Today, the USD/MXN pair appreciated by more than 0.7%, favoring the U.S. dollar over the Mexican peso. The pair’s emerging bullish bias has remained steady, driven by the renewed strength of the dollar after the release of the Federal Reserve’s latest meeting minutes. Meanwhile, negative economic outlooks for Mexico have temporarily weakened investor confidence in the peso. If these factors persist, buying pressure on USD/MXN could become more significant in the short term.

Fed Minutes

At 2:00 p.m. ET today, the minutes from the early-May Federal Reserve meeting were released. The document outlined various economic considerations that have led the central bank to keep its benchmark interest rate unchanged at a neutral level of 4.5% for the time being.

One of the key themes was the inflation-unemployment dilemma. On one hand, most Fed members agreed that inflation could remain persistently high in the coming months, especially due to the impact of new tariffs promoted by the White House. On the other hand, the Fed is in a tough position if both inflation and unemployment rise simultaneously, given that the trade conflict has also led to negative labor market projections. The minutes also noted rising economic uncertainty, which reinforces the bank’s cautious stance and suggests that any interest rate cuts are likely to be postponed.

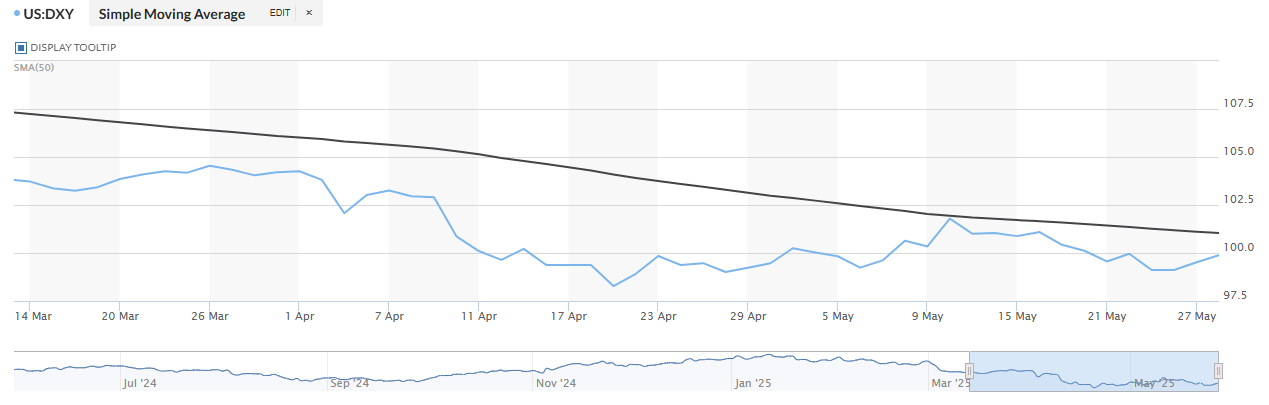

This more hawkish tone from the Fed has once again strengthened the U.S. dollar, while the Mexican peso has lagged. A less accommodative Fed typically enhances the appeal of U.S.-denominated assets, attracting renewed demand for the dollar. This strength is evident in the DXY index, which is currently approaching the 100 level again and showing a sustained upward move.

Source: Marketwatch

Thus, the Fed’s firm tone may act as a short-term demand catalyst for the dollar, which could reduce interest in the Mexican peso in upcoming sessions and intensify buying pressure on USD/MXN.

How Strong Is Confidence in the Mexican Peso?

It’s important to recall that the U.S. currently maintains a 25% tariff on Mexican exports outside the USMCA agreement. In recent sessions, it was also reported that Trump reignited the trade war with the European Union. While that situation did not escalate, it reflected a more aggressive stance from the White House toward countries with no concrete negotiation progress. In this context, any sudden reactivation of the trade conflict with Mexico could hurt investor confidence in the peso, as has happened in previous months.

Moreover, while Mexico’s economy is not facing an imminent risk of recession, there is ongoing concern about a sustained economic slowdown. This could worsen if the trade dispute escalates and no concrete agreements are reached in the short term. Such a scenario may further weaken sentiment toward the peso and support a more persistent bullish trend for USD/MXN.

USD/MXN Technical Outlook

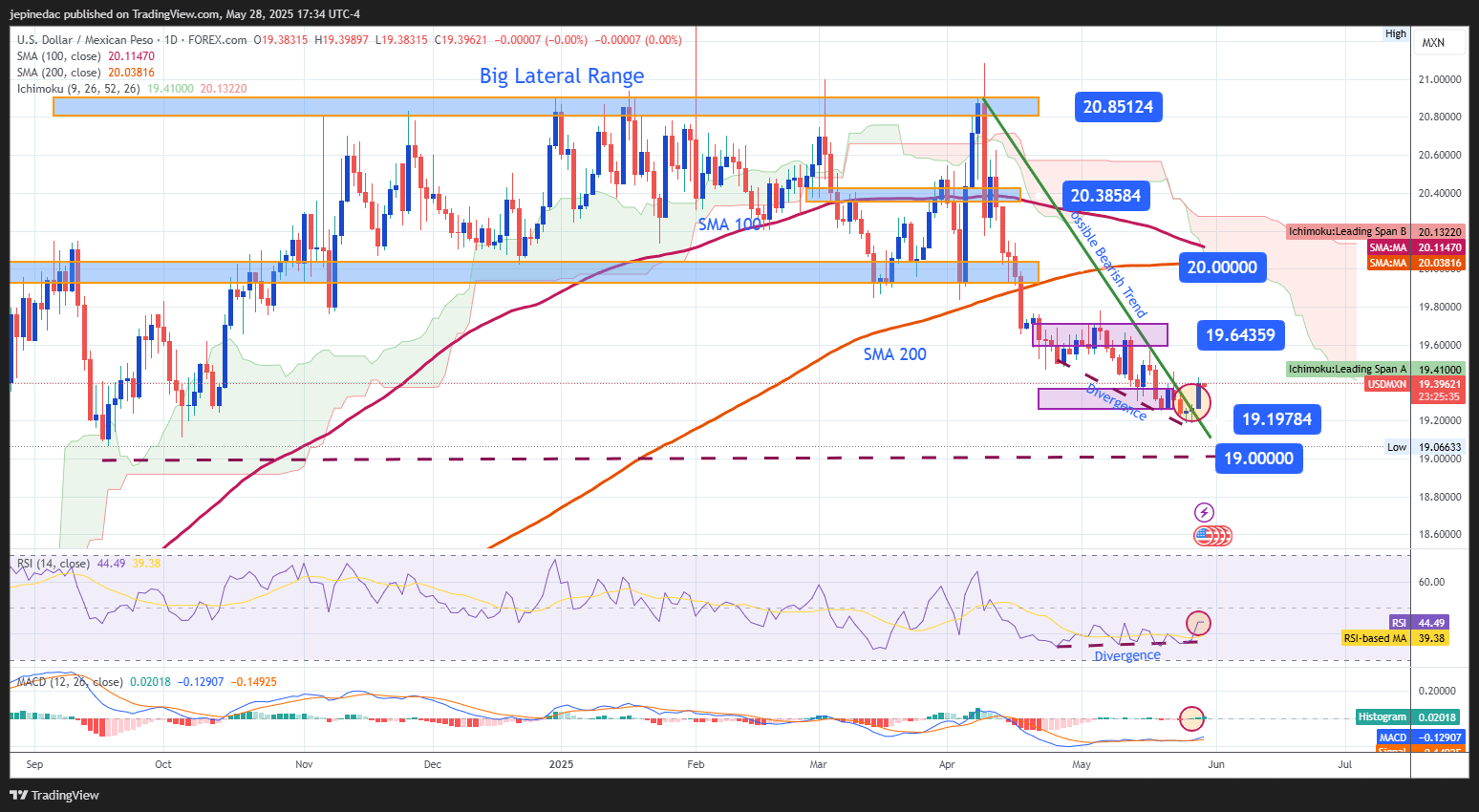

Source: StoneX, Tradingview

- Bearish Trend Breaks: Since April 9, USD/MXN had been in a consistent downtrend, trading below the 20 pesos per dollar level. However, recent sessions have shown signs of price consolidation, and today’s session produced a notable bullish candle, enough to challenge the prior bearish structure. This shift opens the door for more meaningful upside moves in the coming sessions.

- RSI: The Relative Strength Index (RSI) is now showing neutral behavior, with a potential bullish divergence: higher lows on the RSI versus lower lows in price. This indicates a loss of downside momentum, suggesting the possibility of corrective upward movements in favor of the dollar.

- MACD: The MACD histogram is hovering near the zero line, reflecting a balance between bullish and bearish forces. This suggests the market may enter a sideways phase if no directional catalyst emerges.

Key Levels:

- 20.00 – Major Resistance: A psychological level aligned with the 200-period moving average. A sustained move toward this area could trigger a new short-term bullish trend.

- 19.65 – Nearby Barrier: A recent consolidation zone that may act as a temporary resistance for further upward corrections.

- 19.00 – Key Support: A key psychological level and the strongest support zone currently in place. A clear break below this area could reactivate the previously dominant bearish bias.

Written by Julian Pineda, CFA – Market Analyst

Follow him at: @julianpineda25