USD/MXN has registered a variation of just 1% over the last five trading sessions, and the recent loss of strength in the Mexican peso has led to a phase of neutrality in the pair’s movements. For now, uncertainty over a clear direction persists, partly due to the recent interest rate decision by Banxico and also because of ongoing concerns about Mexico’s role in the trade war. If this uncertainty continues, the peso could continue losing ground in the short term.

The Role of Banxico

On May 15, the Bank of Mexico cut its interest rate by 50 basis points, lowering it from 9% to 8.5%. This marks the third consecutive cut of that size, reflecting the view that the Mexican economy is still showing signs of persistent weakness, which could keep the door open for further cuts throughout the year.

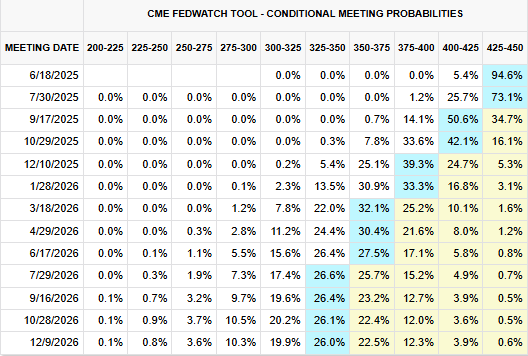

Meanwhile, the United States continues with a neutral monetary policy, keeping its rate at 4.5%, according to the CME Group’s probability models. Currently, there is a 94.6% probability that the rate will remain unchanged at the June 18 meeting, and a 73.1% probability it will stay at that level at the July 30 decision.

Source: CME Group

In this context, the interest rate differential between both countries remains a key factor in USD/MXN movements. Although Mexico continues to offer a higher rate than the U.S.—even after recent cuts—, which in theory could keep attracting investment into Mexican fixed-income assets, it's important to note that this higher yield comes with greater risk. Unlike U.S. bonds, Mexican assets are perceived as more volatile, which could deter capital flows if investors prioritize safety over returns.

Moreover, if Mexico’s 8.5% rate continues to move closer to the U.S. rate of 4.5%, the relative attractiveness of peso-denominated assets could diminish, potentially generating sustained upward pressure on USD/MXN.

What’s Happening with the Trade War?

Currently, a 25% tariff imposed by the U.S. government on Mexican exports outside of the USMCA agreement remains in place, causing continued uncertainty in sectors such as automotive over the past few months.

Although some agreements have been reached to delay the implementation of certain tariffs, no definitive resolution has been found. The Mexican peso has been highly sensitive to developments in the trade conflict, especially when lacking other supportive factors. If the current truce does not hold, any escalation could erode confidence in the peso, acting as a key bearish catalyst. For now, the relative calm has allowed selling pressure to dominate USD/MXN, but if the situation changes, buying pressure could resurface.

USD/MXN Technical Outlook

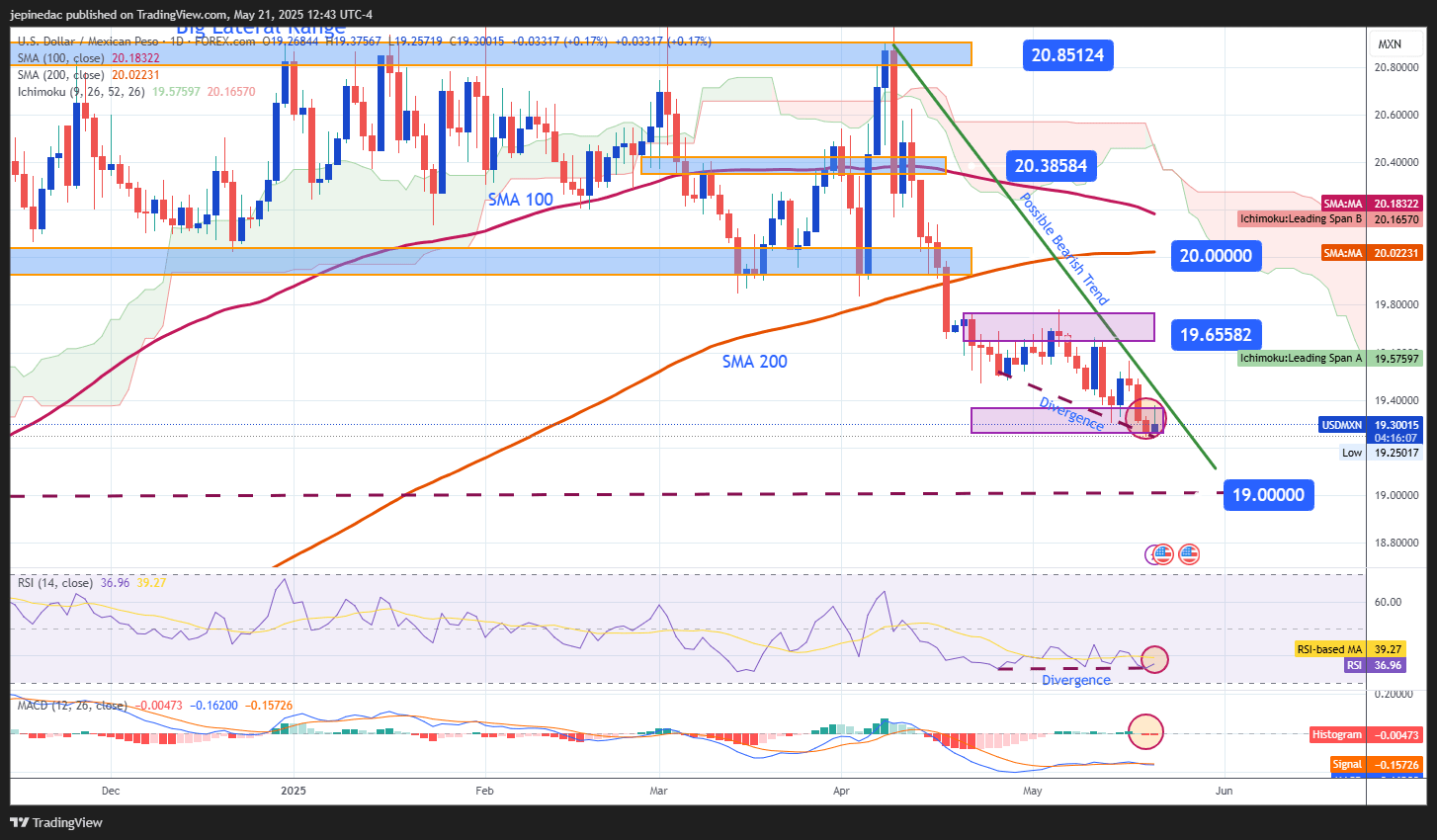

Source: StoneX, Tradingview

- Persistent Downtrend: Since April 9, a clear downtrend has taken shape, with price trading below 20 pesos per dollar. However, this trend may now be entering a consolidation phase as it approaches key support at 19 pesos. So far, no bullish correction has been strong enough to break the trend, which remains the most relevant technical structure in the short term. The pair continues to show a bearish bias, although it has recently entered a pause phase.

- RSI: The RSI line is starting to show neutral behavior, with a possible technical divergence: higher lows in the RSI vs. lower lows in the price. This indicates a market imbalance, where bearish momentum may be losing strength, potentially opening the door to short-term upward corrections.

- MACD: The MACD histogram continues to oscillate around the neutral 0 line, indicating a balance between bullish and bearish momentum. This suggests a lack of clear direction in the market at the moment.

Key Levels:

- 20.00 – Key Resistance: A psychological level aligned with the 200-period simple moving average. A sustained move toward this level could break the downtrend and spark a new bullish wave.

- 19.65 – Nearby Barrier: A recent consolidation area that could act as a resistance zone for any upcoming bullish corrections.

- 19.00 – Key Support: A major psychological level, currently serving as the strongest sell-side barrier. A sustained break below this point could strengthen the downtrend and trigger a new bearish leg in USD/MXN.

Written by Julian Pineda, CFA – Market Analyst

Follow him at: @julianpineda25