/JPY on TradingView

- USD/JPY struggles to push above the 148.70 (38.2% Fibonacci retracement) to 150.30 (61.8% Fibonacci extension) zone as it snaps the recent series of higher highs and lows, and failure to defend the monthly low (146.54) may push the exchange rate towards the 144.60 (50% Fibonacci retracement) to 145.90 (50% Fibonacci extension) region.

- Next area of interest coming in around the October low (142.97), but the recent pullback in USD/JPY may turn out to be temporary should the exchange rate defend the weekly low (148.26).

- Need a break/close above the 148.70 (38.2% Fibonacci retracement) to 150.30 (61.8% Fibonacci extension) zone to bring 151.95 (2022 high) back on the radar, with the next region of interest coming in around 153.80 (23.6% Fibonacci retracement).

Additional Market Outlooks

Gold Price Rally Pushes RSI Back into Overbought Territory

British Pound Forecast: GBP/USD Vulnerable to Dovish Bank of England (BoE)

Canadian Dollar Forecast: USD/CAD Coils Ahead of Reciprocal Trump Tariffs

EUR/USD Rebounds Ahead of Weekly Low to Keep RSI in Overbought Zone

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong