Tesla Q1 Earnings Preview

Tesla is due to report quarterly earnings on April 22 after the market close. Expectations are for EPS to fall 4% $0.43, on revenue, which is expected to rise 1% to $21.45 billion.

Earlier in April, Tesla reported Q1 global deliveries, which missed estimates at 336,681 compared to expectations of 390,342, making it the worst quarter for deliveries since Q2 in 2022. The brand has been hit hard by Elon Musk’s political activities heading up the U.S. President Trump's Department of Government Efficiency.

The results show that Tesla will reportedly delay the release of its cheaper EV model by three months, suggesting it will come in late 2025 or 2026. Production will start in the US, followed by Europe and China.

Tesla's share price is down some 40% so far in 2025, hit hard by Trump's trade tariffs and its weakening brand. The share price has underperformed rival BYD, which is expected to report Q1 earnings on Wednesday. In sharp contrast, BYD is expected to see net income rise by 86% to 119% versus a year earlier, suggesting another stellar quarter. BYD’s share price is up 35% so far in 2025.

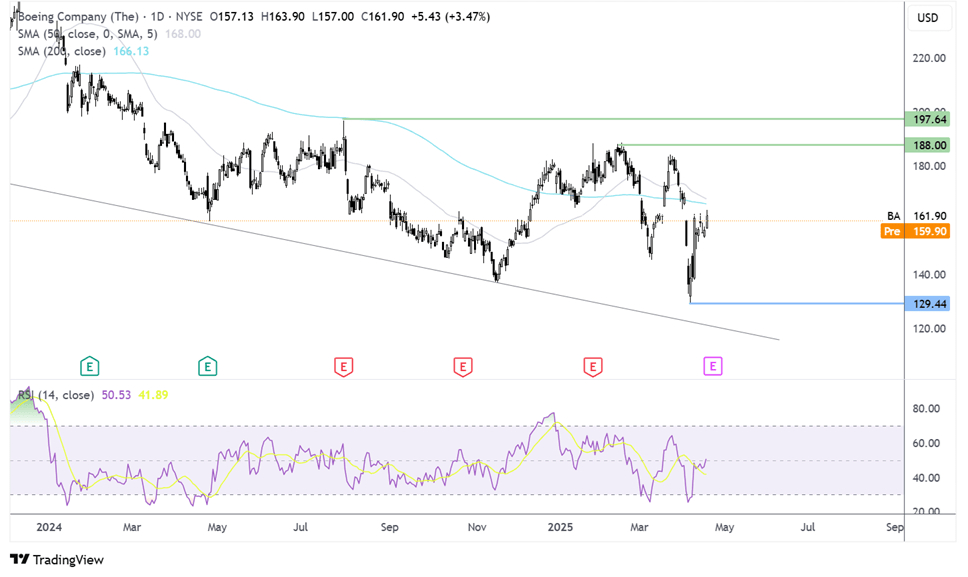

How to trade TSLA earnings?

Tesla's share price has fallen sharply from the high of 483 reached in December last year, dropping to a low of 216. The recent recovery from this low failed to retake the 200 SMA, which, combined with the RSI below 50, keeps sellers hopeful of further losses.

Sellers will need to take out support at 216 to create a lower low bringing 200 round number and 157 the 2024 low into focus.

Buyers would need to rise above the 200 SMA at 290 for buyers to gain momentum.

Alphabet Earnings Preview

Heightened volatility and escalating trade tensions have dragged on Magnificent 7 stocks, including Google parent Alphabet, which has fallen 20% year to date. The share price fell after Alphabet posted mixed Q4 results in early February, with revenue of $96.47 billion,, which was just shy of expectations of $96.62 billion, though earnings of $2.15 per share beat estimates of $2.13.

The firm said it planned to spend $75 billion on AI this year, 29% higher than analysts had forecast. Investors have become nervous about the amount of AI spending because start-up disruptor DeepSeek is releasing a low-cost AI model.

As the largest global ad platform, Alphabet could also be considered a reflection of the broader economy, which could be negatively impacted by deteriorating consumer and business confidence owing to a tariff-related slowdown. How to trade GOOGLE?

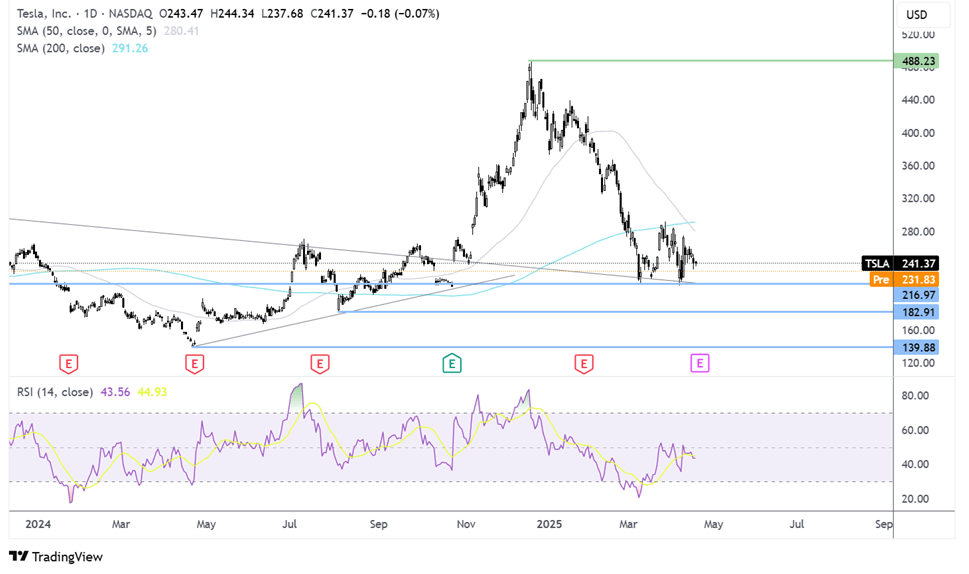

How to trade GOOGLE earnings?

After reaching an all-time high of 206 on February 4 the price has rebounded lower, forming a series of lower lows and lower highs. The price broke below the rising trendline dating back to 2023, the 50 SMA breaks below the 200 SMA in death cross sell cross.

After hitting a low of 140 the price has recovered slightly to 160 before easing lower again.

Sellers supported by the death cross and the RSI below 50 keep sellers hopeful of further losses. Sellers will need to take out support at 150 and 140 to create a lower low, opening the door to 130.00, the 2024 low.

Buyers will need to rise above 160 to create a higher and expose the rising trendline resistance at 170.00

Boeing Q1earnings preview

Boeing will release Q1 earnings on Wednesday, April 23. This comes after China last week ordered airlines to stop taking new deliveries of its jets. These are now being returned to the US from China. According to Reuters,s, a Boeing 737 MAX that was meant for Xiamen Airlines was returned to the US production facility on Sunday.

The firm has found itself in the middle of escalating tensions between the US and China amid rising tariffs, which now sit at 145% for Chinese imports and 125% for US imports into China. Investors will listen closely to management’s comments on plans to navigate these turbulent times.

A halt in deliveries would be another headwind for Boeing, which is facing a series of issues, including safety, quality control, and labour strikes.

Amid looming uncertainty over who will acquire Boeing's jets, Wall Street expects Boeing to post a quarter loss of 1$1.24 per share, rising from -$1.13 per share in the same period last year.

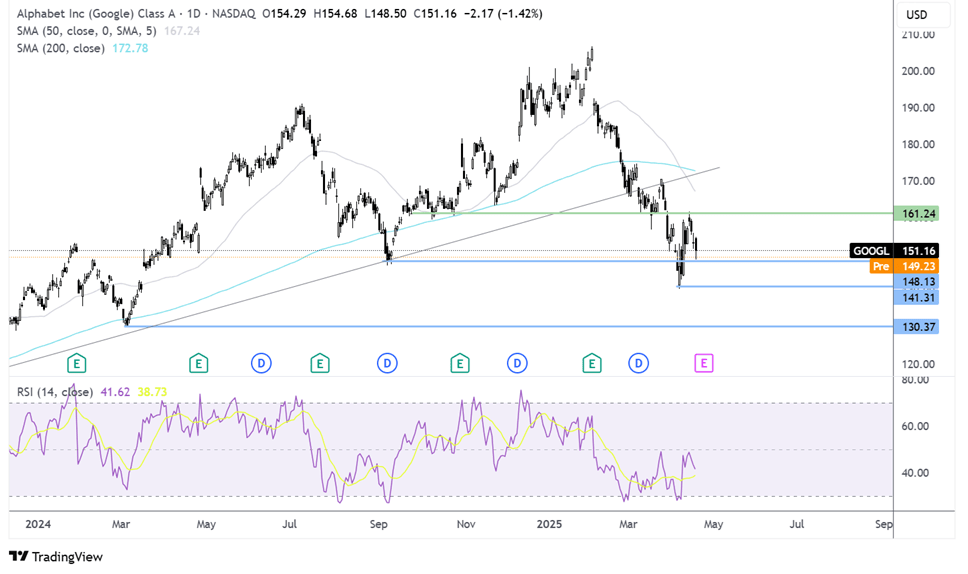

How to trade BA earnings?

Boeing has been trending lower across the past 12 months, forming a series of lower lows. The price rose to a peak of 188 in 2025 before dropping to a low of 128 in April, its lowest level since September 2022.

While the price has recovered from the 128 low, it has failed to retake the 200 SMA at 168. Buyers would need to extend the recovery above this level to bring 188 into focus and a higher high.

If the price fails to rise above the 200 SMA, the price could be retested to the 128 low. A break below here is needed to create a lower low.