Reports that Israel has launched a pre-emptive strike on Iran have sent volatility surging during Asian trade on Friday. Traders are now on edge over the prospect of a full-blown Middle East conflict, especially as Iran had already warned it would target Israel’s nuclear facilities if attacked first. At this stage, it seems more a question of when Iran will respond — not if.

Oil Rally Stalls Below Resistance as Safe-Haven Demand Pressures AUD/JPY

While Israel’s strike was unexpected, it did not come without warning. The U.S. and Iran have been engaged in nuclear talks since April 2025. However, President Trump has accused Iran of “slow-walking” the negotiations and has expressed waning confidence that a deal will be reached. He also warned that a "massive conflict" could erupt in the Middle East if the nuclear talks fail. In anticipation of potential escalation, the U.S. has begun evacuating nonessential personnel from its embassy in Baghdad, and the Pentagon has authorised military dependents across the region to leave voluntarily.

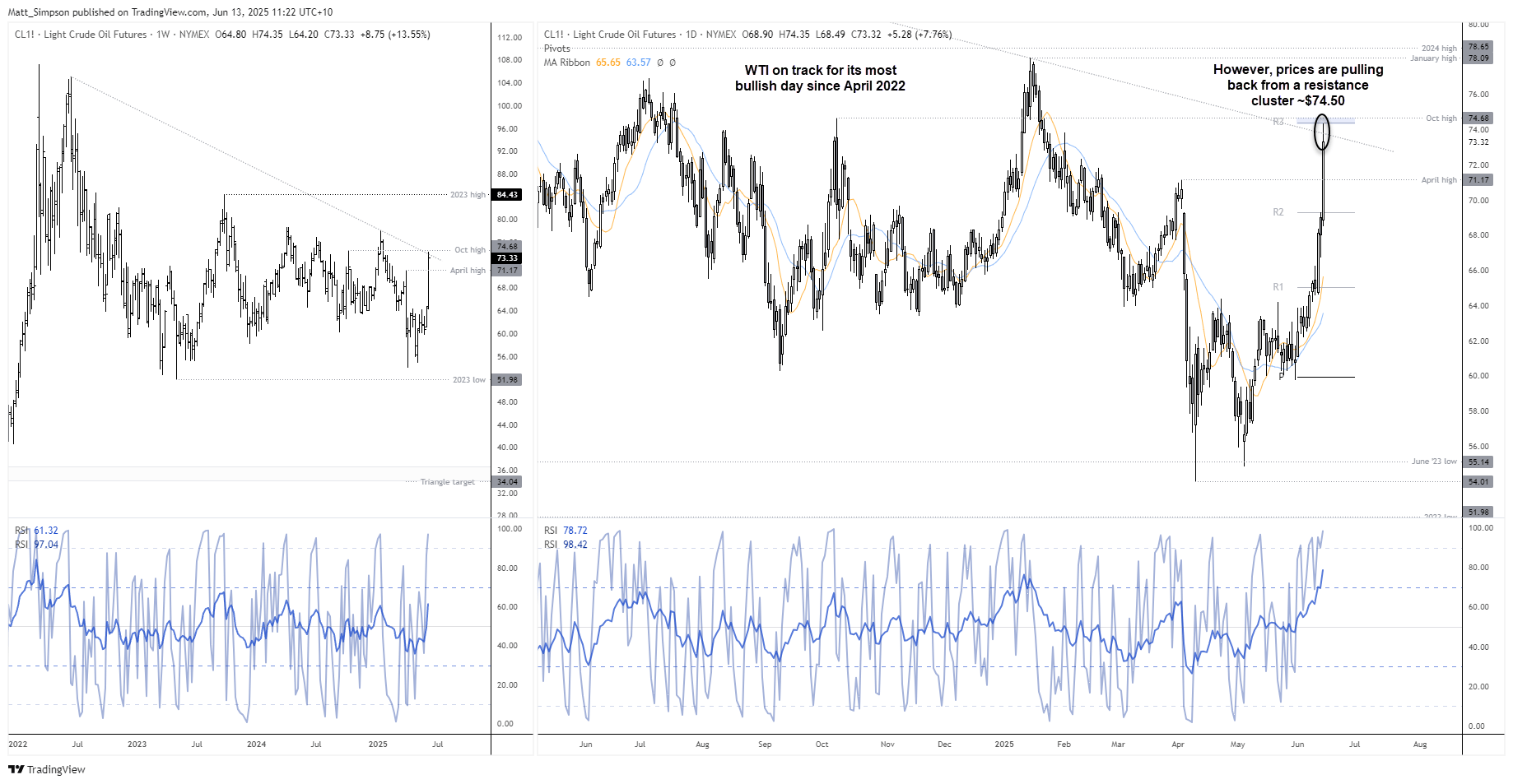

- WTI crude oil prices surged over 7% in the past hour, taking its three-day total to 15% and briefly trading above $74

- At current levels, WTI crude oil is on track for its most bullish day since April 2022

- Traders flocked to the safety of the Swiss franc (CHF), Japanese yen (JPY) and gold amid the bout of risk off

- AUD/USD and NZD/USD are the weakest FX majors, with AUD/CHF and AUD/JPY leading the way lower among FX majors and crosses

- Wall Street futures rolled over with Nasdaq 100 futures down -1.8%, S&P 500 -1.6% and Dow Jones -1.4%

- The technology-focussed Nikkei 225 futures market is currently down -1.5%

- ASX 200 futures (SPI 200) have reversed earlier gains and currently down -0.1%

WTI Crude Oil Futures (CL) Technical Analysis

While oil prices have surged this past hour, bullish momentum has stalled around a cluster of resistance levels around $74.50. A long-term trendline from the June 2022 high, October high and monthly R3 pivot all reside in this area, and prices are pulling back from it at the time of writing.

It is possible we have seen the worst part of this surge, but traders will remain vigilant heading into the weekend and seek to hedge gap risk for next week. This should keep demand for the Japanese yen and Swiss franc elevated, and therefore AUD/JPY, AUD/CHF, NZD/JPY and NZD/CHF under pressure.

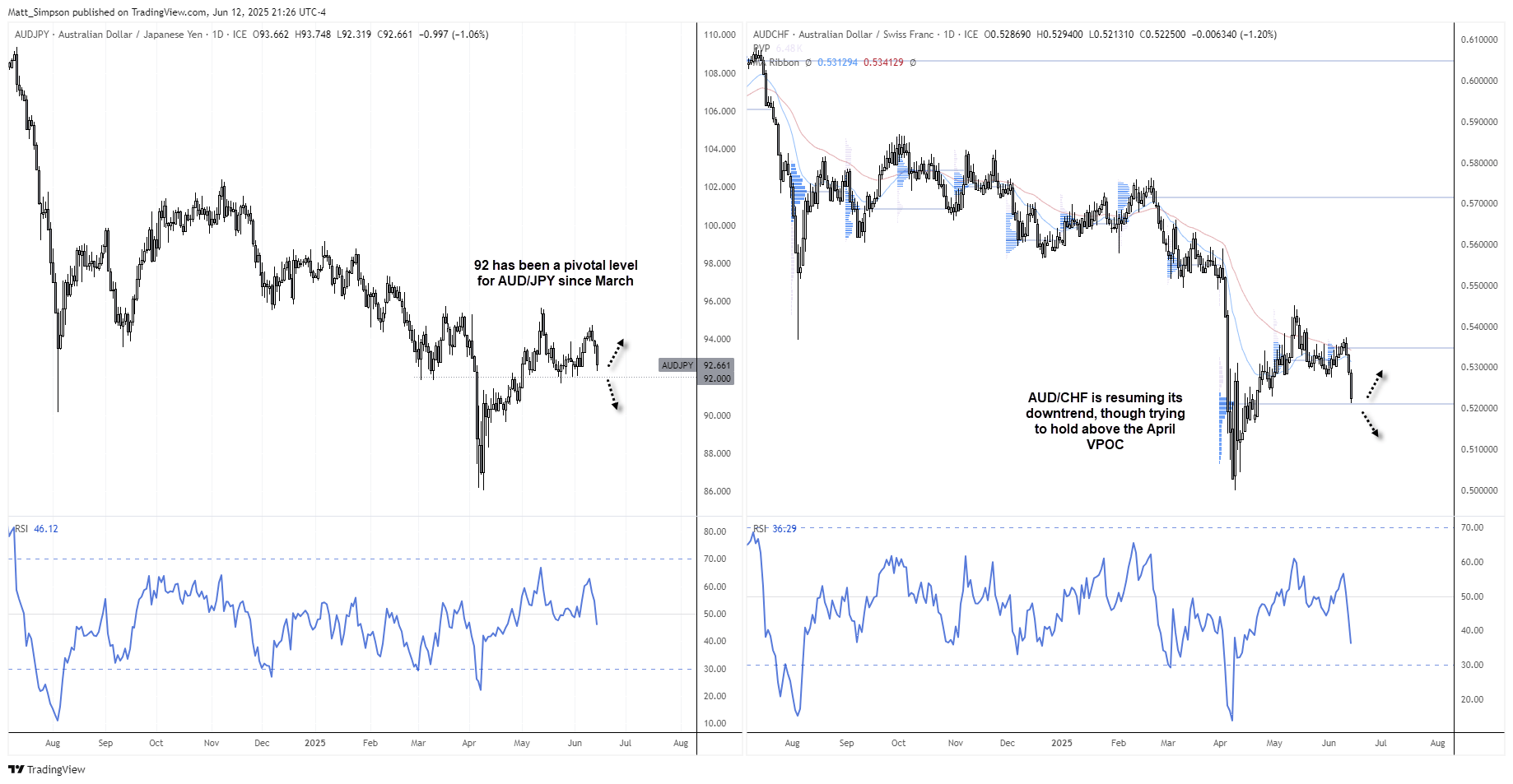

Australian Dollar (AUD) Technical Analysis

With risk appetite souring, traders betting on RBA rate cuts are finally seeing some much-needed bearish momentum. While this has pulled AUD/USD back from its recent cycle highs, bears may want to focus on AUD/JPY or AUD/CHF, as the Japanese yen and Swiss franc are currently outperforming in this risk-off environment.

AUD/USD Technical Analysis: Australian Dollar vs US Dollar

92 has been a pivotal level for AUD/JPY since March, and the pair is now approaching this level again, having slipped below the 93 downside target outlined yesterday. This makes 92 a key level to watch, as it may serve as a broader barometer of risk sentiment in the FX space.

AUD/CHF Technical Analysis: Australian Dollar vs Swiss Franc

Bearish momentum has taken hold of AUD/CHF, which now appears to be the cleaner short compared to AUD/JPY—at least while the Aussie holds above 92 yen. That said, AUD/CHF is currently hovering above the April VPOC (Volume Point of Control), which presents a near-term pivot. Traders should also monitor crude oil prices, as further gains could support the AUD and cap downside here.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge