US Dollar Outlook: USD/JPY

USD/JPY may stage a larger rebound ahead of the Bank of Japan (BoJ) meeting as the central bank is expected to keep interest rates on hold.

USD/JPY Rebound in Focus with BoJ Expected to Hold Interest Rate

USD/JPY trades near the weekly high (149.20) even as the U. of Michigan Confidence survey prints at 57.9 in March versus forecasts for a 63.1 reading, and the exchange rate may attempt to retrace the decline from the monthly high (151.31) as the recent rebound keeps the Relative Strength Index (RSI) out of oversold territory.

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

In turn, the RSI may show the bearish momentum abating as it moves away from oversold territory, and the BoJ rate decision may keep USD/JPY afloat as the central bank carries out a gradual approach in normalizing monetary policy.

Japan Economic Calendar

The BoJ is expected to keep the benchmark interest rate at 0.50% after delivering a 25bp rate-hike in January, and the central bank may endorse wait-and-see approach as the ongoing transition in US trade policy clouds the outlook for global growth.

As a result, USD/JPY may extend the rebound from the monthly low (146.54) should the BoJ tame speculation for an imminent rate-hike, but more of the same from the central bank may drag on the exchange rate as Governor Kazuo Ueda and Co. acknowledge that ‘if the outlook for economic activity and prices presented in the January Outlook Report will be realized, the Bank will accordingly continue to raise the policy interest rate.’

With that said, shifts in the carry trade may continue to sway USD/JPY especially as the Federal Reserve unwinds its restrictive policy, and the recent rebound in the exchange rate may turn out to be temporary as the 50-Day SMA (152.84) starts to reflect a negative slope.

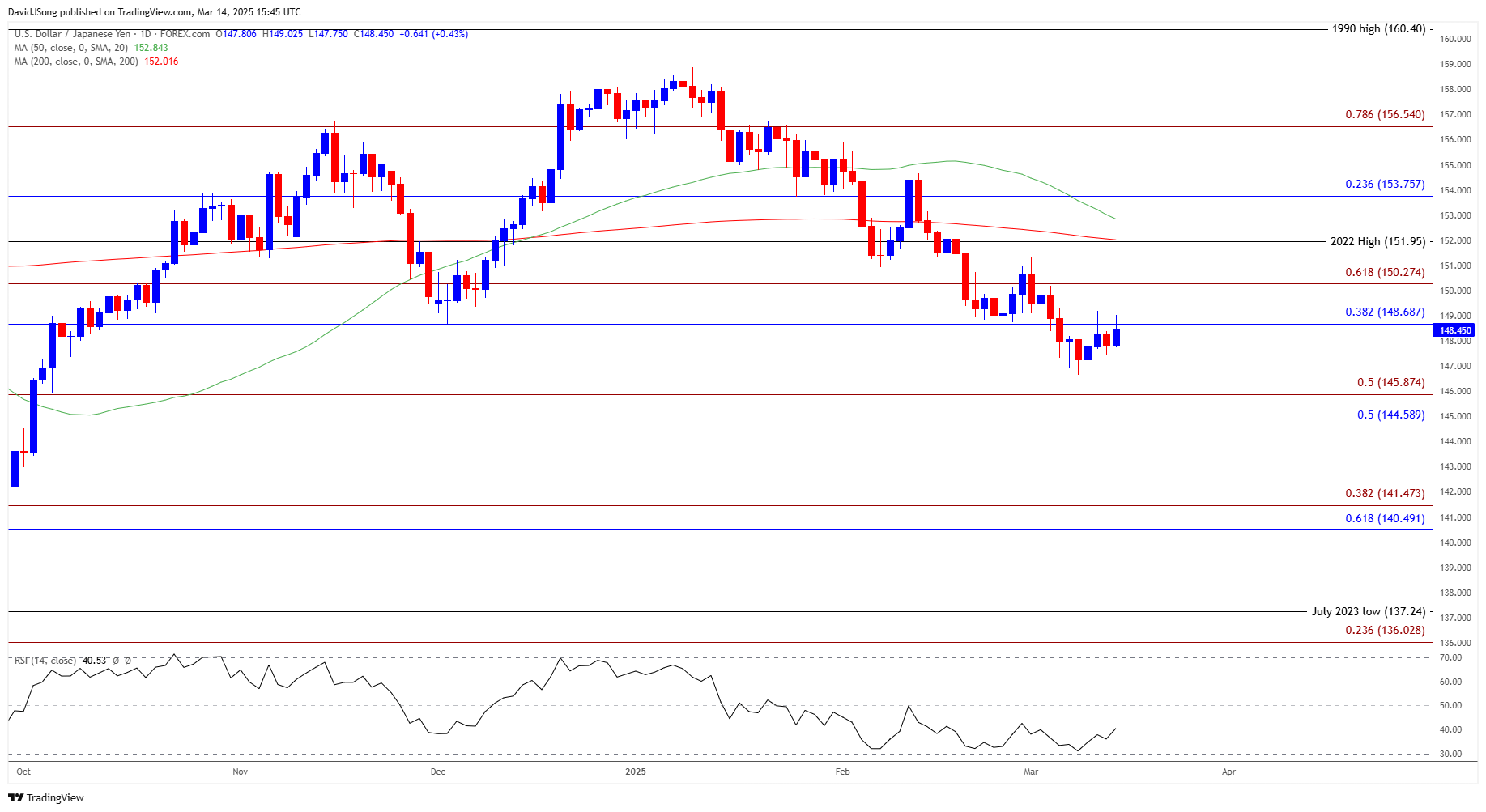

USD/JPY Price Chart – Daily

Chart Prepared by David Song, Senior Strategist; USD/JPY on TradingView

- USD/JPY seems to be stuck in narrow range after snapping the series of lower highs and lows from last week, but a move back above the 148.70 (38.2% Fibonacci retracement) to 150.30 (61.8% Fibonacci extension) zone may push the exchange rate towards the monthly high (151.31).

- Next area of interest comes in around 151.95 (2022 high), but USD/JPY may track the negative slope in the 50-Day SMA (152.84) should struggle to trade back above the148.70 (38.2% Fibonacci retracement) to 150.30 (61.8% Fibonacci extension) zone.

- Failure to defend the monthly low (146.54) may push USD/JPY towards the 144.60 (50% Fibonacci retracement) to 145.90 (50% Fibonacci extension) region, with the next area of interest coming in around the October low (142.97).

Additional Market Outlooks

Gold Record High Price Pushes RSI Towards Overbought Zone

British Pound Forecast: GBP/USD Pulls Back Ahead of November High

Euro Forecast: EUR/USD on Cusp of Testing November High

Canadian Dollar Forecast: USD/CAD Faces BoC Rate Cut as Trump Tariffs Loom

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong