XAG/USD Summary

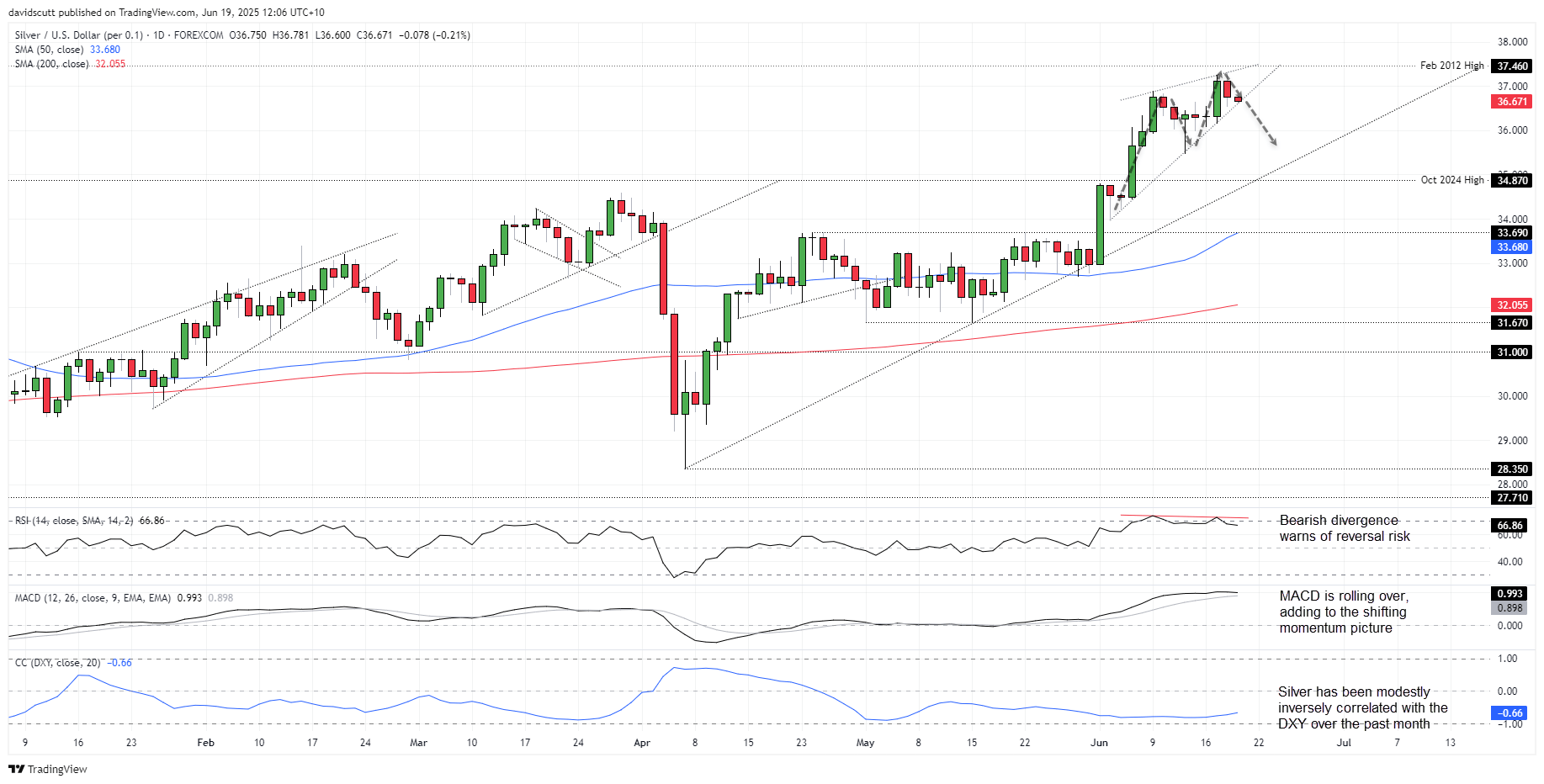

Silver’s bullish run may be coming to an end. Sitting in a rising wedge and with momentum indicators rolling over, the ducks look to be lining up for a potential downside break. Throw in signs the U.S. dollar may have bottomed—an adversary to commodity prices—and the unwind could be sizeable, especially if risk appetite were to evaporate.

Reversal Risk for Silver Grows

Source: TradingView

If silver were to break beneath wedge support and hold there, it would allow for shorts to be established with a tight stop above the level for protection. $35.50—where the price bounced strongly from on June 12—screens as an initial target. If broken, it would bring uptrend support established in early April, along with the October 2024 highs at $34.87, into play.

Bullish momentum that helped power silver higher is also showing signs of waning—we’ve seen bearish divergence between RSI (14) and price, while MACD is also rolling over towards the signal line. The momentum picture isn’t outright bearish but just looks heavy.

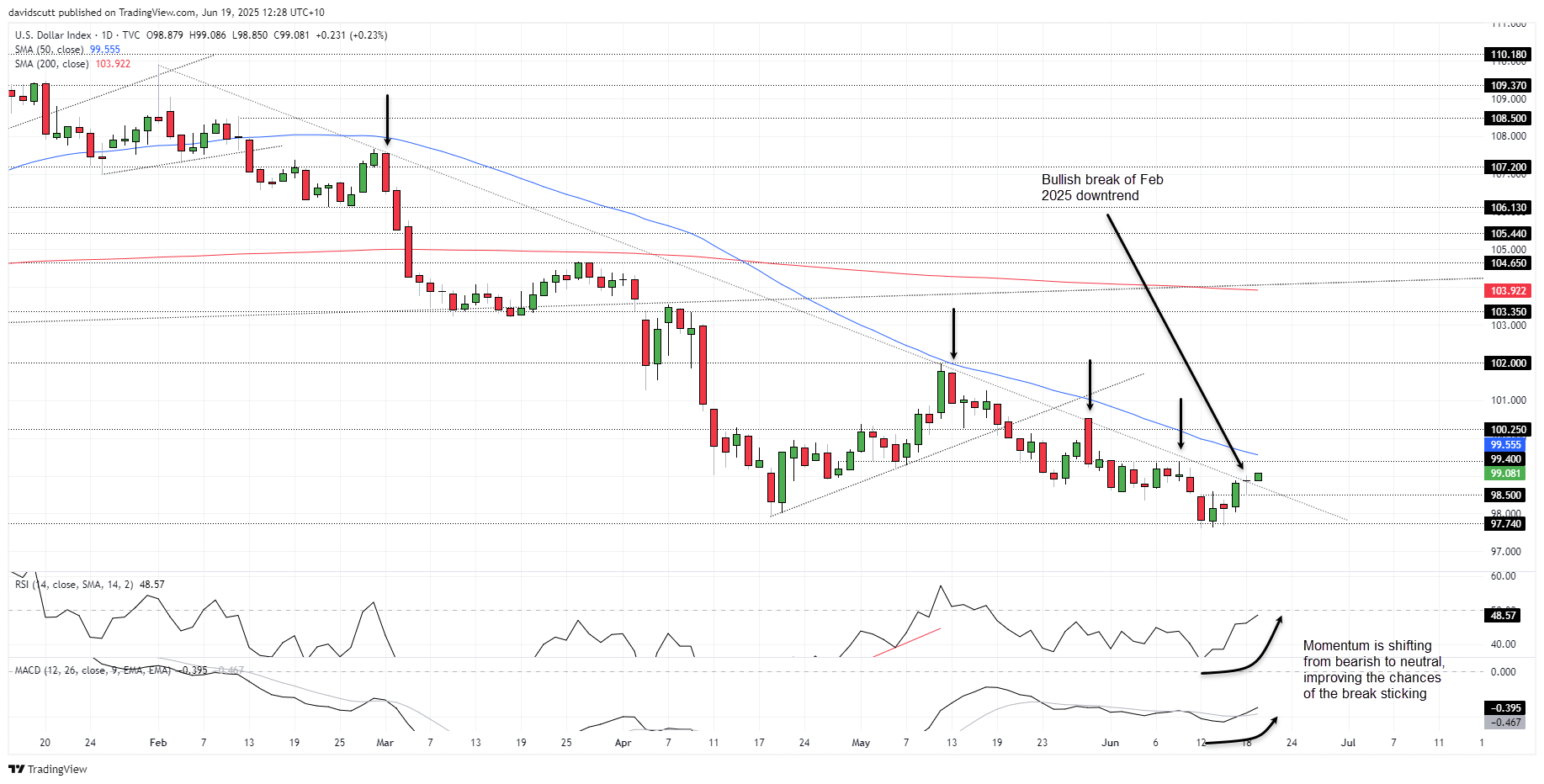

U.S. Dollar May Have Bottomed

Another important factor to consider beyond technicals is that silver and other commodity prices often struggle in an environment where the U.S. dollar is strengthening. That point is reinforced by the inverse correlation between silver and DXY over the past month, sitting with a score of -0.66—not strong by any stretch, but not something you can ignore either.

Source: TradingView

Looking at DXY on the daily chart, after repeatedly failing to break horizontal support at 97.74 either side of the weekend, the buck has bounced over the past few days, pushing above long-running downtrend resistance dating back to the February highs. With RSI (14) trending higher towards neutral and MACD crossing the signal line from above, the shifting momentum picture suggests the trend break may stick.

99.40 is a level to keep on the radar near term given it offered support and resistance over recent months. Beyond, the 50-day moving average, 100.25, 101.25, and 102 are levels to watch given how the DXY interacted with them earlier in the year.

Should the bullish break fail, 98.50 and 97.74 are the downside levels of note.

-- Written by David Scutt

Follow David on Twitter @scutty