Apple Q2 earnings preview

Apple will report fiscal Q2 results on Thursday after the market closes, and the market will be watching closely to gauge the impact of Trump's tariffs on its business.

Apple could potentially see a lift in the March quarter from inventory pull-ins and customers buying ahead of feared tariff-related price hikes. As a result, Wall Street is expecting Apple to post EPS of $1.61 a share, up 5% year over year on revenue of $94.08 billion, up 4% compared to Q2 in 2024.

Apple imports from China and is subject to a 20% tariff, although the company did manage to dodge 125% reciprocal tariffs on Chinese goods when the White House announced an exemption on smartphones, PCs, and other electronics in early April.

The results come as Apple announced on Friday that it plans to shift all its US iPhone production to India from China by the end of 2026. Apple currently sells more than 60 million iPhones per year in the US. New Indian factories are likely to be less efficient than Chinese ones.

Guidance for the June quarter and full year will be closely watched. Expectations for Q3 are for EPS of $1.47 on sales of $88.96 billion, up 5% and 4%, respectively.

How to trade AAPL earnings?

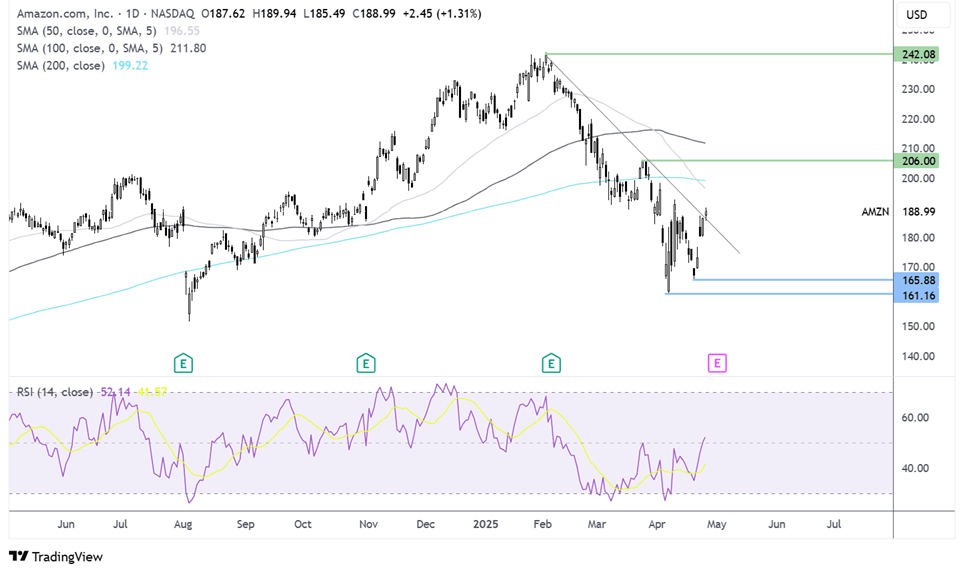

Apple fell from its record high of 260, before running into resistance at 169. The price closed above the 200 SMA on the weekly chart and also rose above the rising trendline dating back to May 2020, in an encouraging sign. Buyers would need to extend gains above the 200 SMA at 223 to negate the near-term selloff and rise towards 260 again. On the downside, a break below 190, the rising trendline opens the door to 177, the 200 SMA. A break below 169 is needed to create a lower low.

Meta Q1 earnings preview

Meta is due to report Q1 earnings on Wednesday April 30. Expectations are for EPS to rise 12% year on year to $5.29 the slowest EPS growth since Q 1 2023 on revenue of $41.4 billion a 13.6% annual increase, down from 20% growth at the end of last year.

Earnings come as Meta share prices have fallen 35% from their record high in February amid economic and policy uncertainties under the Trump administration.

As a service-based provider, Meta is more insulated from the direct impacts of the US tariffs but is exposed to the secondary indirect impact. Advertising is a key revenue generator, bringing in 96% of revenue, and this is projected to slow to 13.3% growth year on year in Q1, down from almost 21% in Q4 2024. Advertising spend is often the first sign of weighing consumer and business sentiment, and advertising, particularly from Chinese retailers such as Temu and Shien, will likely slow..

Attention will be an AI-driven value, and whether this could potentially offset a fall in advertising demand.

At the end of last year, daily active users jumped 58.8% to 3.35 billion, with average revenue per user climbing 8.6% to $14.25. This quarter, average revenue per user is expected to rise 9.5%, and daily active users are expected to increase 4.4%.

Whilst AI will remain a key focus, margins will also be under the spotlight as Meta implements cost-cutting measures such as layoffs to enhance efficiency.

How to trade META earnings?

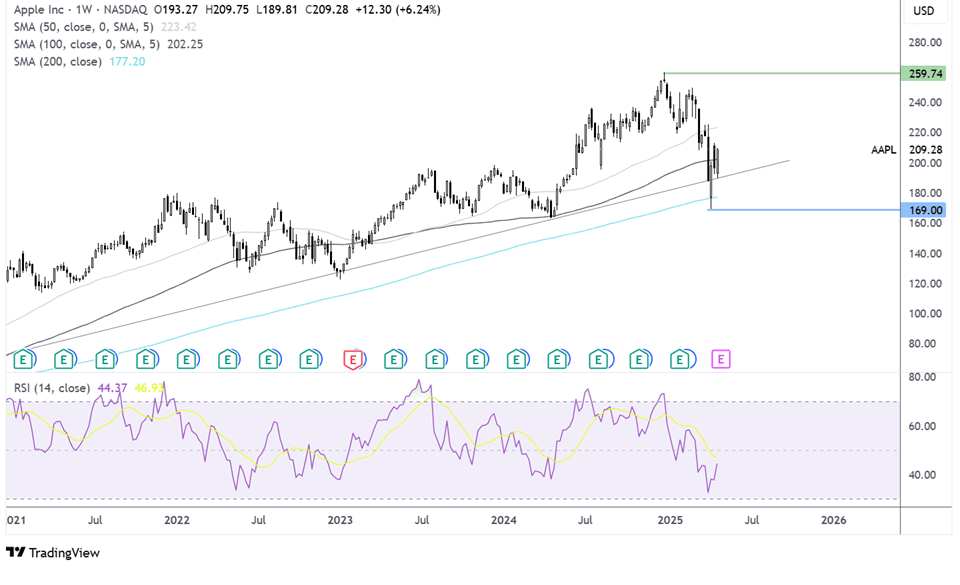

Meta fell from its record high of 740, falling to a low of 479. Its rebound from this low failed to retake the 200 SMA at 578. Any recovery would need to retake the 200 SMA for buyers to gain momentum towards 600 and 635, the late March high.

Failure to retake the 200 SMA could result in a retest of 479. A break below here creates a lower low,, bringing 450 into focus.

Amazon earnings preview

Amazon will release Q1 results on May 1st, and Wall Street is expecting solid year-over-year growth. Consensus estimates point to EPS of $1.36, up 39% from a year earlier, on revenue of $155.1 billion, marking an 8% climb. Despite macroeconomic worries and tariff-related pressures, Amazon's scale in e-commerce, cloud computing, and advertising would work in its favour.

Amazon Web Services will be a key focus area for the market. Growth in this segment is expected to remain in the low double digits amid an increasingly competitive environment. AWS margins will still be a significant figure to watch, and reduced margins could impact sentiment. The sector continues to see intense competition from Microsoft Azure and Google Cloud, which aggressively pursue increased market share. Any commentary surrounding AI within AWS and customer adoption could impact sentiment as well.

Meanwhile, Amazon's advertising business is expected to deliver another solid quarter, with improved monetisation on the platforms. Amazon can leverage its vast customer data and shopping intent information, which makes it an attractive area for advertisers.

E-commerce operations will be watched closely, as online retail remains a barometer for company health and broader consumer sentiment.

Forward guidance will be key, especially on projected AWS momentum and any views on macro-driven e-commerce demand.

How to trade Amazon earnings?

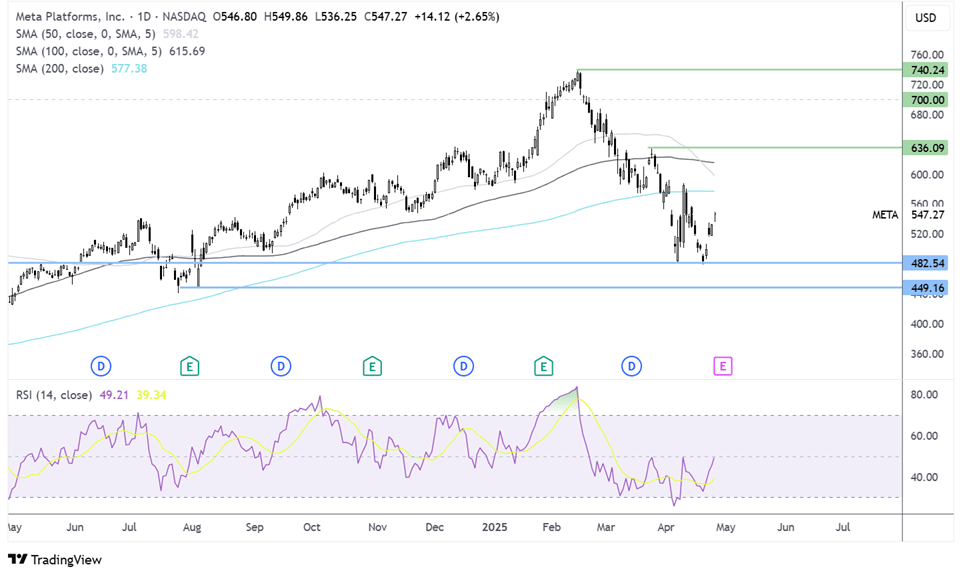

Amazon fell from 242, its record high, dropping to a low of 161 before recovering higher to its current price of 189. Buyers supported by the rise above the falling trendline and RSI above 50 will look to extend gains towards the 200 SMA at 200. A rise above here and 206, the late March high, could see buyers gain momentum. Support is seen at 165, the weekly low, with a fall below here and 161 needed to create a lower low.