- WTI opens below $56 after another OPEC+ output hike

- June production boost matches May’s surprise increase

- Geopolitical risks rising but not yet impacting price

- Support eyed at $55.12, with $54 and $49.33 below

Summary

WTI opened the week sharply lower as OPEC+ delivered another surprise output hike, extending bearish momentum that’s been building since March. With global supply rising and macro risks mounting, downside levels are back in play, even as Middle East tensions threaten to stir volatility if they escalate further.

OPEC+ Boosts Crude Production Again

Crude oil futures have opened at the weakest level since early 2021, extending April’s heavy losses after OPEC+ announced a second straight month of accelerated production increases. U.S. crude fell more than 4% while Brent dropped nearly 4%, with both hitting their lowest levels since early April.

Eight core members of the group, led by Saudi Arabia, agreed to lift output by 411,000 barrels per day in June, matching the surprise hike delivered in May. The combined increases now exceed 800,000 bpd, marking a significant step towards unwinding the 2.2 million bpd in voluntary cuts pledged since 2022.

The aggressive supply boost is fuelling concerns of a growing surplus just as demand worries re-emerge, driven by soft economic signals and renewed trade frictions between the United States and its major trading partners.

Geopolitical Tensions Create Reversal Risk

However, while price action remains firmly focused on supply, tensions in the Middle East are simmering. Israel has vowed to retaliate after a missile fired by Yemen’s Houthi rebels landed near its main international airport over the weekend. Tehran, in turn, has warned it will strike back if either the U.S. or Israel initiates an attack.

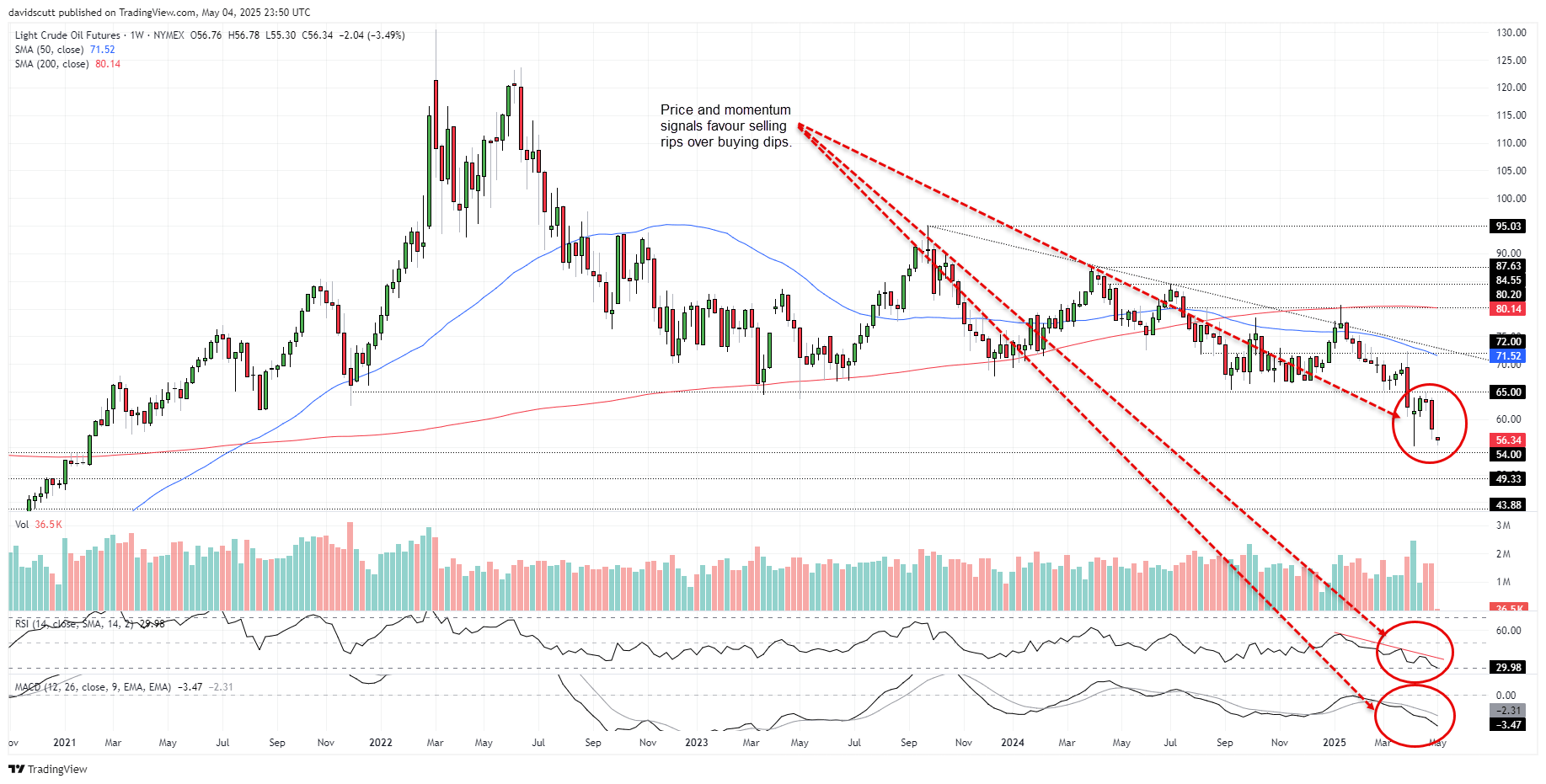

For now, the geopolitical backdrop has failed to counter the bearish tone driven by OPEC+’s rapid unwind of earlier cuts, as shown in the weekly chart below of WTI crude futures.

WTI Remains Sell-On-Rallies Play

Source: TradingView

Having broken and closed below support at $65 in late March, and with momentum indicators such as RSI (14) and MACD delivering increasingly bearish signals, WTI remains a clear sell-on-rallies play for now. That view is reinforced by the evening star pattern completed over the past three weeks, warning of potential downside ahead.

$55.12 is the first level of note for shorts, coinciding with where futures bounced aggressively in early April and again today. If it were to be taken out, support at $54, $49.33 and even $43.88 may come into play. Anything beyond those levels would likely require a major negative economic shock to eventuate, placing emphasis on trade negotiations between the United States and China in the week ahead. On the topside, resistance may be encountered just above $60 and again at $65.

-- Written by David Scutt

Follow David on Twitter @scutty