Several sessions have passed since the Mexican peso's bullish momentum pushed the USD/MXN pair below the key 20 pesos per dollar level. Since breaking that threshold, the pair has dropped nearly 2.5%, but neutrality has recently set in, consolidating around the 19.50 level. This stabilization is largely due to the rebound in the U.S. dollar, which has regained strength against its major peers. If confidence in the dollar continues, a new bullish bias could emerge for USD/MXN after several weeks of declines.

The Role of the U.S. Dollar

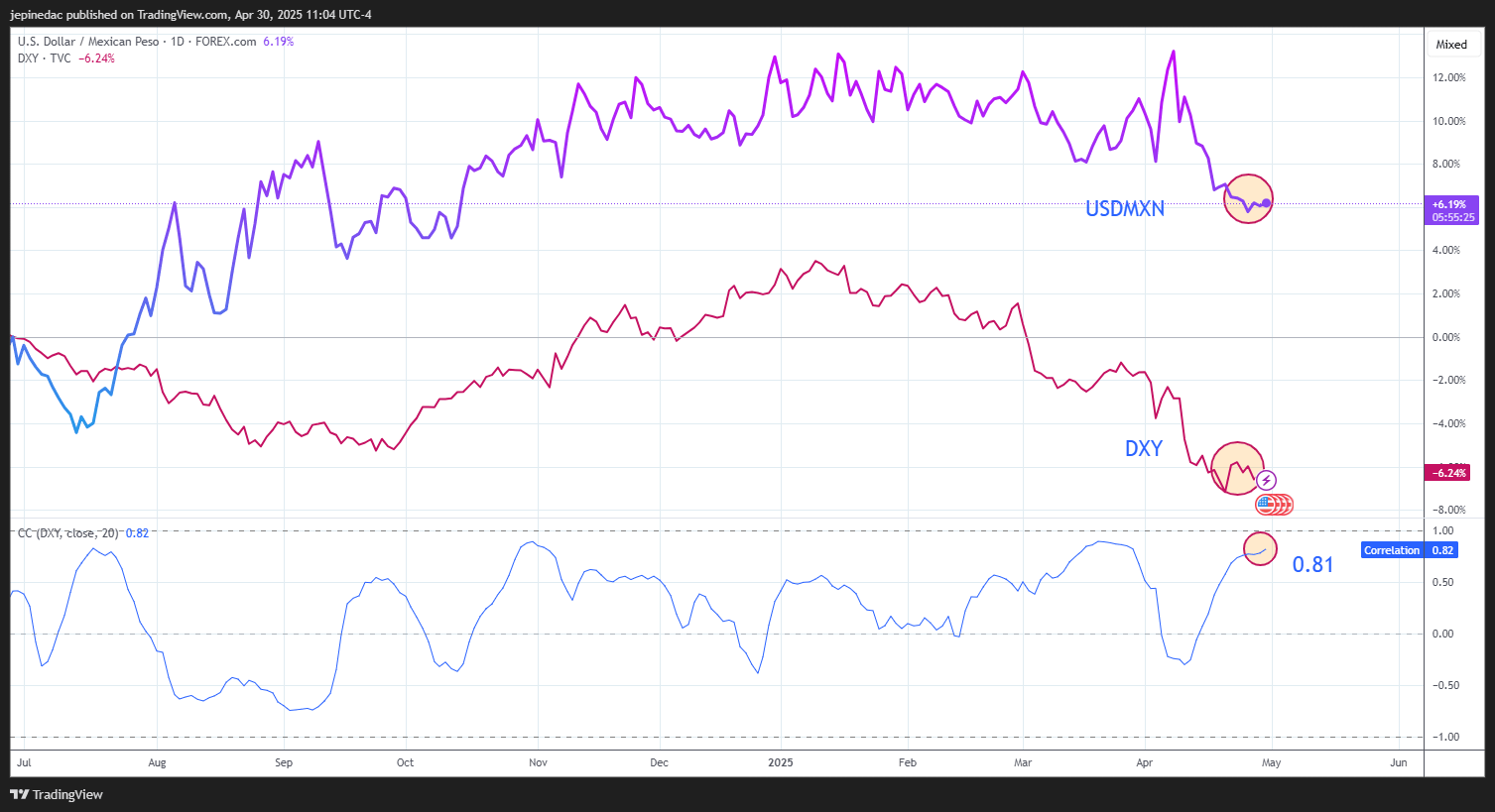

In recent trading weeks, the DXY index, which measures the strength of the dollar, has shown a positive correlation of about 0.81 with USD/MXN. This suggests that investors are viewing dollar strength as a key factor behind the pair’s movements. At present, this correlation remains steady, and we can see that, as the DXY halted its decline—which began in early 2025—the USD/MXN also stopped weakening. However, it's worth noting that this correlation could shift over time.

Source: StoneX, TVC, Tradingview

With the DXY having recently touched lows not seen since 2022, a new wave of confidence could begin to lift the dollar, especially following conciliatory statements by President Trump regarding the trade war. As long as the correlation holds, a short-term recovery in the DXY could translate into buying pressure for USD/MXN, particularly now that the pair is holding near the key support level of 19.50 pesos.

What About the Central Banks?

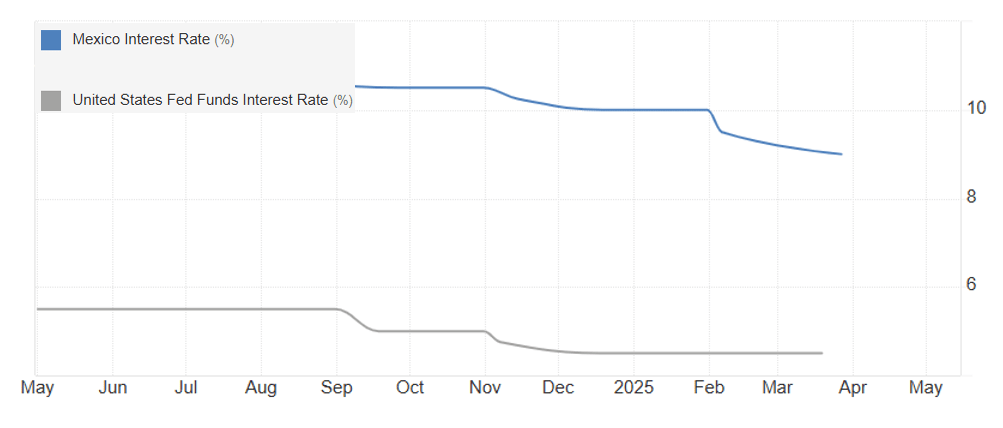

Banxico has its next monetary policy decision scheduled for May 15, and the central bank has indicated that it may continue with interest rate cuts, as it has done in recent meetings. The current rate stands at 9%, but further reductions are possible, supporting expectations of a more accommodative policy cycle in the near term.

Meanwhile, the Federal Reserve is facing a key decision on May 7. According to data from CME Group, there is a 94.9% probability that the FED will maintain its rate at 4.5%, reinforcing a neutral but firm stance, likely more aggressive than Banxico's current approach.

With this in mind, the divergence in policy outlooks between the two central banks remains in place: Mexico with a high rate that could fall, and the U.S. with a lower, but stable, rate. This alters risk and return perceptions between the two economies.

Source: TradingEconomics

The divergence in expectations between both central banks could be critical. If U.S. bonds continue to offer attractive, stable yields with low risk, dollar demand could strengthen. Although Mexico still offers higher nominal returns, perceived risk and expectations of rate cuts could diminish the appeal of Mexican debt. This monetary policy gap could restore strength to the dollar and lead to upward pressure on USD/MXN, particularly if these dynamics persist.

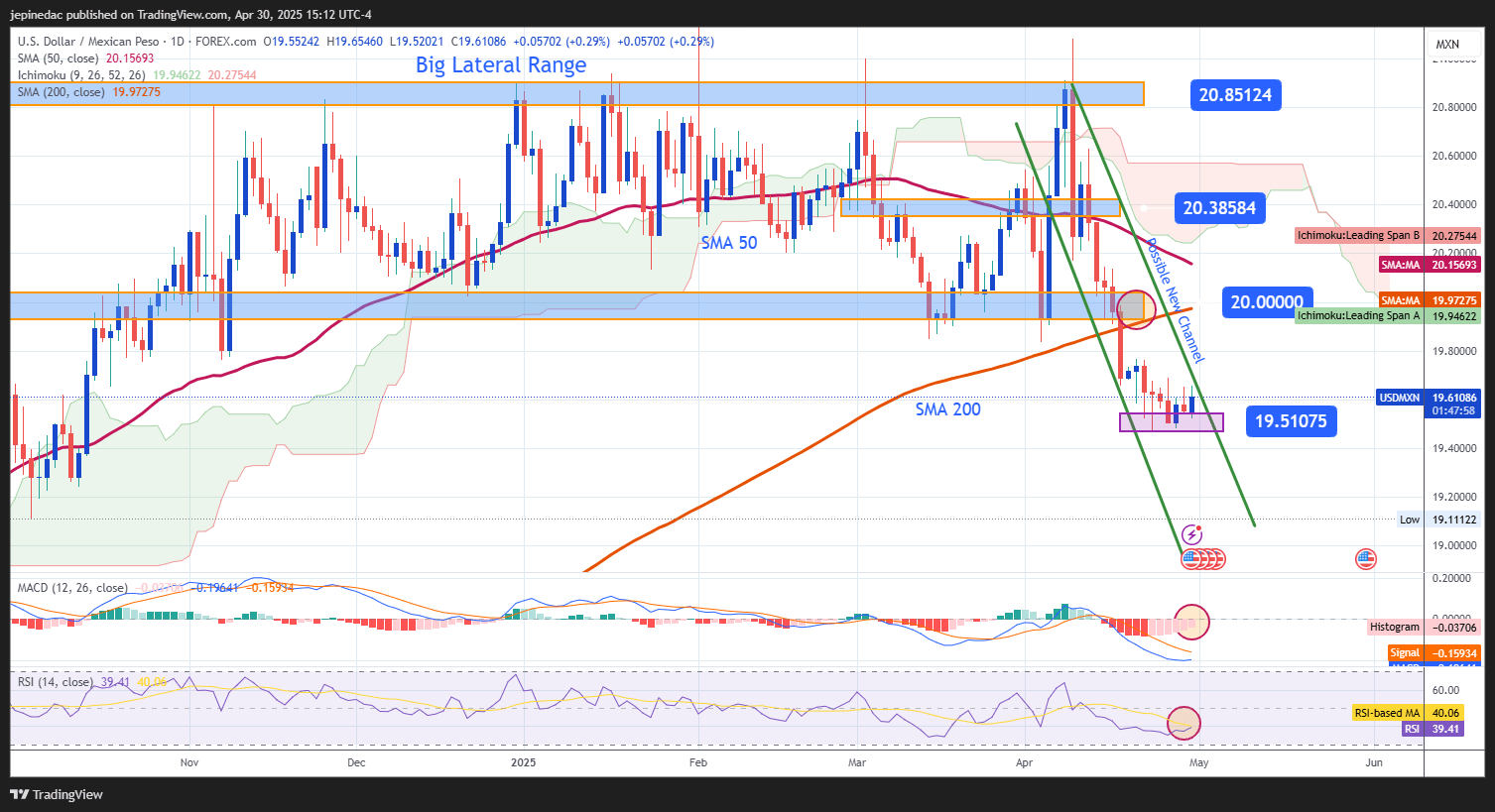

USD/MXN Technical Outlook

Source: StoneX, Tradingview

- Possible New Bearish Channel: On April 17, the pair broke out of the long-standing sideways channel that had held since November 2024, potentially giving way to a new short-term bearish channel with oscillations below the 20 pesos per dollar resistance. However, recent price neutrality has pushed USD/MXN toward the upper boundary of the channel. If this bias continues, an upside breakout is possible, which could lead to a prolonged consolidation phase over several sessions.

- MACD: The MACD histogram has begun hovering near the neutral 0 line, suggesting that the bearish momentum from recent sessions may be fading. If the histogram continues to stabilize around zero, the pair may enter a consolidation phase.

- RSI: The RSI line has started to trend upward, in line with the MACD, indicating that selling pressure over the last 14 sessions is diminishing. If the RSI continues to approach the neutral 50 level, the market may enter a balance phase, with no clear directional bias.

Key Levels:

- 20.38 – Key Resistance: This level corresponds to the mid-range of the previous lateral channel that lasted several months. A rebound to this area could reactivate the bullish trend that dominated USD/MXN for most of 2024.

- 20.00 – Nearby Resistance: A psychological level that also aligns with the 200-period simple moving average. A move toward this zone could break the current bearish channel.

- 19.50 – Major Support: This area reflects recent lows and has acted as a barrier to downward moves. A break below this level could reignite bearish momentum, potentially leading to a deeper downtrend for USD/MXN.

Written by Julian Pineda, CFA – Market Analyst

Follow him at: @julianpineda25