One day after the Federal Reserve’s decision, USD/JPY remains neutral, with a daily variation of less than 0.5% in the last few trading hours. On a broader scale, the pair has maintained a downward trend since December 2024, but recent central bank announcements have created temporary uncertainty in the markets.

The Role of Central Banks

This week has been crucial for USD/JPY, as the central banks of both currencies have announced their respective monetary policy decisions.

The Bank of Japan (BOJ) decided to keep interest rates at 0.5%, the highest level in 17 years. However, the market was surprised to see that the BOJ board shifted from its aggressive stance in January to a more neutral approach. The institution stated that as long as uncertainty surrounding a potential trade war persists, its monetary policy will remain cautious in the coming months.

Meanwhile, the Federal Reserve (FED) chose to hold rates within the 4.25% - 4.5% range. Shortly after the announcement, Jerome Powell acknowledged that inflation remains high and that, for now, economic data does not indicate an imminent risk of recession. This suggests that the central bank may continue its neutral stance in the coming months.

Both institutions have adopted cautious measures amid the decline in market confidence. This has prevented unexpected rate changes and contributed to neutrality in USD/JPY’s recent movements. However, if the BOJ decides to return to a path of higher interest rates, demand for the Japanese yen could increase, as it is a currency that has historically maintained very low rates. This could lead to a shift in interest from the U.S. dollar to the yen, increasing bearish pressure on USD/JPY.

Uncertainty Increases

The CNN Fear & Greed Index currently shows a reading of 23, placing it in the extreme fear zone. This level has remained stable since last week, reflecting a progressive decline in market confidence throughout 2025. This situation could lead investors to avoid higher-risk assets and opt for safer instruments, especially amid rising trade war uncertainties.

Fear & Greed - CNN

Source: CNN

In this scenario, the Japanese yen could regain its position as a key global safe-haven asset. If the Fear & Greed Index continues to decline, demand for safe assets like the yen may increase as capital flows move away from riskier markets. As long as market fear persists, the bullish bias observed in the yen in recent sessions could strengthen further.

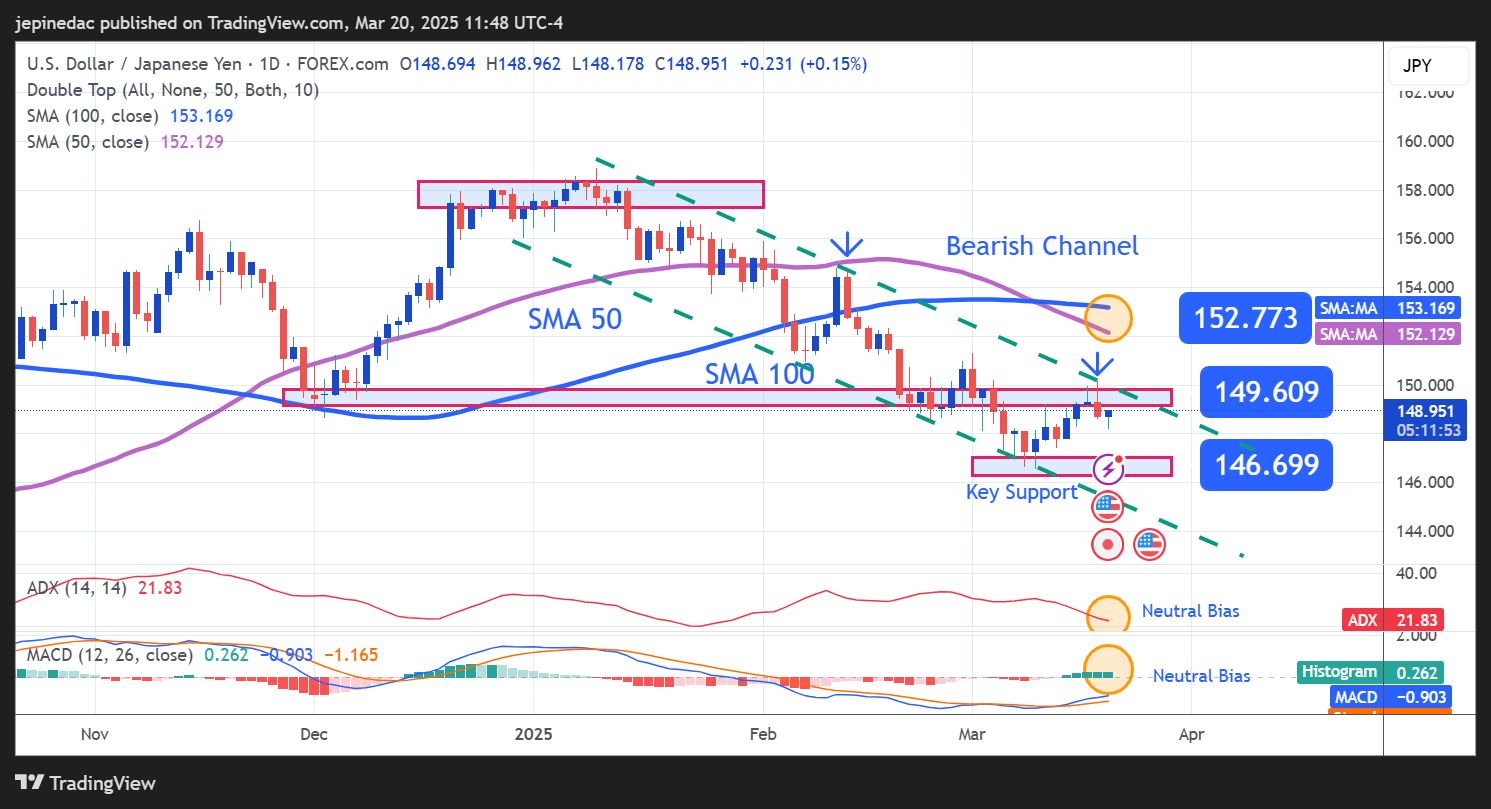

USD/JPY Technical Outlook

Source: StoneX, Tradingview

- Bearish Channel Holds: Since January 2024, USD/JPY has remained in a bearish channel, with no buying pressure strong enough to break this structure. Currently, the price is experiencing a bullish correction, leading to a neutral phase around a key technical barrier. If this zone is not breached, the bearish channel could continue to dominate in the coming trading sessions.

- ADX: The ADX line continues to decline and remains near the 20 level, indicating that buying momentum from recent sessions has weakened. This suggests that price neutrality may persist in the short term.

- MACD: The MACD histogram reflects a similar pattern, staying close to the neutral 0 level, indicating that moving average momentum remains low and that market indecision dominates the short term.

Key Levels:

- 152.773 – Distant Resistance: This level aligns with the barrier marked by the 50- and 100-period moving averages. If the price breaks above this level, it could signal a bullish breakout, leading to a more prolonged upward

- 149.609 – Current Resistance: This level corresponds to the upper boundary of the bearish channel. If the price surpasses this zone, the bullish bias could strengthen, favoring a sideways trend in the short term.

- 146.699 – Key Support: This represents the lowest point of the bearish channel in the short term. If the price falls below this level, it could reinforce the downtrend, leading to a stronger selling movement in the upcoming sessions.

Written by Julian Pineda, CFA – Market Analyst